Creating, not fixing: A new financing paradigm for Africa

DI’s Martha Bekele looks at why African actors should engage with a novel approach to international cooperation: Global Public Investment

At the Eighth session of the Africa Regional Forum on Sustainable Development in March, delegates noted the need for scaled-up and sustainable finance for an inclusive recovery from the Covid-19 pandemic and accelerated delivery of sustainable development in Africa. [1] As part of these discussions, the Forum recognised that the international financial architecture needs reform. It is timely therefore, that an alternative to the current global financing approach is currently gaining traction among a range of actors from the global to the national level. This approach is being coined ‘Global Public Investment’ (GPI). It calls for a radical shift in how global public concessional finance is done, aiming to create a system in which all contribute, all decide and all benefit. GPI comes against a backdrop of an increasingly interconnected world – where our biggest challenges go beyond national borders – and a global system that is struggling to finance the Sustainable Development Goals (SDGs).

Major challenges Africa faces that require a change in the global financing response

Climate change

Comparing the last two decades (2000–2010 and 2011–2021), [2] we find increasing impacts of extreme weather events, which are often linked to climate change. Between the two decades, total deaths increased by 96%; the number of people affected, rendered homeless and injured increased by 139%; extreme temperature doubled, the incidence of floods increased by 85%, and total damages from floods increased by 142%. All these impact human and animal lives, including displacement, food security and food prices. The same conclusion can be drawn about the effects of droughts. In March 2022, East Africa is facing its longest drought in four decades and 20 million people need urgent food aid. La Niña, a climatic phenomenon, is preventing rains for the fourth season in a row in the Horn of Africa, pushing the region to the ‘brink of catastrophe’. [3]

The Covid-19 pandemic

The impact of the Covid-19 pandemic continues to hit Africa hard, and will continue to highlight a great divide in terms of national resilience: which groups of countries will recover quickly and which will see millions of people pushed into extreme poverty? The World Bank, in its latest pandemic-induced poverty update, estimated 97 million people were pushed into extreme poverty in 2020. [4] The African Development Bank estimates the continent required about US$154 billion in the 2020/21 financial year to respond to the pandemic’s impact. [5] While the World Bank expected a global rebound, a reduction in poverty is unlikely for sub-Saharan African countries and, in fact, it is expected to rise in 2021. [6]

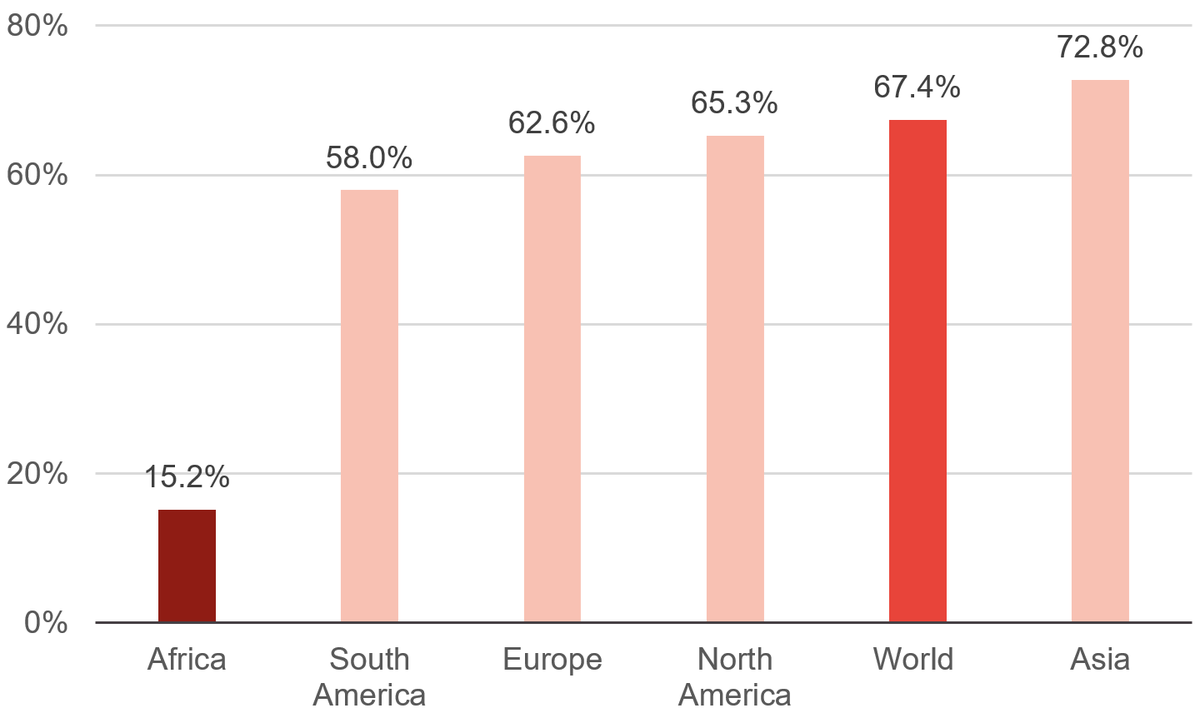

Africa’s marginalisation is exemplified by the slow rollout of Covid-19 vaccinations. Its recovery from “the worst recession in more than half a century” would require the reopening of economic sectors, such as tourism and the end of Covid-related restrictions. [7] But globally, Africa has the lowest number of people fully vaccinated. Only 15% of Africans are fully vaccinated, a quarter of the world average.

Figure 1: Proportion of populations fully vaccinated against Covid-19, by region

Data as of 31 March 2022

The idea of Global Public Investment

Fast-changing global challenges, such as conflict, Covid-19 and climate change, mean there is an urgent need to rethink the current global development financing system. Global Public Investment (GPI) is an ambitious new financing framework designed to be co-created in readiness to step up at the end of the SDG era in 2030.

GPI is a paradigm shift from the current aid structure. First, in terms of ambition, it is a shift from the narrow focus of poverty reduction to meeting wider inequality and sustainability challenges. Second, in terms of function, it is a shift to a permanent effort to finance global challenges – no longer seeing international finance as a last resort that comes in quickly to respond to a crisis and disappears again until the next crisis. Third, it is a shift away from outdated post-colonial institutions to a modern, dignified and accountable decision-making structure. Fourth, it is a shift from the outdated notion of concessional financing only as a transfer from North to South, to a universal effort with all paying in and all benefiting. GPI is a shift in narrative from the patronising language of ‘foreign aid’ to empowering cooperation as a common endeavour, the responsibility of all, not just the rich few.

GPI’s fundamental principles are “all contribute, all decide, all benefit”.

All contribute

In terms of pay-in, GPI proposes public finances to be concessional (grants), sourced at country level from all countries tiered by their level of ability to contribute. This is a change from the current official development assistance model, in which OECD DAC countries commit to providing aid under the DAC rules. Under GPI, all countries contribute toward global issues as they are the responsibility of all. All countries take mutual responsibility for ensuring that financing reaches the right places; that it is constant and structured and not hijacked by a country’s politics; and that it is able to be spent to achieve accountable solutions.

All decide

GPI is truly a multi-stakeholder initiative. It proposes representation for both country leadership and sectoral specialists in governance, and also CSOs to bring in the voices of those who are most affected by global challenges. In such a decision-making structure, GPI proposes the effective representation of not only all governments but also civil society and public issue experts, such as climate change scientists, among others.

All benefit

GPI proposes a transparent, fair-share arrangement. It recognises that poverty, inequality and sustainability issues exist in all countries, they are not just a problem of the Global South. This is contrary to the current system where some countries graduate out of extreme poverty, mainly based on income measured by their GDP, a measure that doesn’t reflect the persistence of poverty, inequality or a lack of resilient systems. This means some countries remain vulnerable and roll back progress when they encounter a shock.

Why Africa must join the debate on GPI

The current global financing approach, particularly towards public goods, has not been working for Africa. Amid recurrent disasters, climate change and public health shocks to health systems, the ambition of African countries to meet the SDGs holistically by 2030 remains unachievable.

If there is a continent that needs an urgent overhaul of current global partnerships, based on an approach of equitable global solidarity, it is Africa. With myriad development challenges, such as weak capacity to recover and build back better, and lack of an effective global cooperation framework, it can no more be business as usual for Africa. The region needs the kind of global cooperation approach GPI offers: people-centred, accountable to all, fair and localised.

To Africa, which hosts two-thirds of all least developed countries, GPI also means:

- Alignment with the aspirations of Agenda 2063 of the African Union, particularly Aspiration 1 (“A prosperous Africa based on inclusive growth and sustainable development”) and Aspiration 7 (“Africa as a strong, united, resilient and influential global player and partner”).

- Accessible money that remains in the continent to address priorities.

- An equitable approach – that all come together, regardless of their income levels, to set priorities and decide how resources are allocated based on fair-share calculations.

- Sustained support for local investments in global common goods with high return.

- Increased overall contributors towards common global goods.

- A better-governed framework that works for all.

During the Eighth session of the Africa Regional Forum on Sustainable Development, delegates called for innovative financing mechanisms that are initiated and led by African countries to ensure African debt sustainability, to support the development of “nature-based solutions, and a green and sustainable recovery from the Covid-19 pandemic”. [8]

It is time for African development practitioners, policy-makers, scholars, pan-African institutions and all other stakeholders to co-create the GPI concept. Together, we need to explore the viability of GPI, its governance system and accountability mechanisms to make it an African model under GPI’s principles that is owned by us and that works for us.

Notes

- 1 Annex of the ‘Kigali Declaration on Neglected Tropical Diseases’ [opens as PDF]. Available at: https://www.uneca.org/sites/default/files/TCND/ARFSD2022/kigali-declaration.pdf

- 2 All data on disaster occurrence and impacts is from https://public.emdat.be/data [requires registration]

- 3 National Geographic, 2022. Historic drought looms for 20 million living in Horn of Africa. Available at: https://www.nationalgeographic.com/environment/article/historic-drought-looms-for-20-million-living-in-horn-of-africa

- 4 World Bank, 2021. Updated estimates of the impact of COVID-19 on global poverty: Turning the corner on the pandemic in 2021? Available at: https://blogs.worldbank.org/opendata/updated-estimates-impact-covid-19-global-poverty-turning-corner-pandemic-2021

- 5 African Development Bank, 2021. African Economic Outlook, 2021. Available at: https://blogs.worldbank.org/opendata/updated-estimates-impact-covid-19-global-poverty-turning-corner-pandemic-2021

- 6 World Bank, 2021. Updated estimates of the impact of COVID-19 on global poverty: Turning the corner on the pandemic in 2021? Available at: https://blogs.worldbank.org/opendata/updated-estimates-impact-covid-19-global-poverty-turning-corner-pandemic-2021

- 7 African Development Bank, 2021. African Economic Outlook, 2021. Available at: https://www.afdb.org/en/documents/african-economic-outlook-2021

- 8 Annex of the ‘Kigali Declaration on Neglected Tropical Diseases’ [opens as PDF]. Available at: https://www.uneca.org/sites/default/files/TCND/ARFSD2022/kigali-declaration.pdf p. 9.

Related content

Global Public Investment and Africa: A better approach to financing the SDGs

The world’s system of financing public goods and common challenges isn’t working for the African continent. A new discussion paper explains why and how Global Public Investment is important for Africa, and what questions remain to be resolved.

Why we need Global Public Investment after Covid-19

Simon Reid-Henry argues that the Covid-19 response has highlighted the international need for an ongoing pool of public money and explains how Global Public Investment (GPI) would work.