The African Development Bank as a catalyst for reforming global financial architecture

Unfair systems are increasing African debt. Will the African Development Bank (and other IFIs) take the opportunity to catalyse meaningful change in the global financial architecture?

DownloadsIntroduction

From 27 to 31 May 2024, the Africa Development Bank (AfDB) Group will hold its Annual Meeting in Nairobi, Kenya. The theme of the Group’s 59th Annual Assembly (and 50th meeting of the African Development Fund) is ‘Africa's Transformation, the African Development Bank Group, and the Reform of the Global Financial Architecture’ .

Ahead of this meeting, we argue that the staggering debt burden only comparable to periods before the 1990s is a result of unfavourable debt composition and borrowing terms, and the SDG and climate financing gaps. We then highlight strategic next steps for the African Development Bank and other actors to reform the global financial architecture by correcting what is not working – including high borrowing costs and improving the mobilisation, allocation and access to more funding. These are needed to tackle global challenges like climate change, and existing development constraints, such as pervasive poverty and insufficient infrastructure.

The context: Debt, debt and more debt

Africa’s debt has ballooned over the past two decades

Between 2008 and 2022, Africa’s public and publicly guaranteed (PPG) external debt tripled to $657 billion, [1] accounting for 60% of the total external debt the continent owes to the rest of the world (Figure 1). During this period, African countries’ median total external debt has more than doubled to nearly 50% of GDP in 2022 (with PPG external debt accounting for most of this debt). This is a much higher debt burden than in other regions, such as South Asia (28%) or East Asia and the Pacific (38%). As of April 2024, half of the 38 African countries using the joint International Monetary Fund/World Bank (IMF-WB) Low-income Countries Debt Sustainability Framework (LIC-DSF) [2] are in or at high risk of external debt distress.

Despite falling short of the historical highs of the 1980s and 90s, Africa’s rising debt burden poses severe challenges to meeting the Sustainable Development Goals (SDGs). The situation is further exacerbated by exogenous shocks like climate change, health crises and geopolitical tensions. The mounting cost of borrowing and the unfavourable global financial architecture pose a significant barrier to the growth ambitions of this already-disadvantaged continent.

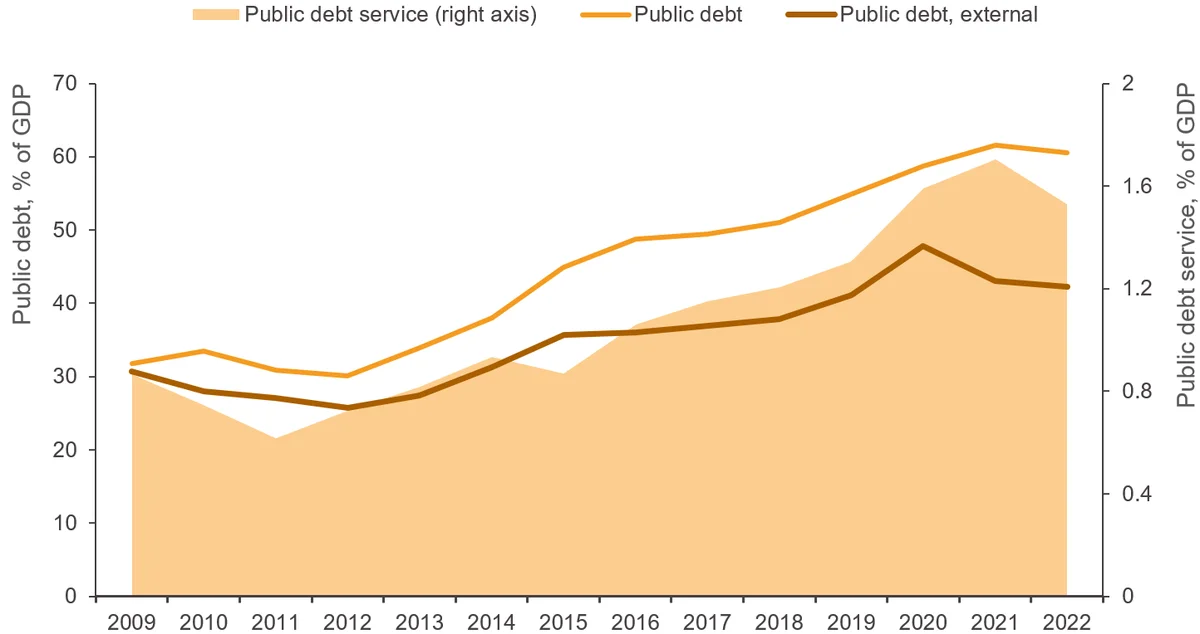

Figure 1: Africa’s debt burden has skyrocketed since 2009

Africa’s public debt, 2009–2022, median values as a % share of GDP

Chart showing that between 2008 and 2022, Africa’s public and publicly guaranteed (PPG) external debt tripled to $657 billion, accounting for 60% of the total external debt the continent owes to the rest of the world.

Source: IMF October 2023 World Economic Outlook; World Bank February 2024 World Development Indicators; and authors' analysis.

Over the past two decades, debt composition and borrowing terms have evolved unfavourably for Africa

According to the February 2024 update to the World Bank’s International Debt Statistics, Africa’s share of PPG [3] private creditors soared from 18% in 2004 to 43% in 2022. This was exacerbated as the share of concessional financing fell from an average of 49% in 2005 to 28% in 2022 as the grant element was cut by 5% during this period. [4] While the average maturity on new PPG external debt commitments has fallen by four years in the past two decades, the average grace period has reduced by two years since 2004, averaging five years in 2022. Africa is also exposed to the volatility of international interest rates as the share of PPG external debt with variable rates doubled from around 20% in the early 2000s to 40% in 2016, despite recent marginal declines. The share of Africa’s PPG external debt with variable rates continues to be high, coming in at 33% in 2022, coming in at 33% in 2022.

The unfavourable debt landscape forces Africa to divert its limited and hard-earned resources to service its debt at the cost of pressing development needs

Following the 2008 global financial crisis, debt service on external debt (PPG) reached its lowest point in 2011 at 0.9% of GDP. This downward trend was reversed in 2012, with debt service then tripling to reach 2.5% of GDP in 2021. The interest burden alone has increased from 4.6% to 10.4% of sub-Saharan Africa government revenue between 2012 and 2022. [5]

African countries spend more on debt servicing than pro-poor sectors. As a recent report established, more than a third of all African countries (23 countries) are spending on externa debt than both health care and education. [6]

Drivers of Africa’s debt burden

Increased borrowing for SDGs and climate action but little progress

Africa’s annual financing requirement to meet the SDGs by 2030 is estimated at US$194 billion. Progress towards those goals that will enable structural transformation is incredibly slow or even deteriorating. SDG 7 (affordable and clean energy) and SDG 9 (industry, innovation and infrastructure) are among those with the lowest score, [7] while progress on SDG 8 (decent work and economic growth) has deteriorated over the years.

One recent estimate suggests that nearly half of funding (47%) for climate action comes as market loans with 30% at a concessional rate. [8] The inauspicious change in the financing landscape over the between 2011–2022 has seen sub-Saharan countries in particular increasingly forced to borrow at market rate.

Unless there are fundamental structural changes in the global financial architecture the continent's debt burden will continue to skyrocket (exacerbated by existing capacity constraints for domestic resource mobilisation). These changes must enable Africa to borrow at fair terms, receive more grants and highly concessional financing, see pledges for climate financing and ODA commitments honoured, cooperate in wider efforts to combat illicit financial flows, and prioritise Africa in mechanisms such as Special Drawing Rights.

There is an urgent need to address the depth and severity of Africa’s debt and fix the ill-designed global financial system

Beyond the alarming extent of Africa’s debt, stakeholders’ (multilateral development banks, governments, bilateral and private creditors) fragmented approaches to addressing the debt crisis complicate the situation and can put African countries at a disadvantage. The low uptake of the Common Framework [9] and the consequences for those African countries applying to it is one example: following application, they must undergo often painful and lengthy restructuring processes and may even lose access to borrowing as they appear risky. This underscores the urgency of the situation.

Unfair global economic governance

Historical legacies have denied Africa a say in the designing and shaping of the global financial environment, leading to an inequitable distribution of benefits. Consequently, the continent has had to contend with unsustainable debt from less concessional resources, increased reliance on expensive private loans for development purposes, and revenue losses due to a global financial system that tolerates illicit financial flows from Africa. Aside from internal capacity issues concerning macroeconomic and debt management, Africa’s borrowing is more expensive due to biased credit rating agencies, [10] outdated debt-distress assessments and failure of debt-resolution mechanisms (including the Common Framework). The judgmental and outdated LIC-DSF – which leads to an inconsistent restructuring [11] approach between African and non-African countries – makes it difficult for Africa to tap the global capital market fairly. This highlights the unfairness of the current system.

Correcting what is not working 1: Action points for IFIs

The call for the reform of the global financial architecture is overdue

Radical change in the global financial architecture is needed if Africa is to meet the SDGs and fulfil climate action commitments. [12] Additional finance is needed for low-income countries and those that are vulnerable, fragile or conflict affected – many of which are in Africa. This should then be spent on high-quality, impactful projects. While a shift in the financing landscape (from grants to loans – concessional or not) is crucial, it is also important to acknowledge the inequitable power dynamics at play. Any proposed solution must address two issues.

Reducing Africa’s exorbitant borrowing costs

Fixing the misconceptions about Africa’s creditworthiness is the responsibility of all development partners as much as it is for Africans. A fundamental behavioural and institutional shift will require an overhaul, or at least a revamping, of the global financial architecture to fit current African realities. For example, there is growing evidence that the current joint LIC-DSF suffers from forecasting errors, [13] including (inaccurately) capturing the economy-wide productivity effects of public investments that led to the pessimistic creditworthiness projections of some African countries. [14]

International financial institutions, like the World Bank and the IMF, could play a constructive role by reforming the current LIC-DSF. They might do so by enhancing the credibility of macro-fiscal and socioeconomic projections regarding low-income countries and avoiding the traps of reductively summarising the creditworthiness of African countries.

For instance, the summary paragraph and table at the front page of the debt sustainability analysis (DSA), judges the countries’ overall creditworthiness as ‘low’, ‘moderate’, ‘high-risk’ or ‘in-distress’ biasing readers (mostly creditors) from the outset. A better alternative could be a relatively neutral/objective 0-100 score or index – or indeed, avoiding such scores at all, as countries’ creditworthiness is much more complicated than the evidence captured by the DSA. Similarly, private and commercial creditors could play a critical role by promoting transparent lending practices. In the same vein, private credit rating agencies should be open to fair criticism about the limitations of their methodology for assessing African countries' creditworthiness and how they communicate their results – and fix them. According to the April 2023 UNDP report, [15] African countries incurred an additional US$74.5 billion because of the less objective assessment of credit rating agencies, which have no presence in the countries and lack relevant data. Africa’s current and future financial needs demand a fundamental shift in the global financial institutions and capital markets, and rating agencies are no exception.

Correcting what is not working 2: The AfDB’s role

The AfDB is holding its 59th annual meeting at a historic juncture: Africans are expecting more development impacts from the Bank than ever before

The Bank carries both implicit and explicit responsibilities to provide the necessary development financing for the sustainable economic development and social progress of African countries. It is also responsible for influencing change in the global financial architecture. The Bank should position itself as an indispensable player when it comes to informing global political economies and revamping/revising financing instruments, programmes, and knowledge products across multilateral development banks and the IMF – which inform private creditors’ and rating agencies’ decisions about Africa’s creditworthiness. Of these, it is most important that the Bank steps up in producing influential knowledge products that inform policy discussions at global levels.

The AfDB needs to develop the necessary geopolitical and market leverages to help bring down high borrowing costs for African countries

The AfDB is best positioned to lead in mobilising and allocating resources aligned to the continent’s priorities. Its joint ‘Africa Adaptation Acceleration Programme’ – which the Bank dubs ‘Africa-owned and Africa-led’ – exemplifies this leadership by prioritising adaptation, which is closely tied to sustainable development. Additionally, the Bank is expected to lead in developing innovative financing mechanisms that bring in new and additional funding to regional public goods, reflecting the aspirations of the Continent’s citizens.

Together with member governments and regional institutions like the African Union, the AfDB can influence global initiatives like the Common Framework to meet Africa’s development needs. Africa is also home to close to 1.5 billion people, of whom more than 60% are young people. This represents a significant market opportunity for producers across the globe which Africa can leverage to ensure it benefits fairly from the global financial and trade system.

The decision to rechannel SDR through the AfDB for more financing of African countries is welcome

When the IMF issued its largest ever Special Drawing Rights (SDR) in 2021 – worth US$650 billion – all 53 African countries combined received only 5% of the total. This contrasts with the US and Japan which together received 24%. [16] The AfDB has been at the forefront in pushing not only for the reallocation of US$100 billion in SDRs from G20 countries, [17] but also the rechannelling of the SDR through the regional bank. As a prescribed SDR holder [18] with an AAA credit rating, the AfDB is best positioned to reallocate SDRs to deliver more financing to African countries. [19] The decision on 15 May 2024 by the IMF Executive Board to allow the AfDB (and other multinational development banks) use of SDRs for the accusation of hybrid capital instruments [20] is more than welcome, but there needs to be commitment from SDR contributors to channel through the AfDB.

More contributors are needed for the 17th Africa Development Fund Replenishment (ADF-17) cycle

Aside from the reallocation of SDR resources, there is a need to step up efforts to mobilise more resources for ADF. African countries – particularly fragile and conflict-affected ones – need sustained access to grants and low-interest, long-tenure loans. Prior to the 17th African Development Fund replenishment in 2025, it is important that all countries step up their contributions to the Fund. While the number of African countries contributing to the fund is steadily increasing, [21] there is still a need for more ownership and pledges to the 2025 replenishment cycle from all countries, including African nations as both recipients from and contributors to the Fund.

In summary, the AfDB is holding its annual meeting during a critical period for Africa. The AfDB should be at the forefront of efforts to influence the DSA, bring down the borrowing costs, and mobilise more resources for SDGs targeting structural transformation and climate adaptation. It is not enough to be at the table; the AfDB must lead in setting the global agenda and reforming the current global financial architecture.

Acknowledgements

This briefing is co-authored by Martha Bekele , Development Initiatives’ Africa Lead for Delivery, Quality & Impact, and Tsegaye Assayew , independent debt expert and consultant.

Downloads

Notes

-

1

World Bank. World Development Indicators. https://databank.worldbank.org/reports.aspx?source=World-Development-Indicators (accessed 24 May 2024)Return to source text

-

2

IMF-World Bank Debt Sustainability Framework for Low-Income Countries. https://www.imf.org/en/About/Factsheets/Sheets/2023/imf-world-bank-debt-sustainability-framework-for-low-income-countries (accessed 24 May 2024)Return to source text

-

3

World Bank. International Debt Statistics. https://databank.worldbank.org/source/international-debt-statistics (accessed 24 May 2024)Return to source text

-

4

Concessional debt is defined as PPG loans with an original grant element of 35% or more. See the IDS database for more. The grant element of a loan is the grant equivalent expressed as a percentage of the amount committed. The grant equivalent of a loan is its commitment (present) value, less the discounted present value of its contractual debt service; conventionally, future service payments are discounted at 10%.Return to source text

-

5

International Monetary Fund, 2023. Debt Dilemmas in Sub-Saharan Africa: Some Principles and Trade-Offs in Debt Restructuring. Available at: https://www.imf.org/en/Publications/REO/SSA/Issues/2023/10/16/regional-economic-outlook-for-sub-saharan-africa-october-2023#:~:text=Debt%20Dilemmas%20in%20Sub%2DSaharan%20Africa%3A%20Some%20Principles%20and%20Trade%2DOffs%20in%20Debt%20RestructuringReturn to source text

Related content

Donors at the triple nexus

DI Senior Policy & Engagement Advisor Sarah Dalrymple presents some of our recent analysis into how donors like Sweden and the UK are approaching the triple nexus between humanitarian, development and peace approaches in crisis contexts.

Implications of coronavirus on financing for sustainable development

DI Executive Director Harpinder Collacott summarises the possible impacts of the coronavirus pandemic on global development - including projections for extreme poverty, the future of different forms of financing, and the countries likely to be most impacted.

What do emerging trends in development finance mean for crisis actors?

DI's webinar ‘What do emerging trends in development finance mean for crisis actors?’ gives crisis actors key information on development finance to better understand what it means for them.