Adapting aid to end poverty: Delivering the commitment to leave no one behind in the context of Covid-19: Chapter 3

Covid-19 and its impact on the financing landscape

DownloadsThe Covid-19 pandemic has further weakened an already difficult financing landscape for the SDGs. Even before the pandemic, weak global growth, heightened debt risks, a retreat from multilateralism and more frequent and severe climate shocks had made conditions more unfavourable to mobilising financing for the SDGs and achieving the promise to leave no one behind.

With disruptions to trade and investment flows caused by Covid-19, a drop in commodity prices, pressure on aid, a fall in remittances and a decline in income from tourism and other sources, the development finance picture has become even more challenging. Added to this is the need for countries to mobilise additional resources quickly and at scale for emergency responses in healthcare, jobs, support to businesses, financial institutions and multiple other areas.

This section explores how Covid-19 has impacted development financing and looks at where financing challenges remain most acute. It looks at how well ODA targets those countries where financing ‘leaving no one behind’ remains the most challenging and asks how aid can be made more responsive to both short- and long-term needs in light of the huge changes brought about by the pandemic.

How effectively do non-ODA resources target the poorest?

Domestic public revenues cannot meet sustainable development needs in the poorest countries

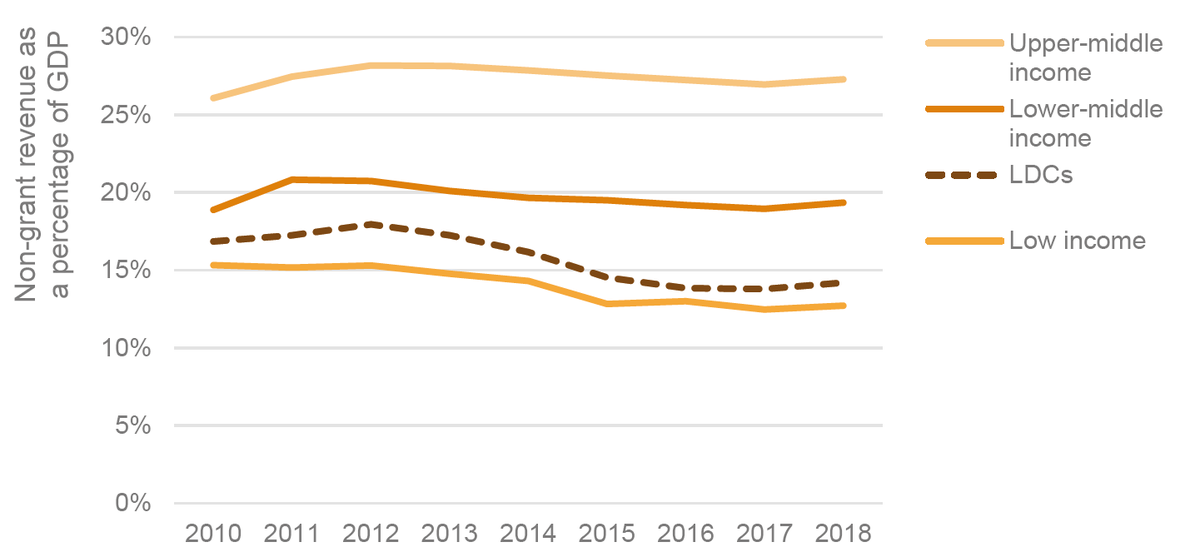

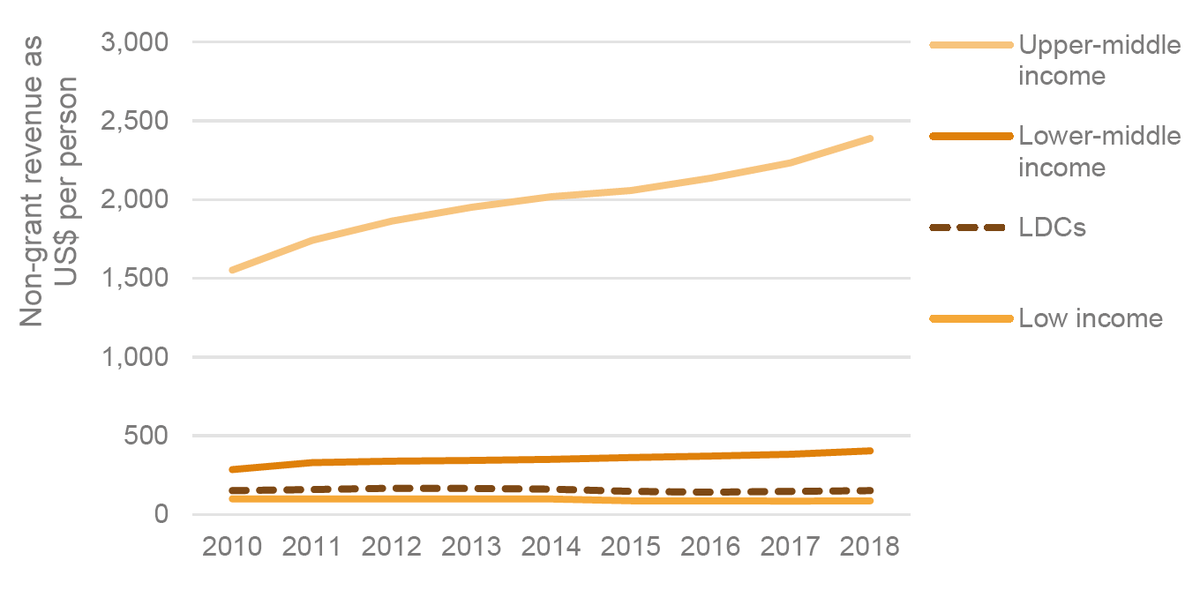

Domestic public resources are the most important source of long-term sustainable finance for the SDGs. Yet the data shows that even prior to the Covid-19 pandemic increases in these resources had failed to materialise and were insufficient to meet sustainable development needs, in particular in the poorest countries.

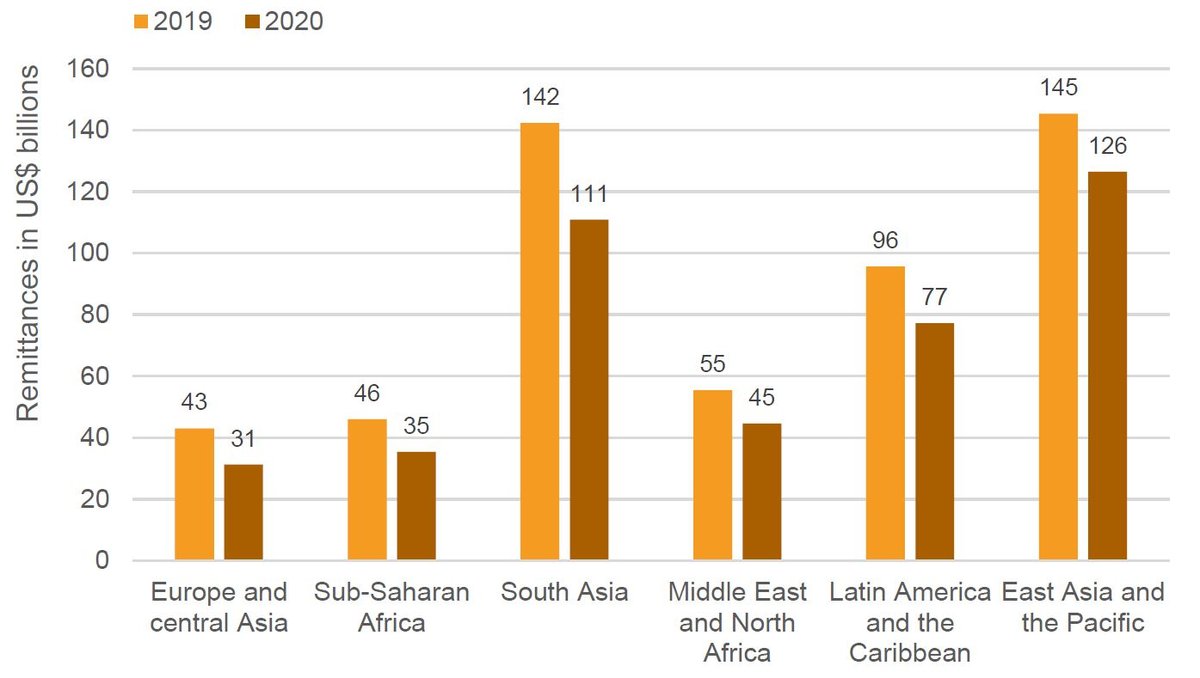

Our data shows that in the LDCs government revenues have in fact declined over the last decade from 17% of GDP in 2010 to 14% in 2018. Government revenues in lower middle-income countries have also flatlined at 19–20% of GDP over the last decade (Figure 2). [1]

To put this data into context, revenues in LDCs amounted to just US$152 per capita in 2018, down from US$161 five years earlier; in upper middle-income countries, revenues per capita were US$2,388 in 2018; and in high-income countries they amounted to US$16,082 in the same year. [2] Particularly striking is the large – and growing – gap between the domestic revenue capacities of the world’s higher income nations and its poorest (Figure 3). Only about 40% of developing countries worldwide have been able to increase tax to GDP revenues over the last five years, with the accelerated digitalisation of economies, tax avoidance and tax evasion as major sources of pressure on domestic resource mobilisation efforts. [3]

Figure 2: Even pre-Covid-19, revenues had fallen in the poorest countries

Non-grant government revenue as a percentage of GDP by country grouping, 2010–2018

Non-grant government revenue as a percentage of GDP by country grouping, 2010–2018

Source: Development Initiatives based on International Monetary Fund (IMF) World Economic Outlook data, IMF Article IV Staff and programme review reports (various) and World Bank World Development Indicators.

Note: LDC: least developed country.

Figure 3: There is a widening gap in revenue growth for the poorest countries

Non-grant government revenue per person by country grouping, 2010–2018

Non-grant government revenue per person by country grouping, 2010–2018

Source: Development Initiatives based on International Monetary Fund (IMF) World Economic Outlook data, IMF Article IV Staff and programme review reports (various) and World Bank World Development Indicators.

Note: LDC: least developed country.

The Covid-19 pandemic is leading to a further deterioration in government revenues, as income from tourism, commodity exports or other important sources declines, with losses potentially sustained over an extended period of time. This challenge is compounded by the need to implement exceptional fiscal support measures in response to the crisis, including both revenue and expenditure measures as well as liquidity support to businesses. While both advanced economies and developing countries have implemented fiscal support packages, the ability of the poorest countries to do so is much more constrained. For example, low-income countries have implemented just 1.03% of GDP in fiscal support measures, such as increases in public expenditure, tax cuts or tax deferments, whereas for advanced economies the figure is 8.85%, according to the IMF. [4]

The ‘fiscal stimulus gap’ threatens to increase inequality between poorer and richer countries. It is even more concerning in the light of the social protection deficits in many developing countries. Low-income countries have only US$7.34 per person to spend on social protection in response to the Covid crisis, compared with US$3,914 per capita in advanced economies (some 533 times higher). When combined with low or negative economic growth, these measures will further reduce public revenues in 2020 and beyond, with important implications for public spending over the next few years.

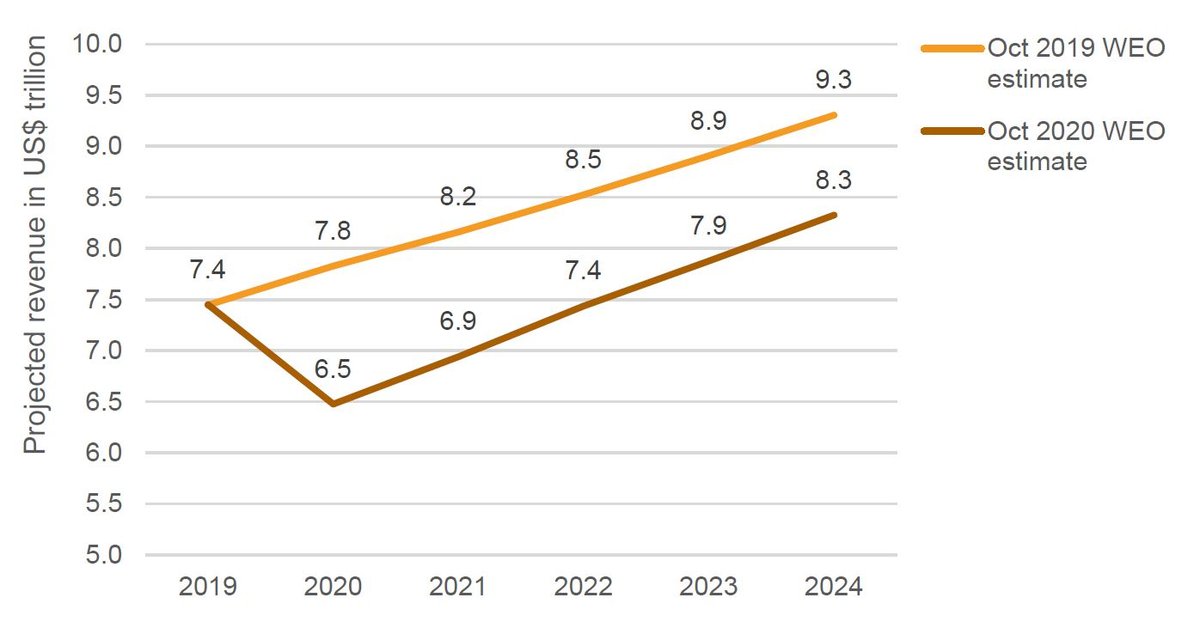

Estimates of the scale of potential revenue losses depend on the scenario modelled. The IMF projects that revenues for all developing countries could decline by US$2.27 trillion over the next two years under an optimistic scenario; if there is a longer outbreak, a fall of US$2.57 trillion is possible over the same period. While most of these losses will be sustained in middle-income countries due to higher overall revenues in volume terms, losses to poorer countries are substantial when measured as a proportion of overall revenues. For example, the LDCs are projected to experience a 17% decline in public revenues in 2020 under a (probable) longer outbreak scenario.

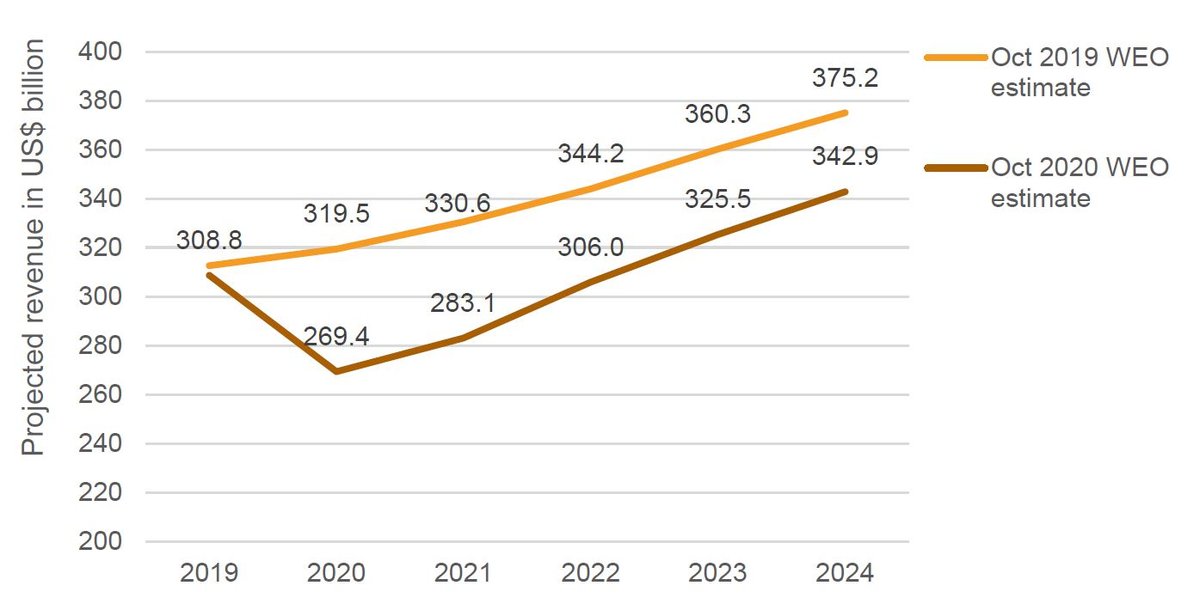

Sub-Saharan African countries will see a 15.7% revenue loss in 2020 and a projected 14% revenue loss in 2021, equivalent to US$97.6 billion in revenue losses over two years under the same scenario. These losses are particularly harmful in a context in which domestic revenues were already low and need is substantial. With current economic projections, the pandemic will likely cause a sustained hit to developing countries’ finances such that even when economies and revenues begin grow again, the effect of the crisis will continue to be felt years into the future (Figures 4 and 5).

Figure 4: Covid-19 will have a long-term negative effect on developing country revenue

Projected revenue declines due to Covid-19 (all developing countries under a prolonged outbreak scenario), 2019–2024

Projected revenue declines due to Covid-19 (all developing countries under a prolonged outbreak scenario), 2019–2024

Source: Development Initiatives based on International Monetary Fund World Economic Outlook (WEO) data.

Figure 5: Covid-19 will depress revenue in sub-Saharan Africa for many years to come

Projected revenue declines due to Covid-19 (sub-Saharan Africa under a prolonged outbreak scenario), 2019–2024

Projected revenue declines due to Covid-19 (sub-Saharan Africa under a prolonged outbreak scenario), 2019–2024

Source: Development Initiatives based on International Monetary Fund World Economic Outlook (WEO) data.

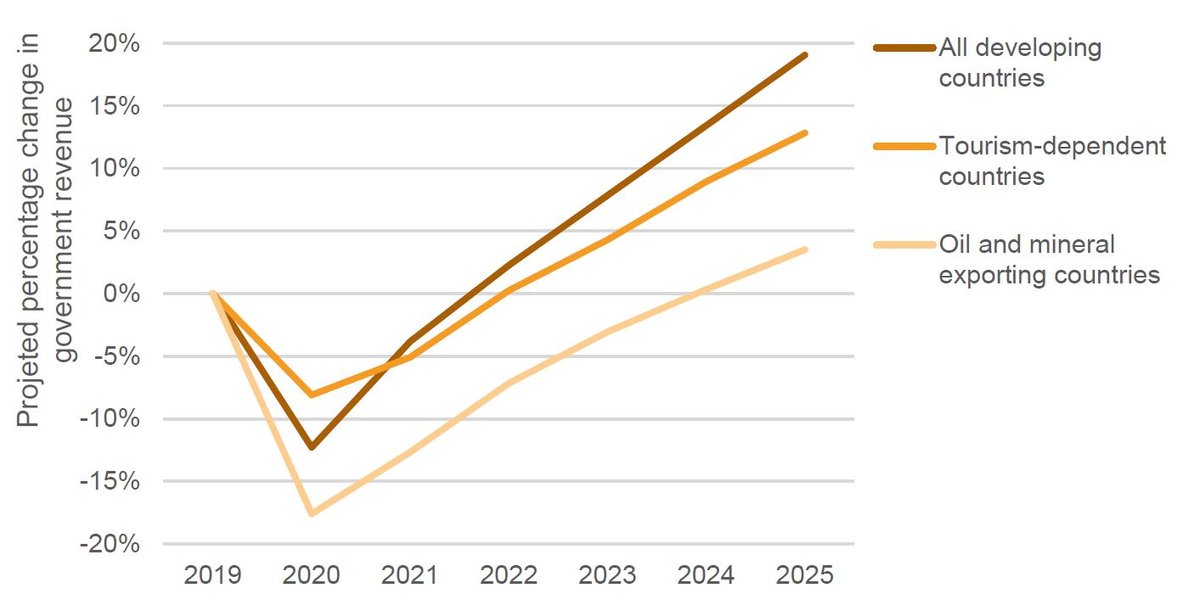

For some countries, such as those that are highly dependent on tourism or commodity exports, the impact on revenues will be even more acute (Figure 6).

Figure 6: Revenues of countries dependent on commodity exports and tourism will be hard hit by the effects of the crisis and revenues will recover more slowly

Projected revenue impacts in commodity-exporting and tourism-dependent countries, 2019–2025

Projected revenue impacts in commodity-exporting and tourism-dependent countries, 2019–2025

Source: Development Initiatives based on International Monetary Fund (IMF) World Economic Outlook and World Bank data.

Notes: Tourism-dependent countries are defined as those that receive 10% or more in tourism revenues as a percentage of GDP; our analysis includes 25 such countries. Oil and mineral exporting countries are defined as those holding 30% of their total exports (merchandise exports and service exports) as fuel and mineral exports and/or those marked as 'oil exporters' in IMF Regional Outlook and Fiscal Monitor publications; our analysis includes 48 countries.

Debt ratios are a cause for concern

Rapid debt accumulation caused alarm even prior to the Covid-19 crisis. In 2019, the World Bank warned that the previous decade had seen the “largest, fastest and most broad-based increase in debt” across the developing world in 50 years, and in particular private debt. [5] In 2018, gross government debt as a percentage of GDP was 82.2% across all countries, its highest level ever; private debt stood at 144.8% of GDP, also its highest ever level. [6] Now, with increased pressure on public finances due to additional spending needs and a collapse in revenues, in particular for commodity exporters and tourism-dependent countries, debt ratios will climb further. According to IMF data, 81 developing countries have requested some US$102 billion in new loan financing from the institution in response to the pandemic, US$4.6 billion of which from low-income countries; this new borrowing will also further increase debt ratios. [7]

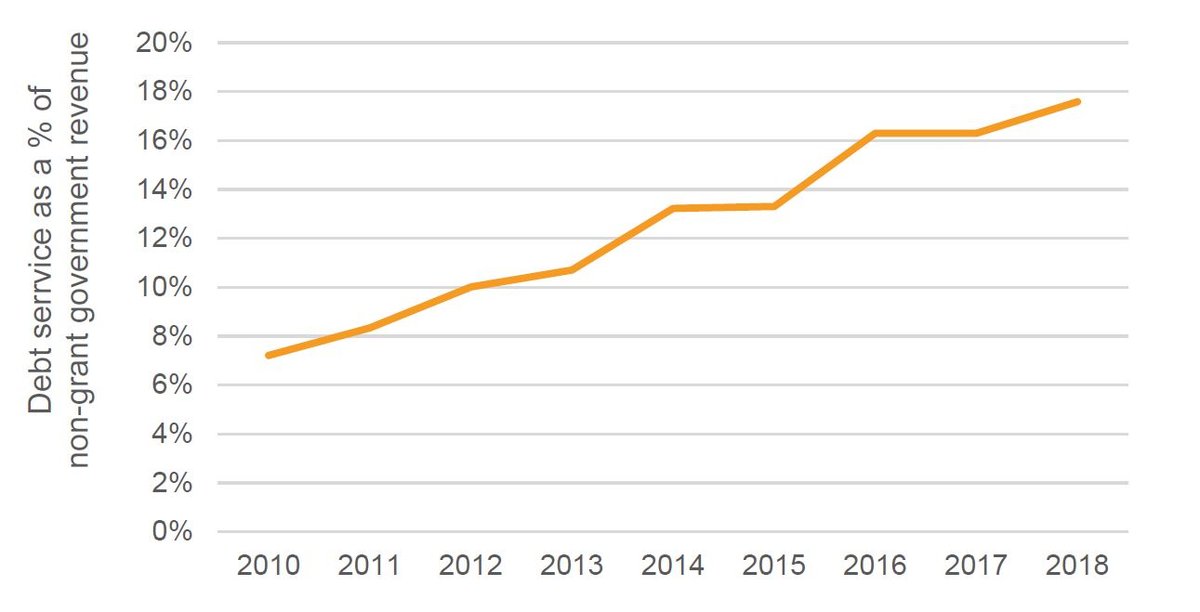

While debt ratios are lower overall in developing countries than in advanced economies, the speed of recent increases in debt has caused unease, in particular in lower income countries. For example, in the LDCs, gross government debt climbed from 39% of GDP in 2008 to over 52% in 2018; across sub-Saharan Africa, debt levels increased by 26 percentage points over the last decade, from 26% in 2008 to 51% in 2018. [8] Moreover, LDCs have increasingly accessed non-traditional and non-concessional sources of credit over recent years, such as bond issuance. As such, debt service ratios had risen sharply even prior to the pandemic; from 1.4% of GNI in 2008 to almost 2.5% in 2018. Debt service as a proportion of non-grant revenues in the LDCs has more than doubled over the last decade, from 7.2% of government revenues in 2010 to 17.6% in 2018 (Figure 7).

At the end of September 2020, the IMF reported that eight developing countries were already classified as ‘in debt distress’, 27 were ‘at high-risk’ of debt distress and a further 23 at ‘moderate risk’. [9] Within these three at-risk categories, the data shows that 24 countries are low income, 24 are lower middle income and just 10 are upper middle income. [10]

Figure 7: Debt service for LDCs has more than doubled in the last decade

Debt service as a percentage of non-grant government revenue in LDCs, 2010–2018

Debt service as a percentage of non-grant government revenue in LDCs, 2010–2018

Source: Development Initiatives based on International Monetary Fund (IMF) World Economic Outlook data, IMF Article IV Staff and programme review reports (various) and World Bank World Development Indicators.

Note: LDC: least developed country.

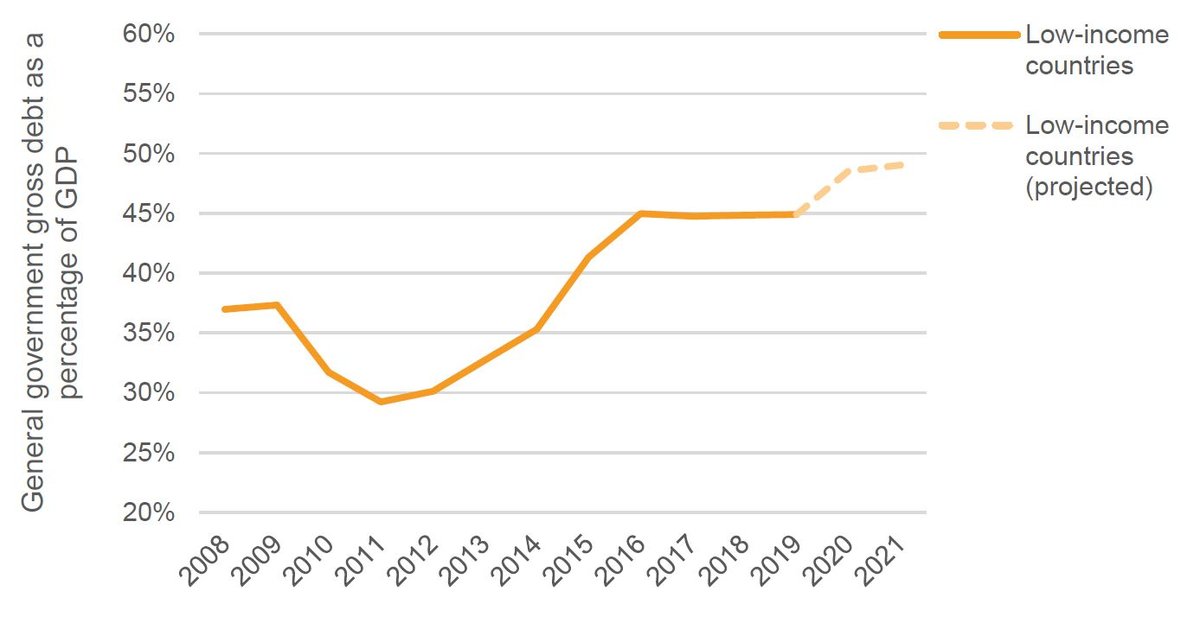

As a consequence of the Covid-19 crisis, debt ratios are projected to rise sharply across all developing countries over the next two years (Figure 8). In low-income countries, debt is expected to rise from 44.9% of GDP in 2019 to 48.5% in 2020 and 49% in 2021. [11] Debt service levels will also rise as borrowing needs and costs have increased in response to the crisis. This will further constrain the poorest countries’ abilities to meet essential public expenditures while need is on the rise.

Figure 8: Debt ratios in low-income countries have risen sharply in the last decade and are projected to continue to grow due to the crisis

Projected increases in general government gross debt as a percentage of GDP, 2008–2021

Projected increases in general government gross debt as a percentage of GDP, 2008–2021

Source: Development Initiatives based on International Monetary Fund World Economic Outlook data and World Bank World Development Indicators.

These projections, however, remain subject to continued uncertainty; if a more adverse scenario were to materialise, debt levels could climb even higher and debt dynamics become even more unfavourable. Debt vulnerabilities are spread across both low- and middle-income countries, however they are of particular concern when they impact countries’ abilities to meet the basic needs of their populations. In countries where poverty rates are particularly high, this is of even greater concern.

International private finance is in retreat

In addition to the considerable impact on domestic revenues, critical sources of international private finance are also in retreat. These include foreign direct investment (FDI), commercial debt, tourism revenues and migrant remittances. While private flows are procyclical in nature, never before have all these flows experienced such a large simultaneous hit, with the impact being felt across all countries.

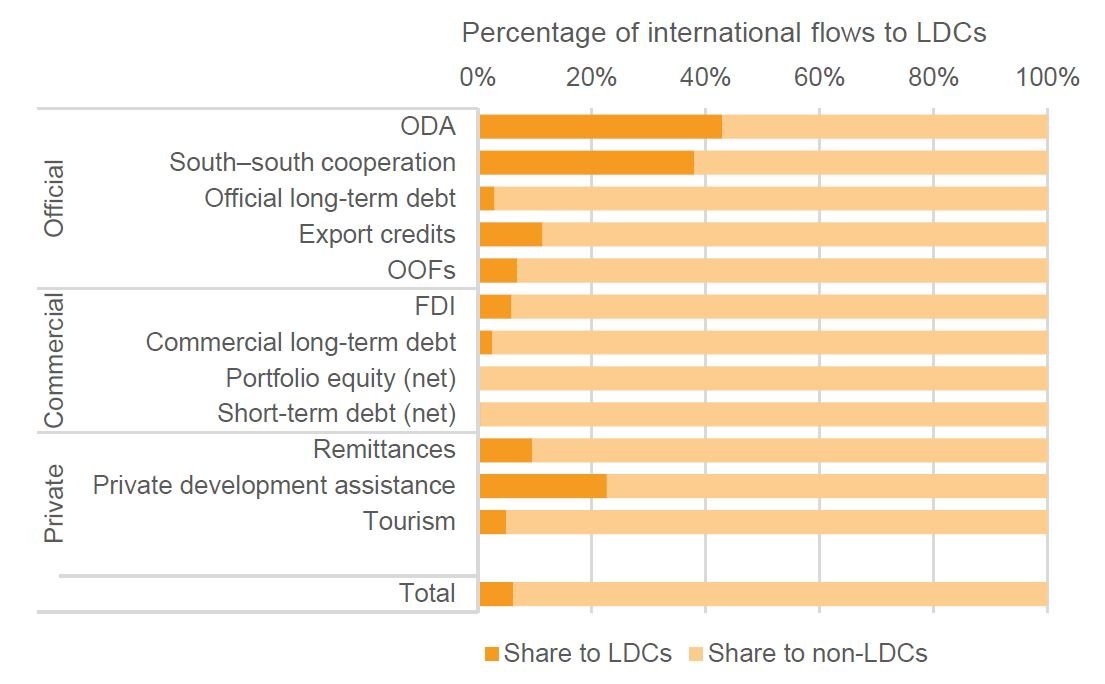

LDCs capture low shares of international private flows overall (Figure 9a). For example, LDCs captured just 6% of FDI to developing countries, 5% of tourism receipts and 9% of migrant remittance flows in 2018. Nevertheless, combined these resources represent important sources of finance for the LDCs (Figure 9b). Any impact on these flows therefore remains substantial at the national level.

Figure 9a: LDCs capture very small proportions of international financial flows

Share of international financial flows to LDCs, 2018

Share of international financial flows to the LDCs, 2018

Source: Development Initiatives based on World Bank, United Nations Conference on Trade and Development and OECD data.

Notes: FDI: foreign direct investment; LDC: least developed country; ODA: official development assistance; OOF: other official flow.

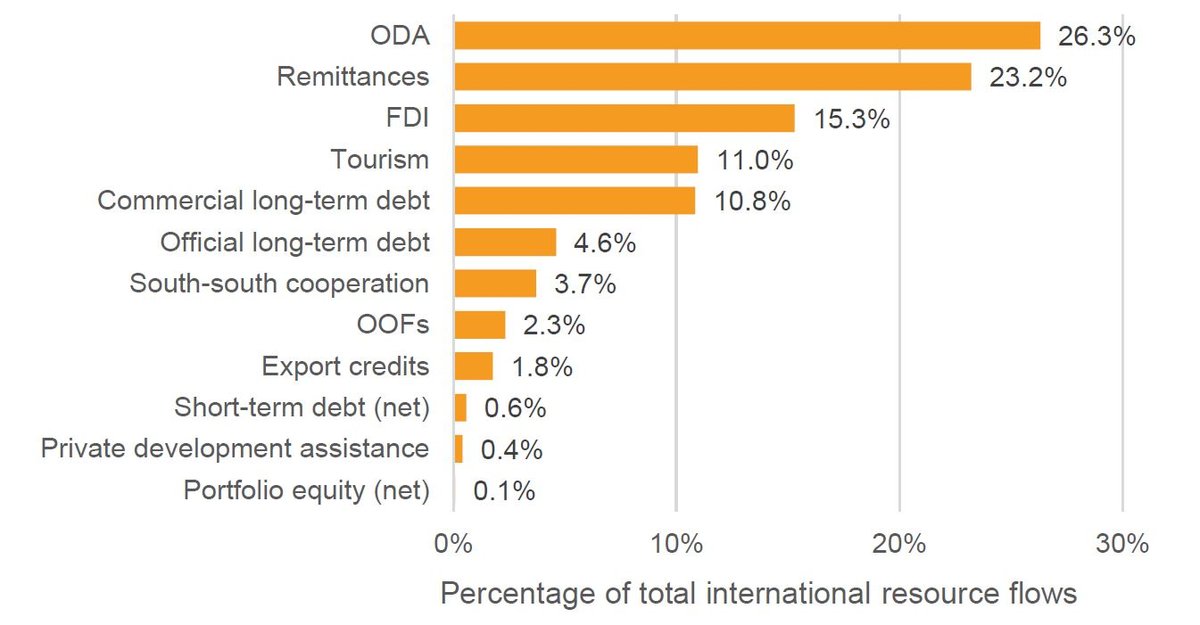

Figure 9b: LDCs are highly reliant on a small number of international flows

International flows received by LDCs, as percentages of the total, 2018

International flows received by LDCs, as percentages of the total, 2018

Source: Development Initiatives based on World Bank, United Nations Conference on Trade and Development and OECD data.

Notes: FDI: foreign direct investment; LDC: least developed country; ODA: official development assistance; OOF: other official flow.

These flows are now all in retreat due to the Covid-19 pandemic, and the crisis could accentuate the poorest countries’ marginalisation from international trade and investment even further.

Even prior to the crisis, several low-income African countries had experienced a significant decline in FDI inflows, such as the Democratic Republic of the Congo and Ethiopia. The United Nations Conference on Trade and Development reports that FDI flows to Africa are forecast to contract between 25% and 40% in 2020, with a further 5% to 10% decrease possible in 2021 before a recovery is initiated in 2022. [12]

Remittance flows, which are often less volatile than other sources of external finance and a lifeline to poor households, are also projected to decline sharply as migrants are impacted by job losses, wage reductions and even repatriation. In the LDCs, remittance inflows amounted to US$45.3 billion in 2018. The World Bank estimates that remittances will fall by 19.7% in 2020 overall with South Asia expected to see a 22% decline, Latin America and the Caribbean a 19.3% decline and sub-Saharan Africa a 23% decline (Figure 10). [13] The LDCs hardest hit include Haiti, Kyrgyzstan, Nepal, South Sudan and Tajikistan where remittances were between 25% and 36% of GDP in 2019.

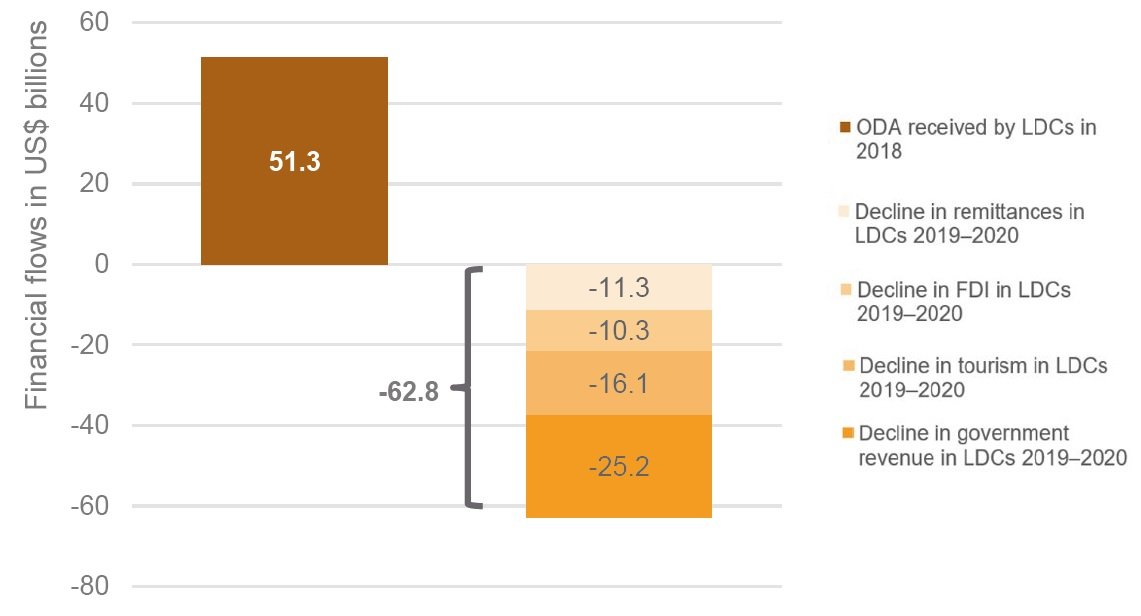

Figure 11: Combined projected falls in commercial international flows and government revenue to LDCs are larger than the volume of ODA received in 2018

Expected losses in revenue in LDCs 2019–2020, compared with ODA to LDCs in 2018

Expected losses in revenue in LDCs 2019–2020, compared with ODA to LDCs in 2018

Source: Development Initiatives based on OECD DAC, International Monetary Fund World Economic Outlook, United Nations Conference on Trade and Development and World Bank data.

Note: FDI: foreign direct investment; LDC: least developed country; ODA: official development assistance; OOF: other official flow.

The impact on tourism, meanwhile, has been unprecedented. In 2018, tourism receipts accounted for 11% of total external financial flows to the LDCs, or US$21.4 billion. Their importance is far higher in some countries, such as the Solomon Islands, Vanuatu and Cambodia. The UN World Tourism Organisation reports that international tourist numbers are down 65% in the first half of 2020, with recovery expected to take anywhere between 2.5 to 4 years. [14] Combined, lost domestic resources, remittances, foreign direct investment and receipts from tourism to LDCs in 2019–2020 will surpass the aid they received in 2018 (Figure 11).

ODA is a vital resource to leave no one behind but needs to be better targeted

ODA and its record on reaching the furthest behind

The Covid-19 pandemic is leading to a serious deterioration in all the non-ODA flows available to the poorest countries to invest in the SDGs. While they may account for lower revenue losses or lower declines in private financing flows in absolute terms, proportionally they will be harder hit since they have higher numbers of people living in poverty and deprivation and fewer resources to help kick-start – and sustain – recovery. Debt levels can be expected to further rise, increasing debt vulnerabilities. These challenges reinforce the critical role of ODA.

ODA is the only international resource that has development and human welfare as its core aims. It also tends to be less procyclical than many private finance flows.

ODA remains the most important source of external finance in many of the world’s poorest countries. In 2018, ODA represented 26.3% of total external financial flows to the LDCs and 17.3% of flows to fragile states. [15] ODA is therefore central to international efforts to support these countries to both contain and respond to the pandemic, as well as ensure public health systems are not overwhelmed and can meet broader healthcare needs. This is critical to minimise the potential long-term damage of the crisis.

Despite the critical importance of ODA, the economic recession in major donor nations is likely to drive significant reductions in ODA over the next few years, just as they are needed most. This may undermine one of ODA’s key attributes, namely its relative stability compared with more volatile procyclical private finance flows.

Even prior to the crisis, ODA levels fell far short of the UN target of 0.7% of GNI to ODA; Organisation for Economic Co-Operation Development Assistance Committee (OECD DAC) donors provided just 0.3% of their combined GNI in ODA in 2019, a ratio that has remained broadly consistent over the last decade. [16]

Considerable uncertainty remains as to the length and severity of the Covid-19 pandemic and the extent to which donors may reduce aid in response to domestic economic pressures. While the crisis has so far seen unprecedented resource pledges and commitments from the international community, our near real-time analysis shows that most of the new resource commitments are from international financial institutions (IFIs) and that bilateral aid resources have declined compared with the same period last year. While this analysis can only look at the donors and institutions that provide sufficient timely data, this does cover a critical mass of the aid landscape and as such it provides useful indications about the current direction of travel.

For example, in the first seven months of 2020, bilateral commitments – ODA and other official flows (OOFs) – reported to the International Aid Transparency Initiative (IATI) were 11% lower than the same period in 2019. ODA alone has fallen by 5%. Commitments from IFIs, on the other hand, have increased by 31%, driven by a 139% increase in ODA commitments compared with the same period in 2019. [17]

This represents an important shift in the official financing landscape since more of the finance provided by IFIs is in the form of loans rather than grants, including to low-income countries. Additionally, IFIs provide proportionally less of their finance to low-income countries (11% from January to July 2020) than middle-income countries (83%), with the latter having stronger resource mobilisation capacities from a range of sources. Countries with high extreme poverty rates, over 20%, are receiving just 21% of IFI commitments in the first seven months of this year, a slight increase from 16% in the same period in 2019. By comparison, 43% of bilateral aid commitments this year are targeted to low-income countries and 49% to countries with high rates of poverty. [18]

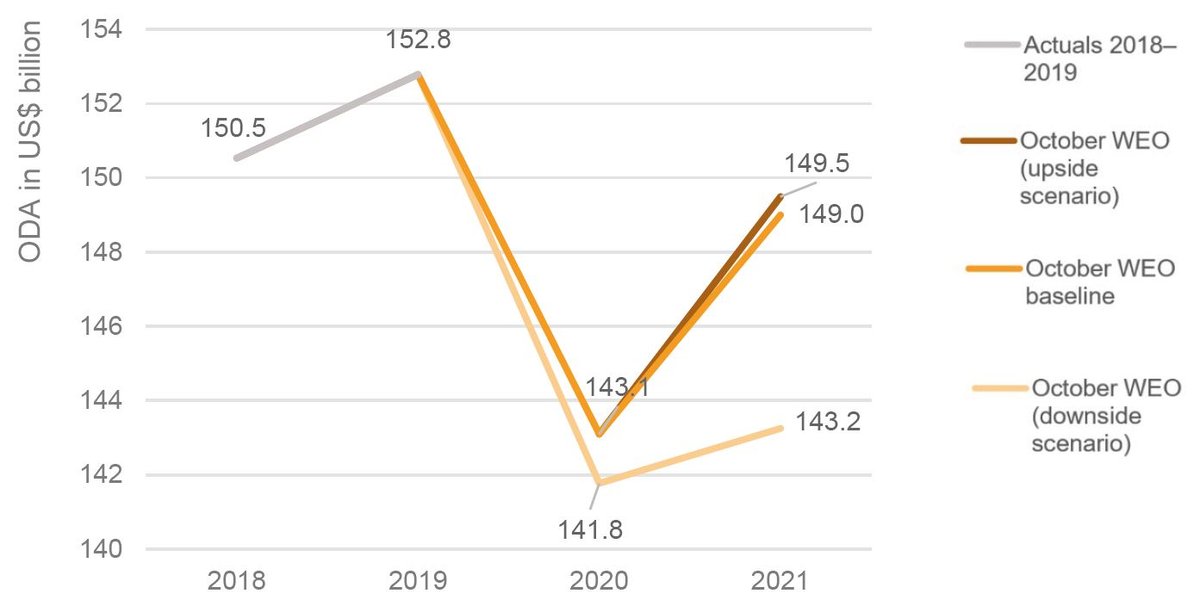

Several aid scenarios are possible over the next few years; all forecast a decline in overall ODA volumes (Figure 12). On the basis of economic projections in donor countries, in 2020 a US$10–11 billion fall in ODA is possible. Beyond this, under a more optimistic scenario, which sees a strong recovery in 2021 (increasingly unlikely as countries are hit by second and third waves and localised outbreaks contribute to a challenging economic picture), ODA could recover to US$149.5 billion by 2021 (still below its 2019 level). In a downside scenario, ODA could fall to below US$142 billion. If these cuts are shared equally across all ODA-eligible countries, the LDCs would see a fall in ODA of US$2.9 billion under a better-case scenario and US$3.3 billion under a downside scenario. It is important to consider, however, that the deeper and more prolonged the crisis becomes, the larger the potential negative impact on ODA for several years to come.

Figure 12: ODA levels are likely to decline due to the effects of the pandemic in donor countries

Total ODA scenarios based on October 2020 WEO, 2018–2021

Total ODA scenarios based on October 2020 WEO, 2018–2021

Source: Development Initiatives based on OECD DAC and International Monetary Fund (IMF) World Economic Outlook (WEO) data.

Notes: Data are from October 2020. The three scenarios are based on the application of 2019 ODA to projected GDP growth rates. The downside and upside scenarios represent a deviation from the baseline in the application of GDP growth in the IMF’s Alternative Evolutions in the Fight against the COVID-19 Virus. ODA: official development assistance; WEO: World Economic Outlook.

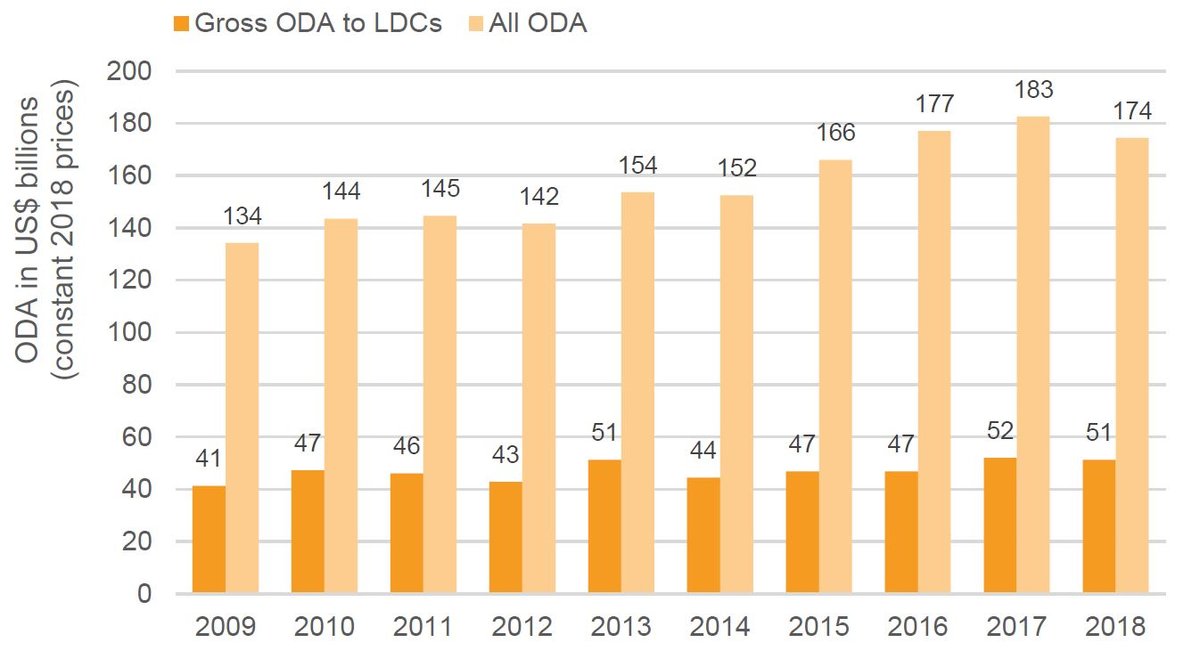

Falls in ODA are of particular concern to the world’s poorest countries, which are more reliant on aid resources than other countries. Even prior to the crisis, ODA was not well targeted to the poorest countries or to those that have a high proportion of the population living in extreme poverty. In 2018, the 47 LDCs received US$51.3 billion in ODA, or 29.4% of total bilateral and multilateral ODA. [19] Bilateral OECD DAC donors provided US$28.9 billion in ODA to the LDCs in 2019. The proportion of total ODA allocated to the LDCs has changed little over the last decade. [20]

Overall, ODA to the LDCs represents 0.09% of donor GNI, well below the UN target of 0.15–0.2%. Had OECD DAC donors met the lower bound of this target, bilateral ODA to the LDCs would have reached US$75.5 billion in 2018; if OECD DAC donors had met the more ambitious upper bound of the target, ODA to the LDCs could have reached US$100.6 billion. [21] Given high population increases in the LDCs, ODA per capita has also failed to increase over the last decade and stands at approximately US$50 per capita.

This data, however, hides wide variations across countries. ODA concentration remains a significant problem; in 2018, the top 10 ODA recipients received 32% of total ODA and the top 20 over 50% (Table 1). Again, these ratios have remained broadly consistent over the last decade.

Table 1: 50% of all ODA goes to the top 20 recipient countries

| Recipient | US$ billions | Percentage of ODA |

|---|---|---|

| India | 5.7 | 4.7% |

| Ethiopia | 5.1 | 4.2% |

| Bangladesh | 5.0 | 4.1% |

| Afghanistan | 3.8 | 3.2% |

| Nigeria | 3.5 | 2.9% |

| Turkey | 3.2 | 2.7% |

| Indonesia | 3.2 | 2.7% |

| Syrian Arab Republic | 3.2 | 2.6% |

| Kenya | 2.9 | 2.5% |

| Viet Nam | 2.7 | 2.3% |

| Democratic Republic of the Congo | 2.7 | 2.2% |

| Tanzania | 2.6 | 2.2% |

| Jordan | 2.5 | 2.1% |

| Pakistan | 2.4 | 2.0% |

| Iraq | 2.3 | 2.0% |

| Uganda | 2.0 | 1.7% |

| Yemen | 2.0 | 1.7% |

| Mozambique | 1.9 | 1.6% |

| Egypt | 1.9 | 1.6% |

| Colombia | 1.9 | 1.6% |

| Top 20 total | 60.6 | 50.6% |

Source: Development Initiatives based on OECD DAC data.

Note: ODA: official development assistance.

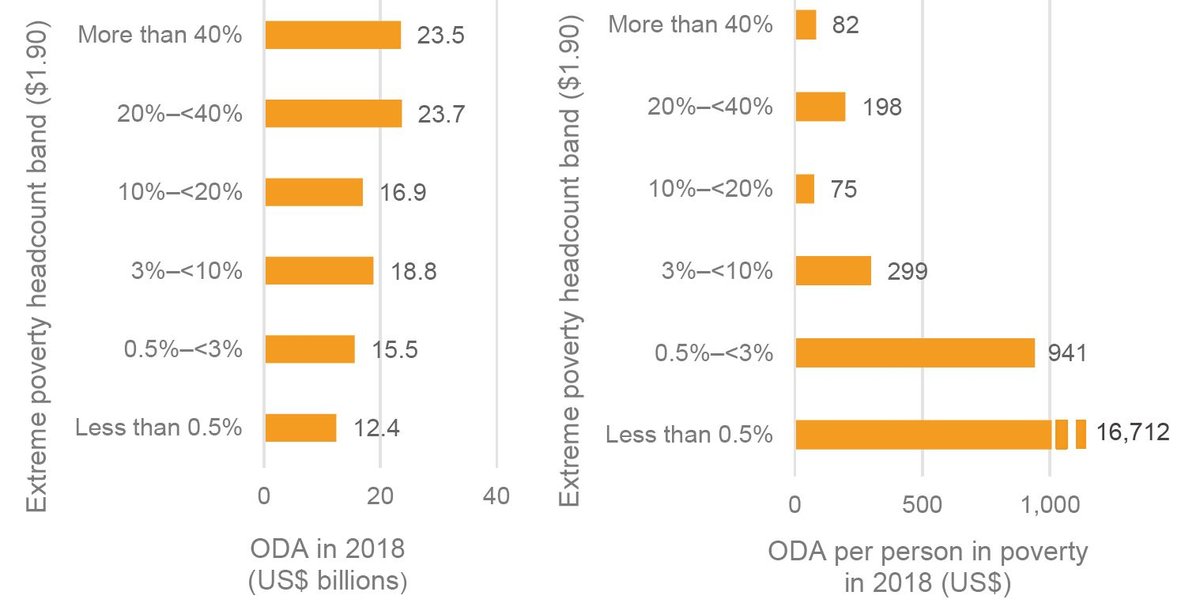

The data also shows that growth in ODA to non-LDCs outpaces growth in ODA to LDCs (Figure 13). In 2018, aid to non-LDC countries was 16% higher than in 2010, while ODA to LDCs rose by only 8.6% over the same period. The data also shows that while more ODA in volume terms is allocated to those countries with a higher extreme poverty headcount (US$1.90 per day, 2011 PPP), large populations of people in poverty in these countries mean that this translates into relatively small amounts of ODA per person in poverty. A significant amount of ODA also continues to be channelled to countries with relatively low extreme poverty rates (Figure 14).

Figure 13: Growth in ODA to the poorest countries has lagged behind

Total ODA volumes and ODA volumes going to LDCs, 2009–2018

Total ODA volumes and ODA volumes going to LDCs, 2009–2018

Source: Development Initiatives based on OECD DAC data.

Notes: LDC: least developed country; ODA: official development assistance.

Figure 14: Significant proportions of ODA are targeted to countries with lower poverty levels

ODA allocations according to extreme poverty headcount, 2018

ODA allocations according to extreme poverty headcount, 2018

Source: Development Initiatives based on OECD DAC, PovcalNet and World Bank World Development Indicators

Notes: ODA: official development assistance.

The trend towards blended finance instruments and increasing levels of ODA allocated to private sector investments and channelled through bilateral and multilateral development finance institutions (DFIs) also impacts aid allocation patterns. They risk reinforcing the marginalisation of the poorest countries and communities, which are not well served or targeted by such approaches. Between 2012 and 2015, just 7% of total blended finance operations benefited the LDCs. [22]

The data shows a high degree of concentration in DFI-supported investments. For example, in 2019 just five African countries accounted for 71% of European bilateral DFIs’ combined direct investments in the continent in 2019, and these represent the larger and faster growing economies in the region (Kenya, Nigeria, South Africa, Uganda and Ghana). In fragile states, just two countries – Côte d’Ivoire and Myanmar – account for over half of European DFIs’ combined fragile states’ portfolios. [23]

OECD DAC ODA to private sector instruments was US$2.7 billion in 2018 and increased to US$3.4 billion in 2019. It can be expected to rise further in light of the Covid-19 crisis, which has prompted many DFIs to announce fresh commitments to support the private sector in developing nations to respond to – and recover from – the crisis. Many donors are also committed to supporting the role of the private sector in development. While this is important, careful attention must also be paid to how ODA deployed in this way actually benefits the poorest and most disadvantaged people and places, and the impact it has on poverty reduction and inclusion in line with the core values and principles of ODA.

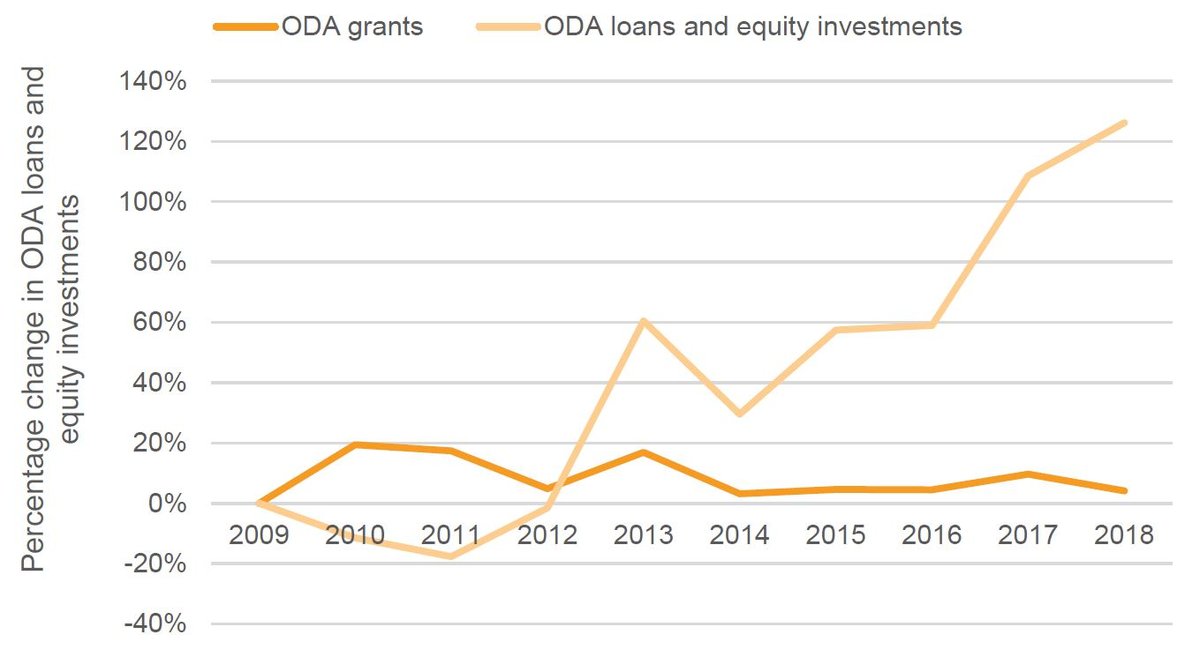

Declining concessionality of ODA, especially to the poorest

In addition, the proportion of ODA provided as loans has increased considerably over recent years. This includes a significant rise in bilateral concessional loans to the poorest countries, despite an increase in their debt vulnerabilities, and reflects a broader donor trend towards a reliance on loan instruments in ODA. The rise in multilateral financial commitments in the wake of Covid-19 relative to bilateral aid will further accentuate the trend towards larger volumes of official finance supplied as loans.

Our analysis shows that in 2018, of the US$51.3 billion provided in ODA to the LDCs, US$36 billion was in the form of grants and US$15.4 billion was in the form of loans (equity investments remain marginal in LDCs). ODA loans to the LDCs have grown over 126% during the last decade (Figure 15). This represents a much faster rate of increase than for developing countries as a whole, which have seen ODA loans rise by 69.7% over the same period. [24]

As indicated earlier in this report, a prolonged outbreak scenario will further increase debt levels and debt vulnerabilities and underscores the need for donors to provide as much finance as possible in the form of grants, especially to the poorest countries where SDG financing gaps remain the most acute.

How might Covid-19 affect sectoral priorities for ODA?

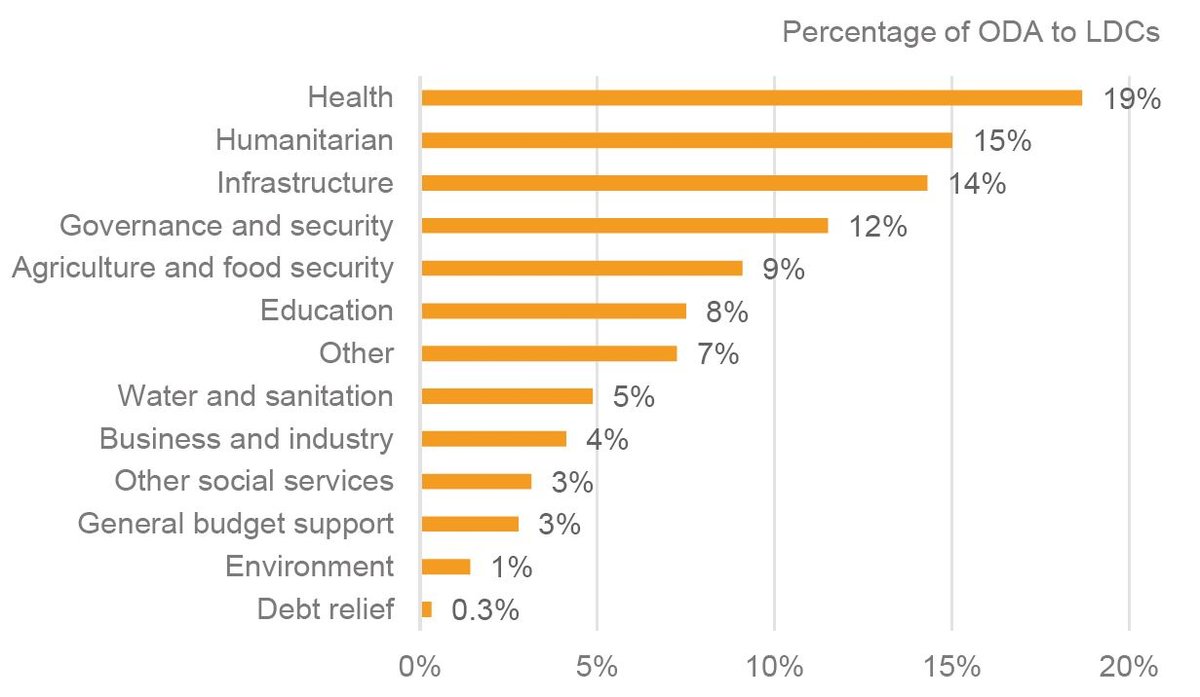

The Covid-19 pandemic has impacted some sectors particularly hard. These include healthcare, social protection, education, business and the private sector as well as critical areas such as gender equality. Scientists have emphasised that the Covid-19 pandemic is connected to the dangerous decline in biodiversity and accelerated natural habitat loss globally. [25] Here, we look at the sectoral distribution of ODA and ask how ODA might need to refocus in light of the pressures caused by the Covid-19 crisis so that it can support both immediate recovery and long-term resilience and development.

With falling domestic revenues, and considerable uncertainty looking forward, flexibility in aid funding will be more important than ever. Yet ODA data shows that donors consistently fail to provide large volumes of aid as direct budget support, by far the most flexible funding modality. In 2018 just 2% of total ODA was delivered as general budget support, which was 3% when looking at ODA to LDCs only. [26]

The Covid-19 pandemic has also underscored the critical importance of ODA for health and social protection to both contain and respond to the pandemic and ensure that social protection programmes are in place to protect the most vulnerable. Prior to the crisis, the data shows that ODA remained a critical source of finance for these sectors in the poorest countries, where domestic public resources are a fraction of what they are in high-income nations. For example, in LDCs, domestic government expenditure on health was just US$29 per capita in PPP terms in 2017, more than 100 times lower than in high-income countries (at PPP$3,692 in 2017). [27]

Recent data from key donors who have reported their 2020 aid commitments to IATI shows an overall increase in ODA for health in 2020, much of which can be considered a probable response to the Covid-19 crisis. While data is not available for all donors, this near real-time analysis shows, for example, that in the first seven months of 2020 commitments to health increased by 80.6% (to a total of US$14.0 billion) compared with the same period in 2019 (US$4.2 billion). [28] Prior to this, however, most LDCs saw a decline in ODA for health in volume terms. [29]

With respect to the social sectors more broadly, the data shows an increase in commitments from IFIs and bilateral donors in response to the crisis, led predominantly by health spending. For bilateral donors, most sectors (beyond health and small increases in education spending) see falls in commitments in 2020. While IFIs are also investing heavily in health (with commitments in 2020 going up 156%) and some other social sectors, commitments to critical sectors such as water and sanitation, which are also vital to tackle Covid-19, and to long-term development are falling (30%). [30] Even prior to the crisis, ODA levels to water, sanitation and hygiene (WASH) interventions were low. In 2018, just 5% of total ODA was allocated to WASH interventions in the LDCs; the figure is even lower to non-LDC developing countries at 4%. [31]

Strengthening ODA commitments to these sectors in the poorest countries over the short term will be critical to efforts to tackle the virus and prevent people from falling into poverty. With IFIs playing a more significant role in financing these vital areas of social spending, a refocusing of both the targeting and concessionality is needed to ensure the poorest countries receive adequate support.

The data also shows overall low levels of ODA allocated to other sectors that have been critically impacted by the Covid-19 pandemic, particularly education, and business and industry. Indeed, education has received consistently low levels of ODA over the last decade; just 8% of total ODA to the LDCs went to education in 2018, and 7% for non-LDCs, a share that has changed little since 2009. Meanwhile, just 4% of ODA was allocated to business and industry in the LDCs in 2018, a figure that has functionally stagnated since 2009. [32]

Given the huge impact of the crisis on the learning, wellbeing and life chances of young people, strengthening ODA to these critical human capital sectors over the medium term will be central to a sustainable inclusive recovery. This is especially important in the context of high population growth across many low-income African nations, many of which were already experiencing high unemployment levels coupled with low-skilled workforces.

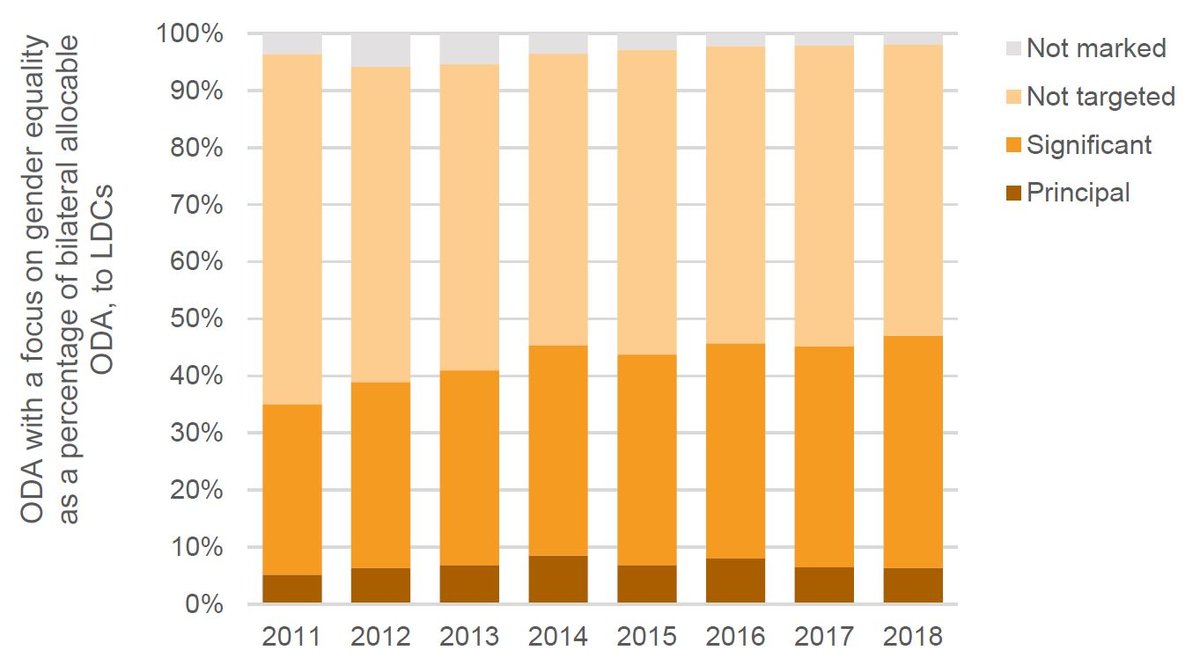

As outlined earlier in this report, women have been disproportionately impacted by the Covid-19 crisis. Yet little ODA is expressly targeted at the advancement of SDG 5 (to promote gender equality), which is significantly off-track (Figure 16). Just 5% of total ODA flows in 2018 were tagged as having gender equality as a ‘principal’ outcome; a further 34% tagged gender equality as a ‘significant’ outcome. In the LDCs, these ratios were only marginally higher: 6% of ODA was tagged as having gender equality as its principal outcome and a further 41% as a significant outcome. [33] Strengthening the gender focus of ODA will be critical to an inclusive recovery and ensure that inequalities between women and men are not further worsened by the crisis.

Figure 16: Gender responsiveness of ODA to LDCs has not improved markedly despite commitments to promote gender equality

ODA to LDCs with a focus on gender equality, 2011–2018

ODA to LDCs with a focus on gender equality, 2011–2018

Source: Development Initiatives based on OECD DAC data.

Notes: LDC: least developed country; ODA: official development assistance.

Covid-19 and its links to environmental degradation have further intensified calls for urgent action on climate change, the biodiversity crisis and the need for financing from all sources to be used strategically to support a green recovery. The data shows that, despite increased political and public concern with these issues, the environment and climate receive very little attention in ODA. Projects that directly target environmental protection as the main outcome received just 1% of total ODA in the LDCs in 2018; in non-LDC developing countries, the figure is only slightly higher at 3% of total ODA (Figure 17). [34]

Humanitarian interventions continue to make up a large share of ODA to the poorest countries at 15% of ODA in 2018. Almost half (23) of the 47 LDCs in 2018 were facing a UN-coordinated plan to respond to humanitarian crises that year. And humanitarian need is continuing to grow; high demands in 2019 became even higher in 2020 when the pandemic compounded existing crises, resulting in record UN appeal requirements of US$40 billion, a third higher than in 2019. The pressure to allocate more ODA to humanitarian responses is therefore as great if not greater than ever before. However, effectively meeting the needs of people in crisis requires more than just humanitarian assistance. Without effective cooperation and collaboration between humanitarian, development and peacebuilding actors, crises will persist and continue to impact the poorest and most vulnerable. Crises slow the rate of poverty reduction and the longer they persist the worse this impact is. [35] It is important that funding for long-term development is therefore targeted to countries and subnational locations experiencing crisis, wherever possible, to address the underlying causes.

Greater coherence between investments into peacekeeping efforts and humanitarian and development assistance is critical to ensure that the needs of populations furthest behind in crisis contexts are addressed in a sustainable manner. Collaboration across that nexus alongside sustained volumes of funding will be crucial to ensure development progress of previous decades is not lost, people in crises receive the urgent assistance they require, and sustainable development in the longer term is supported. [36]

Figure 17: Certain sectors dominate ODA spending in LDCs

Sector breakdown of ODA to LDCs, 2018

Sector breakdown of ODA to LDCs, 2018

Source: Development Initiatives based on OECD DAC data. Investments to End Poverty sectoral classification.

Note: ‘Other’ includes ODA that is reported as multi-sector, unallocated by sector, donor admin costs or refugees in donor countries. LDC: least developed country; ODA: official development assistance.

Downloads

Notes

-

1

Development Initiatives based on IMF Article IV data and World Bank Development Indicators. Data excludes aid resources.Return to source text

-

2

Development Initiatives based on IMF Article IV data and World Bank Development Indicators. Countries for which no government revenue data is available in any year from 2010 onwards have been excluded.Return to source text

-

3

UN Department for Economic and Social Affairs (DESA), 2020. Financing for Sustainable Development Report 2020. Available at: https://developmentfinance.un.org/fsdr2020Return to source text

-

4

IMF World Economic Outlook, June 2020. Available at: https://www.imf.org/en/Publications/WEO/Issues/2020/06/24/WEOUpdateJune2020Return to source text

-

5

World Bank, 2019. Global Waves of Debt: Causes and Consequences. Available at: https://www.worldbank.org/en/research/publication/waves-of-debtReturn to source text