Trends in traditional and non-traditional aid flows to Kenya, Uganda and Ethiopia

Aid is critical to bridging investment gaps in Kenya, Ethiopia and Uganda. In this synthesis paper, we take a closer look at the financing landscape over the past decade.

DownloadsIntroduction

East African countries rely on aid funding to support development projects. Poor revenue mobilisation caused by fundamental structural problems as well as inflation, unsustainable debt servicing, the Covid-19 pandemic, and civil conflicts, continue to lead to budget deficits in Ethiopia, Kenya and Uganda. [1] Aid is thus critical in bridging the investment gap and realising the intended national development priorities of these countries.

Humanitarian and development needs have been increasing in the three countries over the past decade. Appeals for additional aid have increased in recent years due to intensified conflict, economic challenges and drought, [2] particularly in Ethiopia and Kenya. [3] Moreover, a look at the budget proposals across the countries reveals massive resource gaps in key sectors such as health, education, WASH, agriculture and food security, and infrastructure; amplifying calls to increase aid. [4] For example, the annual investment gap in the WASH sector is US$0.7 billion in Kenya, US$3.2 billion in Ethiopia and US$406 million in Uganda. [5]

The paper is a precursor to three country papers – on Uganda, Ethiopia and Kenya – that will zoom into aid funding to specific sectors in each country and analyse whether aid is contributing to country development outcomes. The countries were chosen on the basis of project location and aside from Kenya, are all currently classed as least developed countries (LDCs).

This paper provides an overview of development aid funding in the three East African countries. It follows the money to sectors and identifies the main donors and funding types for the 2012–2021 period. The disbursement aid data used in the analysis was sourced from Organisation for Economic Co-operation and Development’s Development Assistance Committee (OECD DAC). However, for comparison purposes with the China aid data which has flows as commitments, we use commitment data from the OECD in the last section of the paper analysing Chinese aid.

The paper thus presents a comprehensive and up-to-date overview of the aid funding landscape across the three countries.

► Read more from DI about ODA (aid)

► Share your thoughts with us on Twitter or LinkedIn

► Sign up to our newsletter

Box 1

Important note on the data used in this briefing:

This briefing uses data from the OECD DAC, which provides complete and verified data, and therefore an important and detailed picture of what has been happening to aid. OECD DAC data is, however, published at least a year in arrears, meaning that the latest detailed data available is up to 2021. The analysis therefore covers the period between 2012 and 2021 and uses gross disbursement aid data.

To compare DAC donors to other non-traditional donors, the analysis uses China’s official development (concessional loans) data sourced from the China Africa Initiative at the John Hopkins University School of Advanced International Studies (SAIS-CARI). However, this data shows loan commitments only up to 2020. Therefore, for the section comparing aid between DAC donors and non-traditional donors (China), only commitments from 2012–2020 were analysed.

In this briefing, the term ‘aid’ encompasses development assistance but excludes all humanitarian aid. Aid here includes ODA (as defined by the OECD DAC) and equity investments reported by official actors to the OECD.

Key findings

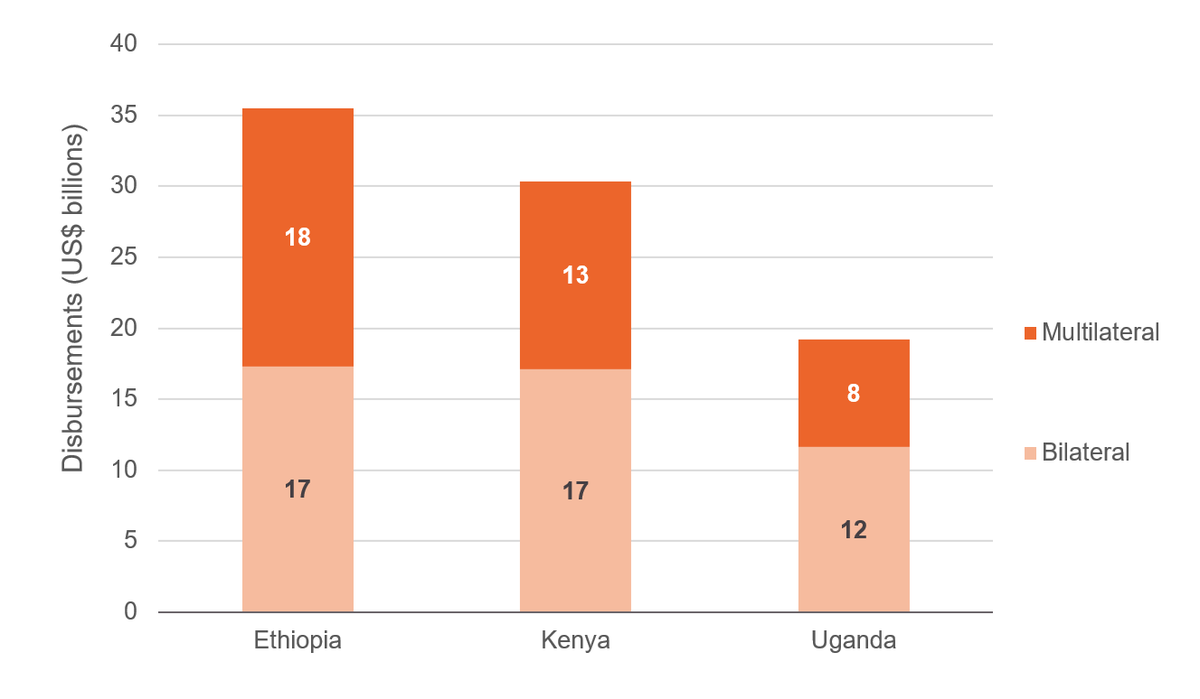

- Of the three countries, Ethiopia has consistently received the most aid over the 2012–2021 period. OECD donors have sent a total of US$35.5 billion to Ethiopia over the past decade, compared to US$30.3 billion to Kenya and US$19.2 billion to Uganda.

- There is a mix of bilateral and multilateral donors. [6] Bilateral donors contributed over half of the total cumulative aid in each country, while multilateral donors contributed 44.7% on average, highlighting the importance of the former.

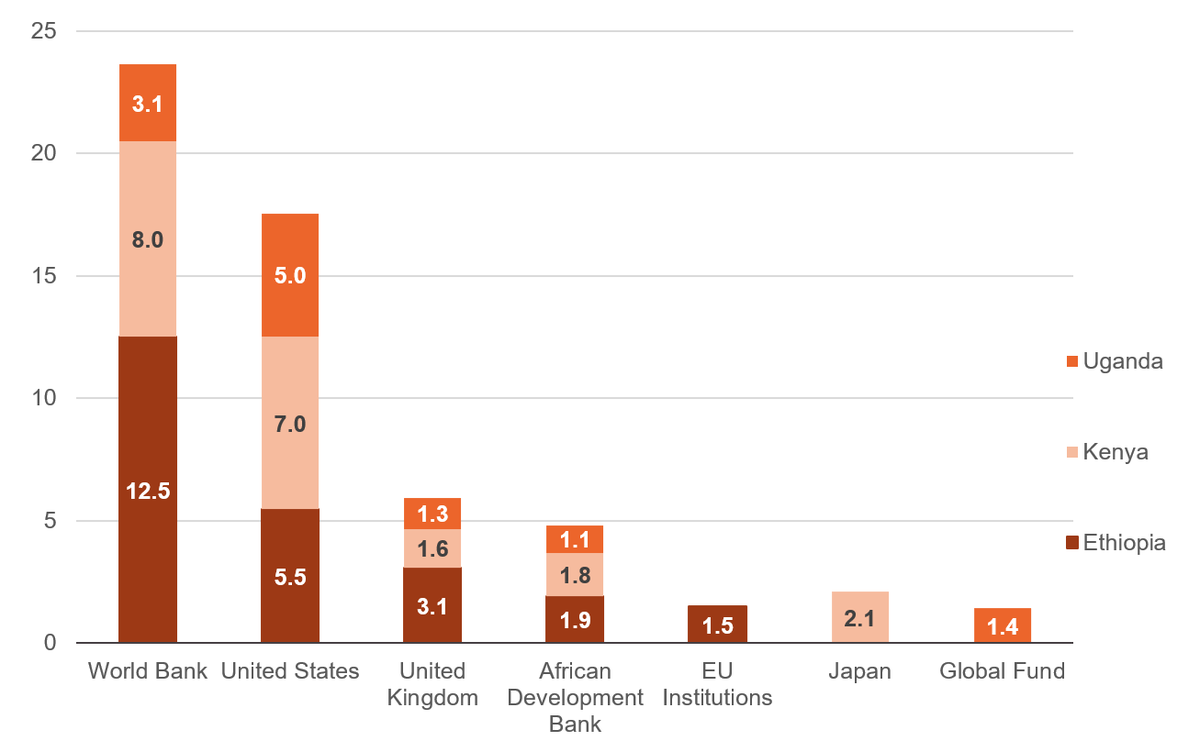

- The World Bank and the US are the two biggest donors across the three focus countries, contributing an average of 47.6% of cumulative aid.

- Most aid (61.1%) to the three countries is provided in the form of ODA grants. ODA loans make up 38.6% of total loans.

- ODA grants to Kenya declined from US$1.6 billion in 2015 to US$1.4 billion in 2020 , following its graduation from least developed country (LDC) to lower-middle income country (LMIC) status.

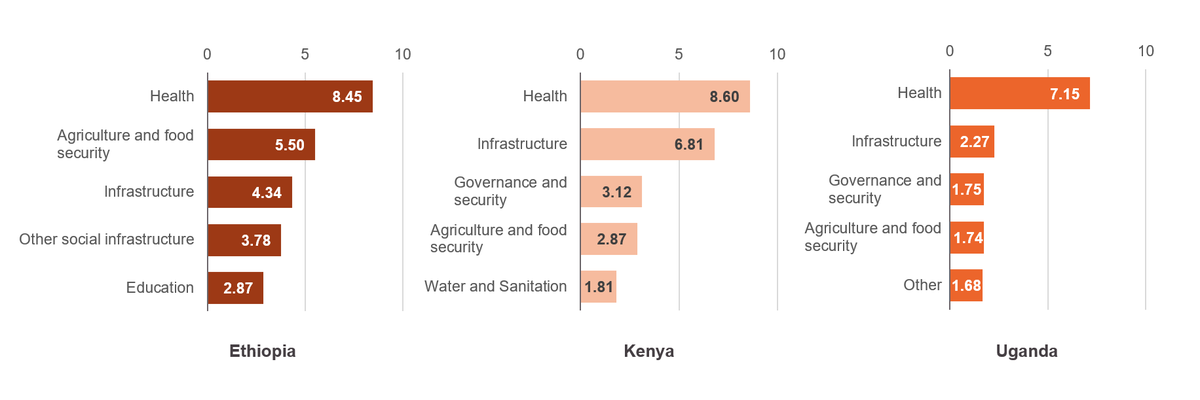

- Health, infrastructure, and governance and security are the top three funded sectors in both Kenya and Uganda, while health, infrastructure, and agriculture and food security are the top three in Ethiopia.

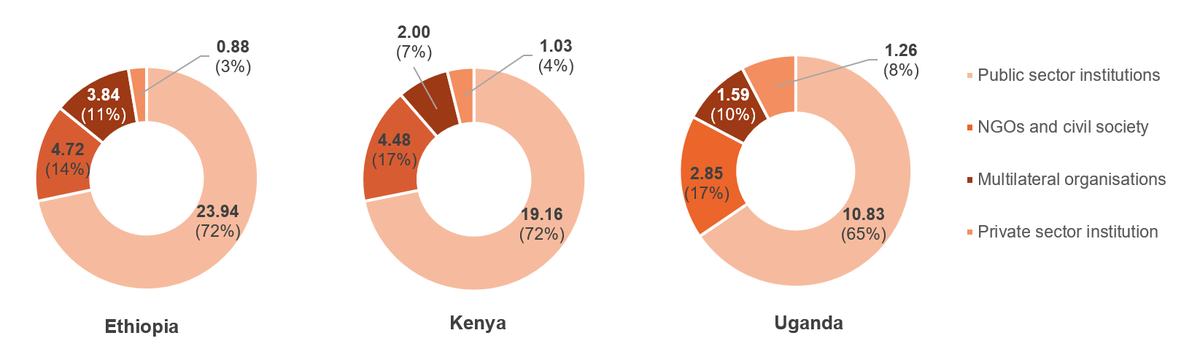

- Public sector institutions are the primary aid flow channel, accounting for an average of 62.3% of total aid in each country (67.4% in Ethiopia, 63.2% in Kenya and 56.4% in Uganda).

- Kenya receives most ODA from China out of the three countries while Ethiopia receives the most from DAC donors. ODA from China to Kenya accounts for 57.2%% of total funding received by the country, as opposed to 27% in Ethiopia and 15.8% in Uganda.

- Sectoral focus differs between donors. China’s main focus has been the transport and power industries, while DAC donors tend to concentrate on social sectors, including health, and agriculture and food security.

- Our analysis of aid from South–South cooperation (Korea, Saudi Arabia, Türkiye and the United Arab Emirates) versus China reveals that while the sectoral prioritisation is relatively consistent, there are massive differences in the amount of funding provided . China has invested over three times the total amount of aid made by these four countries in Kenya and more than twice the total amount in Uganda. In Ethiopia however, China’s ranks second for ODA behind Korea.

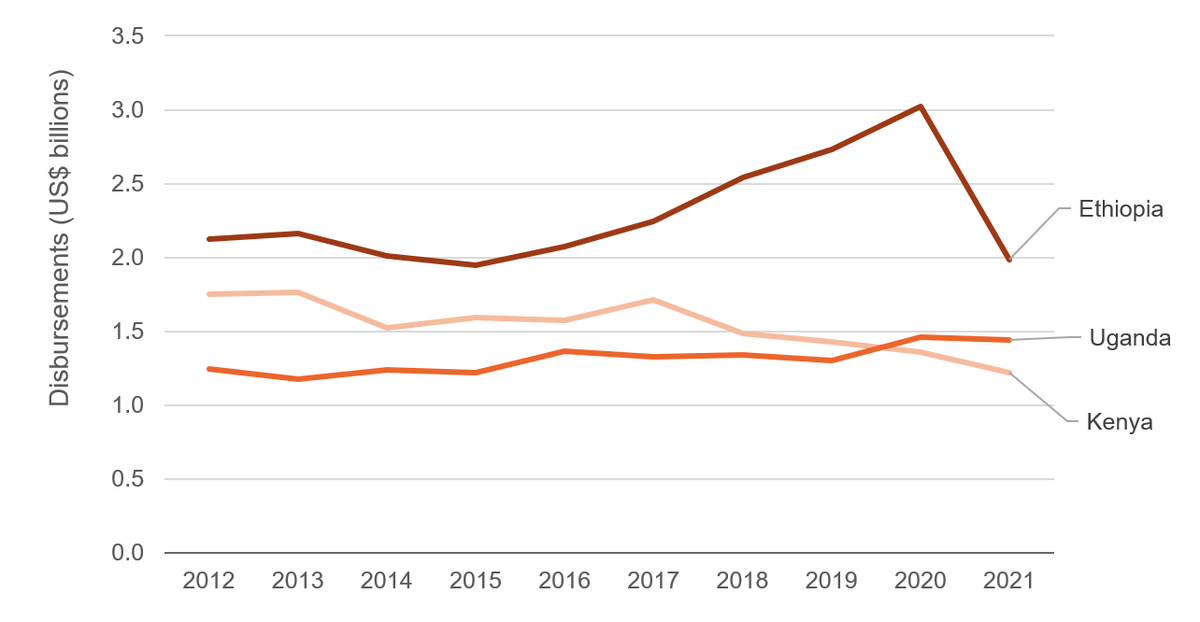

Total disbursements to Ethiopia, Kenya and Uganda

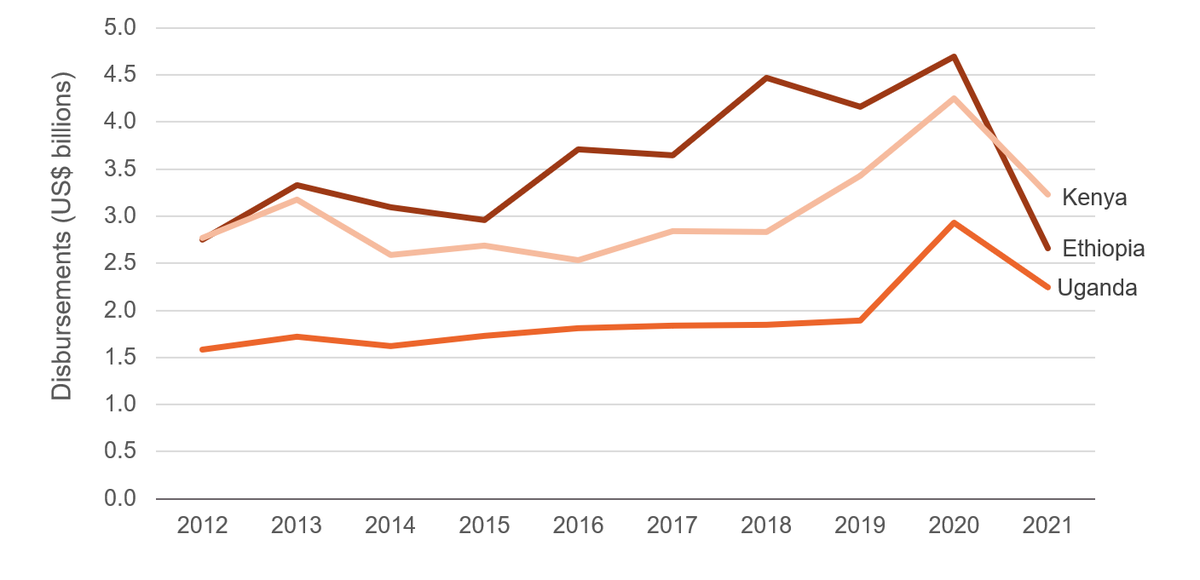

Ethiopia received the greatest amount of aid out of the three East African countries over the last 10 years: US$35.5 billion, compared to Kenya’s US$30.3 billion and Uganda’s US$19.2 billion (Figure 1). This can be attributed to the myriad of economic and social challenges coupled with the fact that the country has the second highest population of any country in Africa. Moreover, the developmental and strategic importance of the country makes it a key player in the region and an important partner for development aid.

Funding increased considerably across the countries in the focus period up to 2020, before declining by an average of 30.3% across all three in 2021. This reduction in aid can be attributed to donor cuts resulting from the Covid-19 pandemic. [7] Kenya and Ethiopia’s aid saw the biggest decrease and was slashed by US$2 billion (43.4%) and US$1 billion (24.1%) respectively in 2021.

Figure 1: Ethiopia received the greatest amount of aid (US$35.5 billion), compared to Kenya (US$30.3 billion) and Uganda (US$19.2 billion)

Total disbursements to Ethiopia, Kenya and Uganda, 2012–2021

Donor types

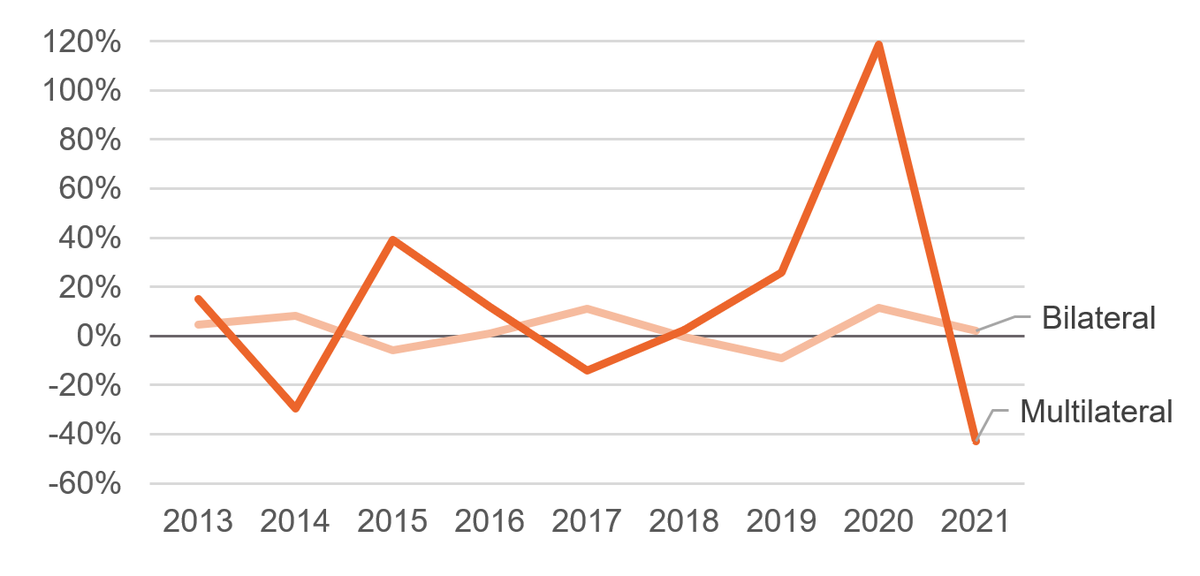

Bilateral donors play a crucial role in the aid landscape in the three countries, judging by the number of donors in the ecosystem and the amount of annual funding from these donors. In Kenya and Uganda, bilateral donors contributed over half of the total aid in each country, while multilateral donors contributed 44.7% on average (Figure 2).

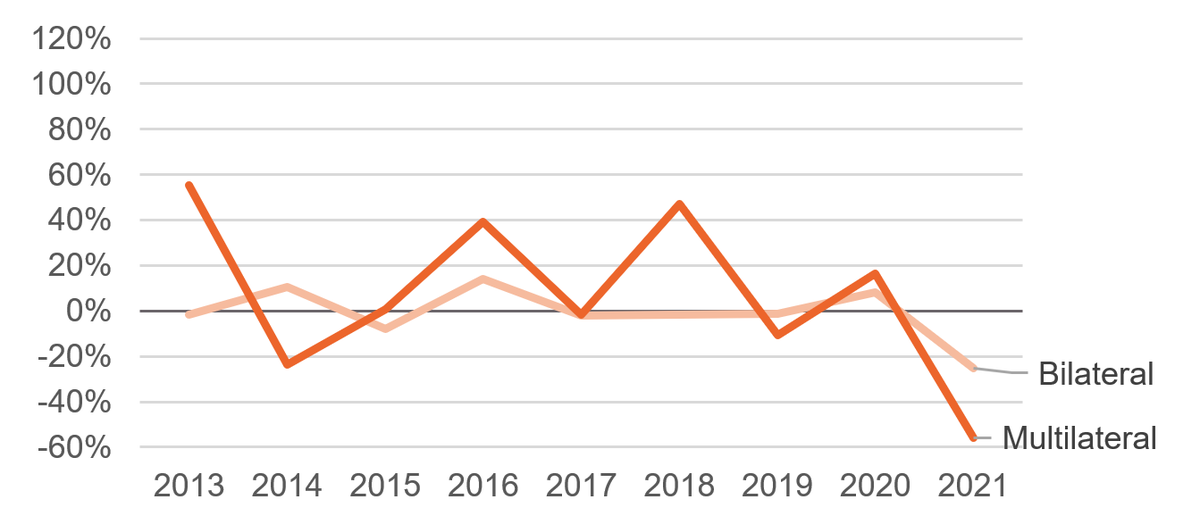

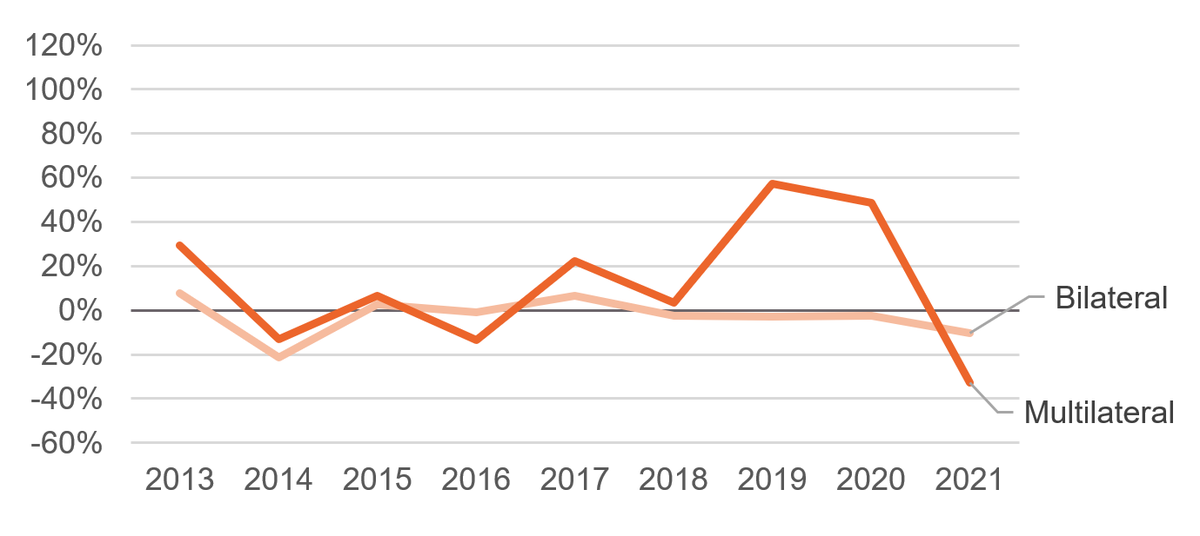

Despite the huge contributions made by bilateral donors, the overall picture is erratic with increases between 2012–2014 followed by decreases and further increases between 2015–2021.

Multilateral donor contributions were inconsistent in both Kenya and Uganda, while aid to Ethiopia increased year on year from 2014–2020. Notably, it is only in Ethiopia that multilateral contributions exceeded bilateral aid.

Figure 2: Bilateral donors contributed over half of the total cumulative aid in each country while multilateral donors contributed 44.7% of the same on average

Disbursements to Ethiopia, Kenya and Uganda by donor type, 2012–2021

Analysis shows that bilateral and multilateral aid decreased across the three countries in 2021, except for bilateral donor contributions in Uganda which increased by 2%. This can be attributed to US aid increasing by 24.5% with contributions mainly directed to the health sector. The decreases in the other countries are related to the Covid-19 aid cuts that dominated 2021. Between 2015 and 2016, only Kenya saw decreases in both multilateral (13.5%) and bilateral (1%) aid which could be due to its reclassification as a lower-middle income country. Across the 10 years analysed, Kenya and Ethiopia’s bilateral aid decreased in six out of nine years. This could be due to shifts in the political priorities or economic conditions of the donor countries, or concerns over the effectiveness of aid.

Figure 3: Covid-19 aid cuts led to huge decreases in both multilateral and bilateral contributions across the three countries in 2021, with the exception of bilateral aid in Uganda

3a) Change in contributions by donor type, Ethiopia, 2012-2021

3b) Change in contributions by donor type, Kenya, 2012-2021

3c) Change in contributions by donor type, Uganda, 2012-2021

The bilateral donors that ranked consistently in the top 10 donors to the three focus countries include the United States, the United Kingdom, EU institutions and Germany.

Figure 4: The US, UK, EU institutions and Germany were consistently among the top 10 donors in the focus countries

The top five donors to Ethiopia, Kenya and Uganda, 2012–2021, US$ billions

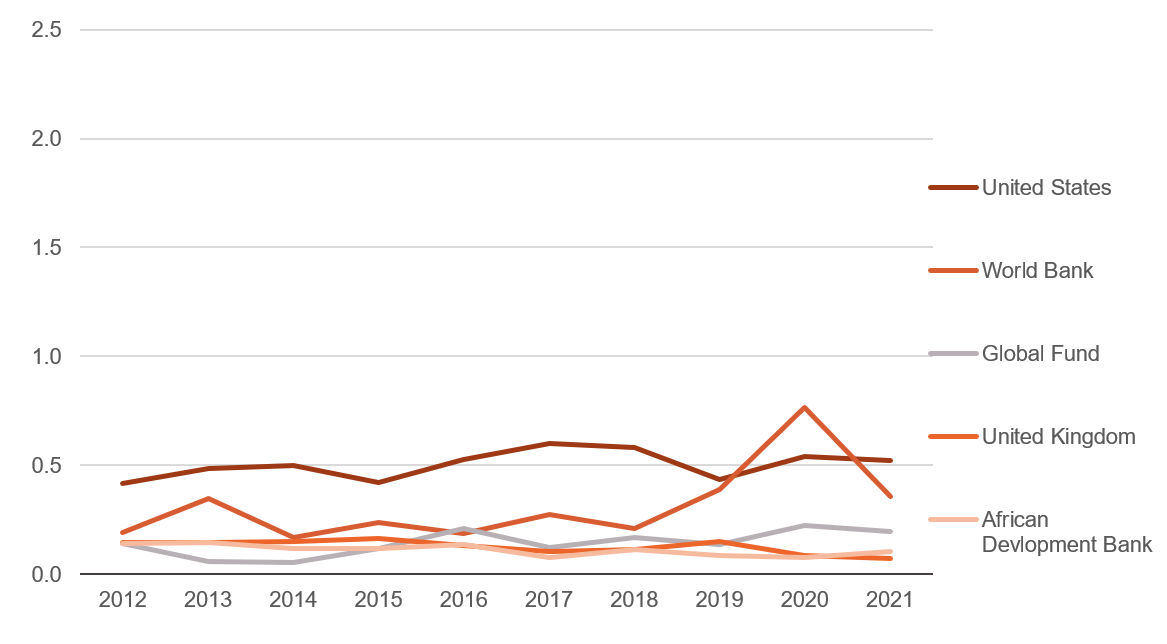

Analysis shows that significant decreases in aid from the top five donors were witnessed in all the three countries in 2021. These could be attributed to aid cuts caused by the Covid-19 pandemic. However, in Kenya we see another period of significant cuts post-2015 – especially in ODA grants – which may be due to the country’s graduation from the least developed country (LDC) category to the lower-middle income (LMIC) group in 2015. A review of grants to Kenya shows there was only one year post-2015 with an increase (2017) with consistent decreases between 2018–2021. It is important to note that despite the aforementioned reductions in aid to Kenya, a conspicuous increase in funding from the World Bank (92%) was witnessed in 2019. These funds supported the Kenyan government’s plans to enhance inclusive growth, accelerate poverty reduction and achieve its Vision 2030 [8] objective of becoming a middle-income industrialised country.

Figure 5: Aside from the significant aid cuts to all three countries in 2021, Kenya also saw a reduction in aid in 2015 due to its graduation from the LDC income category

5a) Changes in the top five donors, Ethiopia, 2012–2021, US$ billions

| 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | |

|---|---|---|---|---|---|---|---|---|---|---|

| World Bank | 0.7 | 0.9 | 0.9 | 0.7 | 1.2 | 1.1 | 2.1 | 1.8 | 2.0 | 0.9 |

| United States | 0.5 | 0.5 | 0.6 | 0.6 | 0.6 | 0.7 | 0.6 | 0.4 | 0.5 | 0.6 |

| United Kingdom | 0.4 | 0.4 | 0.4 | 0.4 | 0.4 | 0.3 | 0.3 | 0.3 | 0.2 | 0.1 |

|

African

Development Bank |

0.1 | 0.3 | 0.2 | 0.2 | 0.2 | 0.3 | 0.2 | 0.2 | 0.3 | 0.1 |

|

EU

Institutions |

0.2 | 0.1 | 0.2 | 0.1 | 0.2 | 0.1 | 0.2 | 0.1 | 0.2 | 0.1 |

5b) Changes in the top five donors, Kenya, 2012–2021, US$ billions

| 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | |

|---|---|---|---|---|---|---|---|---|---|---|

| World Bank | 0.3 | 0.5 | 0.6 | 0.5 | 0.5 | 0.6 | 0.8 | 1.5 | 1.6 | 1.3 |

| United States | 0.8 | 0.8 | 0.7 | 0.6 | 0.7 | 0.8 | 0.8 | 0.6 | 0.6 | 0.6 |

| Japan | 0.2 | 0.3 | 0.1 | 0.2 | 0.2 | 0.2 | 0.2 | 0.3 | 0.2 | 0.2 |

|

African

Development Bank |

0.2 | 0.2 | 0.2 | 0.3 | 0.2 | 0.2 | 0.2 | 0.1 | 0.1 | 0.1 |

| United Kingdom | 0.1 | 0.2 | 0.2 | 0.2 | 0.2 | 0.2 | 0.2 | 0.2 | 0.1 | 0.1 |

5c) Changes in the top five donors, Uganda, 2012–2021, US$ billions

| 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | |

|---|---|---|---|---|---|---|---|---|---|---|

| United States | 0.4 | 0.5 | 0.5 | 0.4 | 0.5 | 0.6 | 0.6 | 0.4 | 0.5 | 0.5 |

| World Bank | 0.2 | 0.4 | 0.2 | 0.2 | 0.2 | 0.3 | 0.2 | 0.4 | 0.8 | 0.4 |

| Global Fund | 0.1 | 0.1 | 0.1 | 0.1 | 0.2 | 0.1 | 0.2 | 0.1 | 0.2 | 0.2 |

| United Kingdom | 0.1 | 0.1 | 0.2 | 0.2 | 0.1 | 0.1 | 0.1 | 0.1 | 0.1 | 0.1 |

|

African

Devlopment Bank |

0.1 | 0.1 | 0.1 | 0.1 | 0.1 | 0.1 | 0.1 | 0.1 | 0.1 | 0.1 |

Source: Development Initiatives based on OECD DAC data.

Flow types

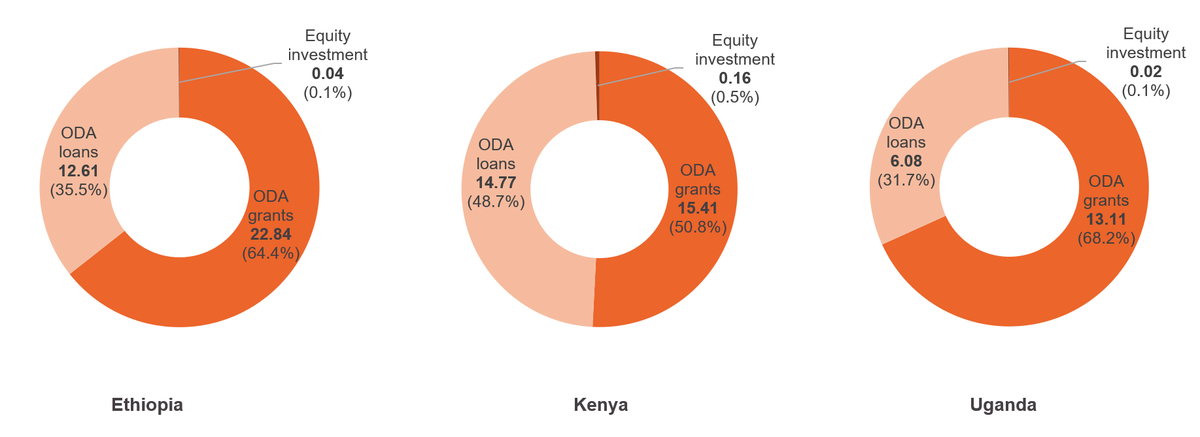

ODA grants remain the main type of aid across the three focus countries, accounting for an average of 61.1% of total aid. ODA loans represent an average of 38.6% of all contributions (Figure 6) with the bulk (32.9%) channelled into infrastructure (mainly the construction of roads, railways lines, dams and communications infrastructure).

The rest of the contributions were provided in the form of equity investments and represented an average of 0.2% of total aid. The majority of equity investments (62%) went to the banking and industrial sectors.

While ODA grants represent more than twice the amount of ODA loans in Uganda (grants: 68.2%; loans: 31.6%), in Ethiopia the grants are worth almost twice the amount received as loans (grants: 64.4%; loans: 35.5%). Conversely, Kenya receives just over half (50.8%) of its aid in the form of grants and 48.7% as loans.

In Ethiopia, ODA grants picked up from 2015 and only decreased in 2021, mainly as a result of Covid-19-related cuts and the start of the conflict in northern Ethiopia. Conversely, ODA grant contributions in Uganda were erratic over the 10-year period studied while in Kenya there was general decline in grants after 2015.

ODA loans in both Kenya and Uganda increased steadily between 2014–2021 and only saw decreases in 2016 and 2021. This underscores the resource needs – particularly in the infrastructure sectors – in these countries. However, in Ethiopia ODA loans were erratic, characterised by both increases and decreases over the 2012–2021 period.

Figure 6: While ODA grants contribute an average of 61.1% of total aid in the focus countries, loans contribute around 38.6%

Disbursements by flow type in Ethiopia, Kenya and Uganda, US$ billions, 2012–2021

Discounting the Covid-19-related decreases in 2021, ODA grants have risen in Ethiopia, have largely remained the same in Uganda and have declined slightly in Kenya (from US$1.6 billion in 2015 to US$1.4 billion in 2020). This could be due to Kenya’s new status as a lower-middle income country. The data could support a call for change in financing for development mechanisms given that the current mechanism renders LMICs like Kenya ineligible to receive most ODA grants, despite graduating from the least developed country (LDC) category with much the same problems as many LDCs.

Figure 7: Discounting Covid-19-related decreases in 2021, ODA grants have declined slightly in Kenya since 2015 while increasing in Ethiopia

ODA grants to Ethiopia, Kenya, and Uganda, 2012–2021

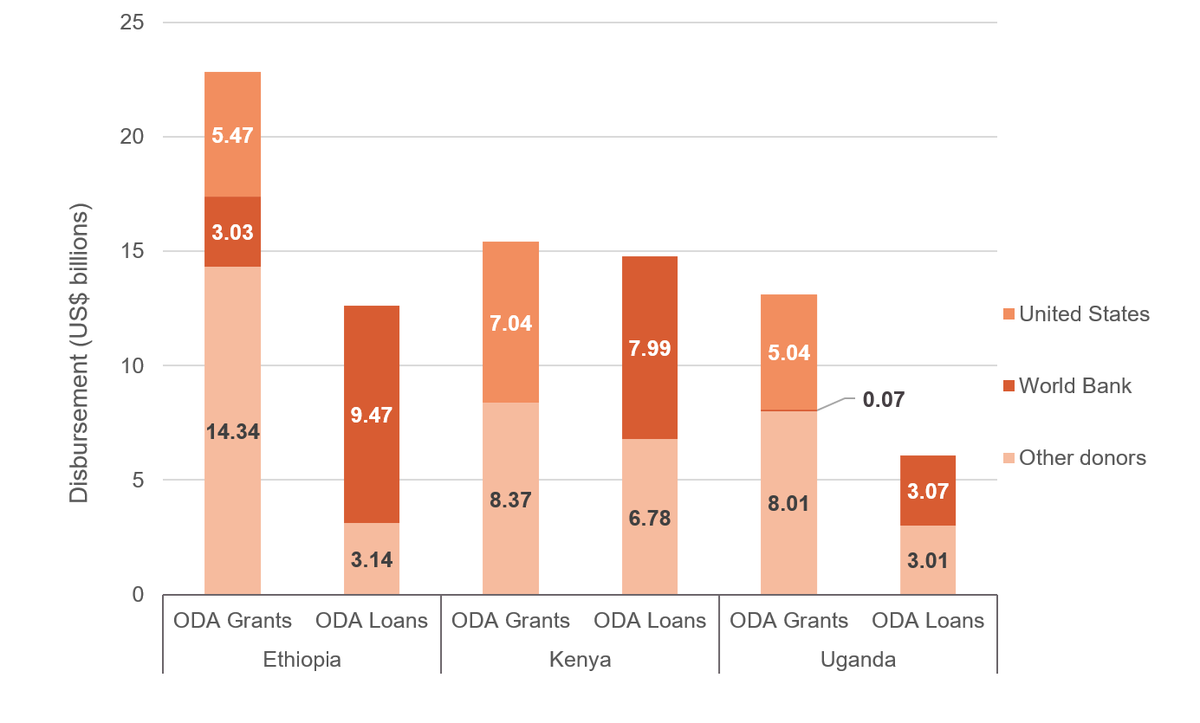

In the three focus countries, the World Bank and the United States are the two biggest donors, contributing an average of 47.6% of total aid to each country. This highlights the crucial role they play, especially when it comes to supporting socioeconomic development priorities in these countries. It is important to note that while the World Bank has provided both ODA loans (86.9% of total contributions) and grants (13.1%) to the focus countries, the United States has contributed only ODA grants, mainly to social sectors (Figure 8).

Figure 8: The World Bank has provided both ODA loans and grants to the focus countries while the US has contributed only ODA grants

ODA loans and grants from United States and the World Bank to Ethiopia, Kenya, and Uganda, 2012–2021

Flows to sectors

Health, infrastructure, and governance and security are the top three funded sectors in Kenya and Uganda, while in Ethiopia agriculture and food security supplant governance and security due to the prolonged drought and conflict that has aggravated the food insecurity situation.

In all of the countries, the top three sectors account for over half of the total aid received in the last decade: Kenya (61.1%), Uganda (58.1%) and Ethiopia (51.1%). This underscores not only the resource needs in these sectors – particularly health [9] and infrastructure [10] – but also the critical role they play in promoting human development and economic growth.

The health sectors of all three countries received the greatest amounts of aid with funds mainly channelled into programmes on basic health, population policies and reproductive health. These programmes together account for an average of 93% of total allocations to the health sector in each of the focus countries.

Infrastructure – the second most funded sector in Kenya and Uganda and the third in Ethiopia – has seen its funding mostly channelled into the transport and energy subsectors. Meanwhile 94% of funding to governance and security in Kenya and Uganda – the third most funded sector in both – has been funnelled into governance and civil society projects. Finally, 69.8% of total funding to the agriculture and food security sectors (the second most funded sector in Ethiopia and fourth in Kenya and Uganda) goes to agricultural subsectors.

Despite progress, the education sectors in all three countries still have significant resource gaps that could be supported by donors. Education is not among the top five funded sectors in Kenya and Uganda and ranks fifth in Ethiopia with only an 8% share of the total aid contributions in that country. The water and sanitation, and environment sectors do not make the top three funded sectors in any of the countries, with the former averaging only 5.8% of the cumulative aid contributed to the three countries and the latter, only 1.7%. This is notwithstanding the fact that the water and sanitation sectors in both Kenya and Ethiopia still have a huge investments gap of about US$1 billion and US$3.2 respectively as of 2021. [11]

Figure 9: Social sectors and infrastructure are among the top funded sectors in the three focus countries

Disbursements by sector in Ethiopia, Kenya and Uganda, US$ billions

| Country | Sector | Total disbursements |

|---|---|---|

| Ethiopia | Health | 8.45 |

| Ethiopia | Agriculture and food security | 5.50 |

| Ethiopia | Infrastructure | 4.34 |

| Ethiopia | Other social infrastructure | 3.78 |

| Ethiopia | Education | 2.87 |

| Kenya | Health | 8.60 |

| Kenya | Infrastructure | 6.81 |

| Kenya | Governance and security | 3.12 |

| Kenya | Agriculture and food security | 2.87 |

| Kenya | Water and Sanitation | 1.81 |

| Uganda | Health | 7.15 |

| Uganda | Infrastructure | 2.27 |

| Uganda | Governance and security | 1.75 |

| Uganda | Agriculture and food security | 1.74 |

| Uganda | Other | 1.68 |

Source: Development Initiatives based on OECD DAC data.

Flow channels

Aid to the three focus countries flows through public sector institutions, non-governmental institutions and civil societies, and multilateral organisations. On average, 62.3% of funding is channelled through public sector institutions: 67.4% in Ethiopia, 63.2% in Kenya and 56.4% in Uganda (Figure 10). Public sector institutions include donor governments, recipient governments and so-called ‘third world governments’ through delegated co-operation. [12]

Aid flowing through public sector institutions accounts for over four times the amounts flowing through either NGOs and civil societies or multilateral organisations. Flows through NGOs and civil societies average 14% of cumulative aid in each country while aid flowing through multilateral organisations averages 8.6% across the same countries.

Figure 10: Aid coming into the focus countries flows mainly through the public sector institutions, accounting for an average of 62.3%

Disbursements by flow channel in Ethiopia, Kenya and Uganda, US$ billions

| Country | Flow channel | Disbursements | Percentage share |

|---|---|---|---|

| Ethiopia | Public sector institutions | 23.9 | 72% |

| Ethiopia | NGOs and civil society | 4.7 | 14% |

| Ethiopia | Multilateral organisations | 3.8 | 12% |

| Ethiopia | Private sector institution | 0.9 | 3% |

| Kenya | Public sector institutions | 19.2 | 72% |

| Kenya | NGOs and civil society | 4.5 | 17% |

| Kenya | Multilateral organisations | 2.0 | 8% |

| Kenya | Private sector institution | 1.0 | 4% |

| Uganda | Public sector institutions | 10.8 | 65% |

| Uganda | NGOs and civil society | 2.9 | 17% |

| Uganda | Multilateral organisations | 1.6 | 10% |

| Uganda | Private sector institution | 1.3 | 8% |

Source: Development Initiatives based on OECD DAC data.

Chinese aid (concessional loans only)

The database of the China Africa Initiative at the John Hopkins University School of Advanced International Studies (SAIS-CARI) shows concessional and non-concessional loans from China. Given that aid from China does not conform to the OECD’s definition of official development assistance (ODA), this paper focuses on concessional loans only as they are widely considered an equivalent to ODA. [13] It is important to note that there are two sources of data on Chinese development finance: the SAIS-CARI database and Aiddata. Loan figures vary widely between the two, possibly due to differences in methodological approach. We chose to use data from SAIS-CARI as Aiddata only covers the period up until 2017, rather than the full 2012–2021 focus period.

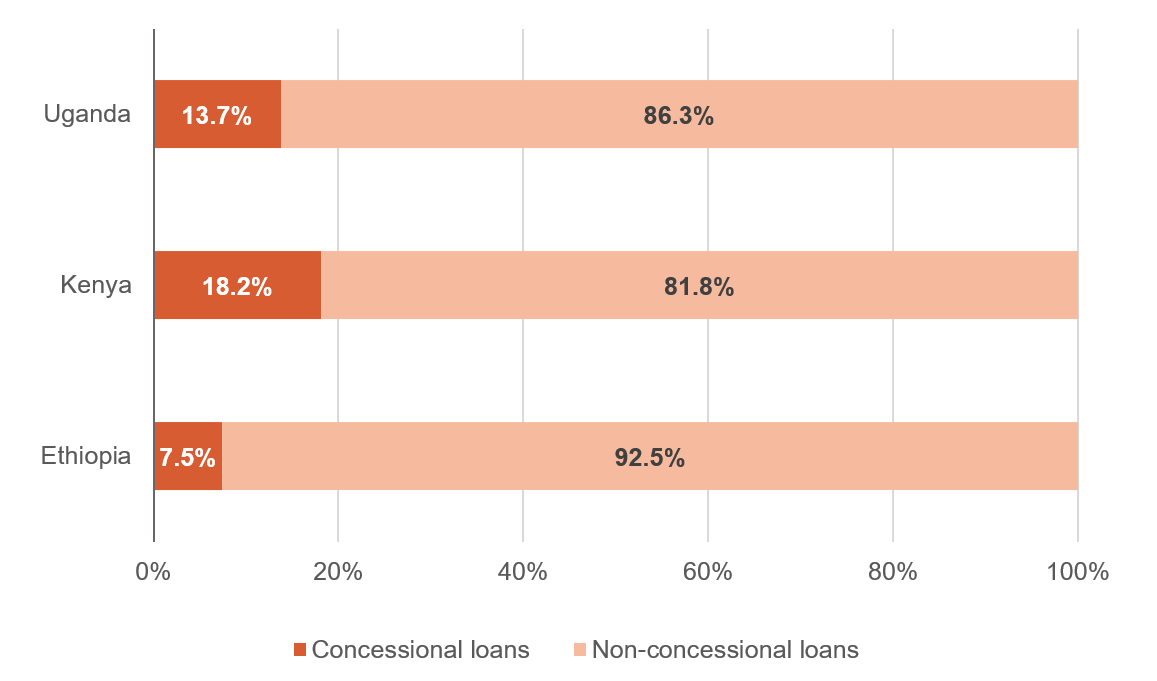

Notwithstanding data issues, available data shows that Kenya benefits more from Chinese concessional loans (18.2% of all loans or US$1.5 billion) than Uganda (13.7%, or US$407 million) and Ethiopia (7.5% or US$697.5 million). However, the data on concessional loans is sporadic with data only available for two years for Uganda (2015 and 2019) and Ethiopia (2013 and 2016).

Figure 11: China has mainly provided non-concessional loans to the focus countries which account for an average of 86.9% of its total loan contributions

Share of concessional and non-concessional loans in total funding commitment from China to Ethiopia, Kenya and Uganda, 2012–2021

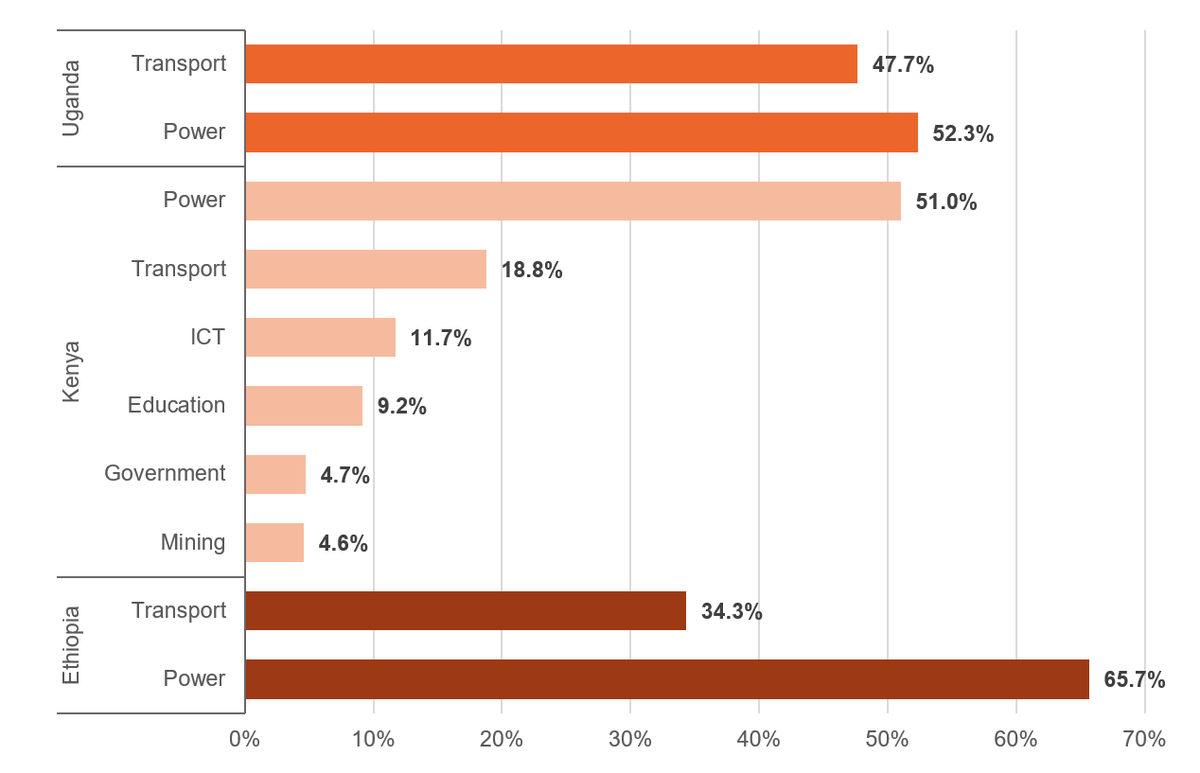

The bulk of concessional loans goes to the power and transport sectors in all three countries. Over half of the total concessional loans in Ethiopia (65.7%) are allocated to the power industry while the figure is 52.3% in Uganda and 51% in Kenya. On average, just over a third (33.6%) of concessional loans go to the transport industry.

Figure 12: The majority of Chinese concessional loans go to the transport and power sectors

Proportion of Chinese concessional loans allocated to each sector in Ethiopia, Kenya and Uganda, 2012–2021

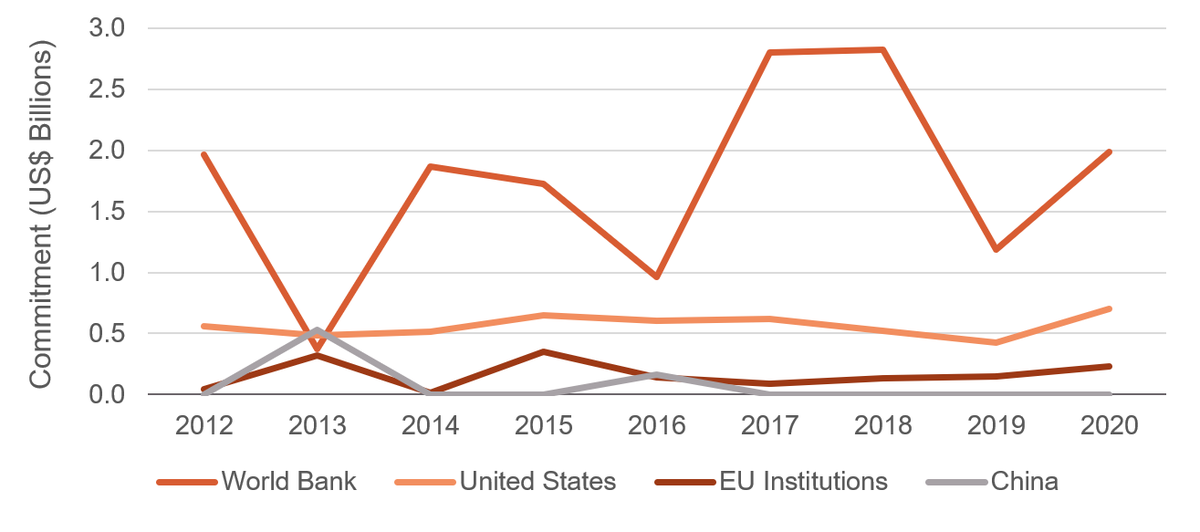

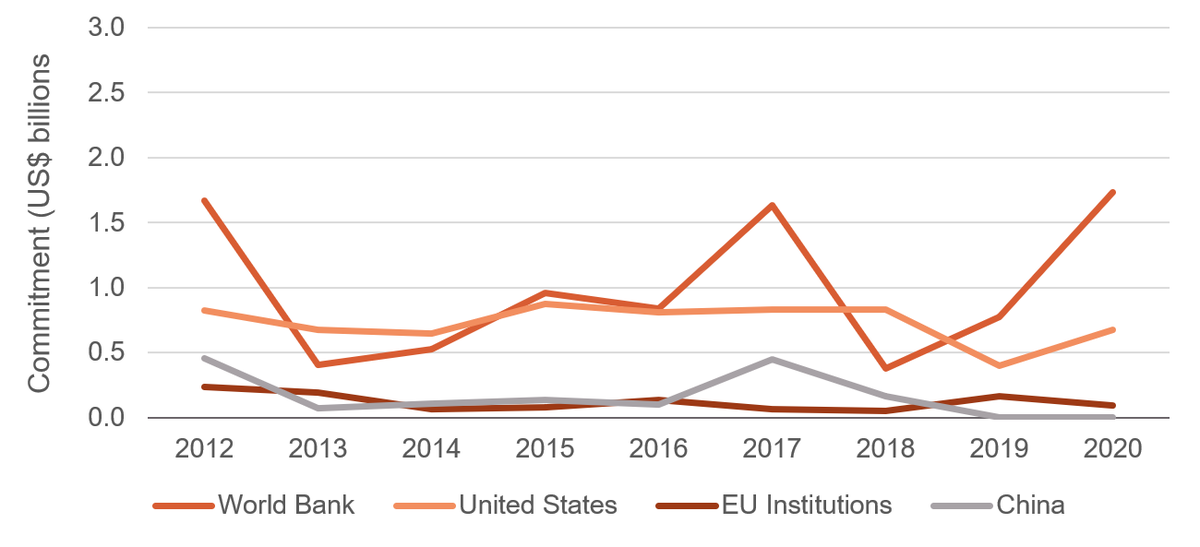

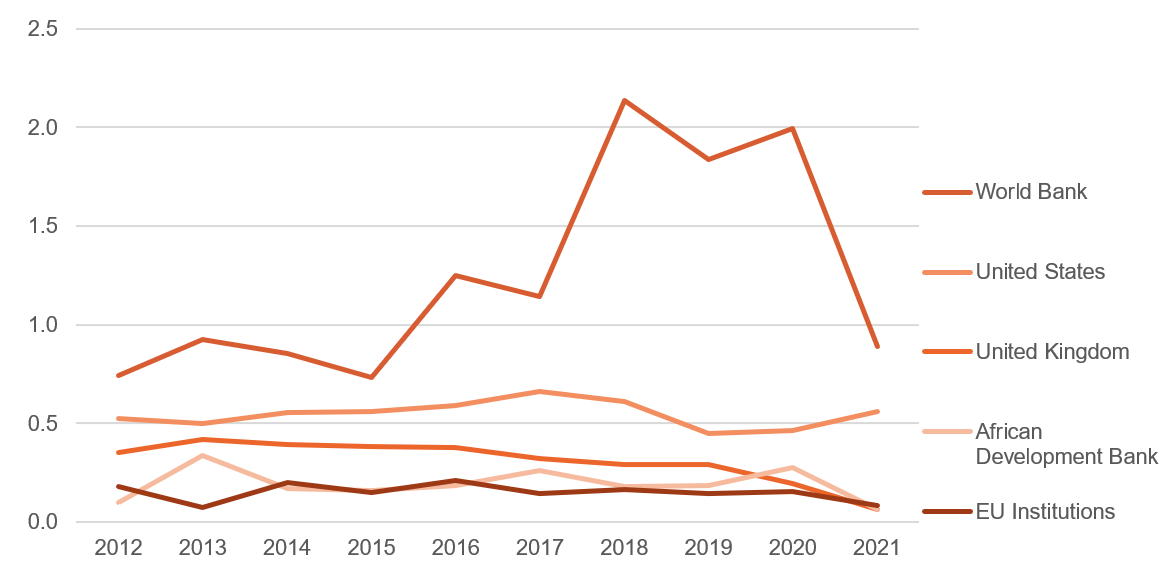

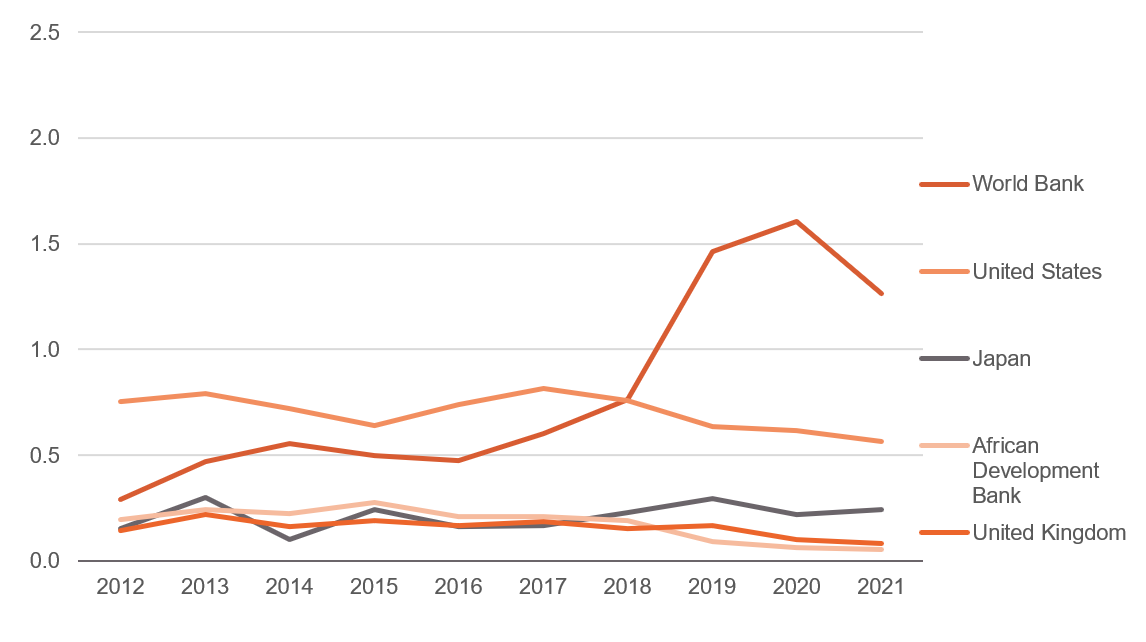

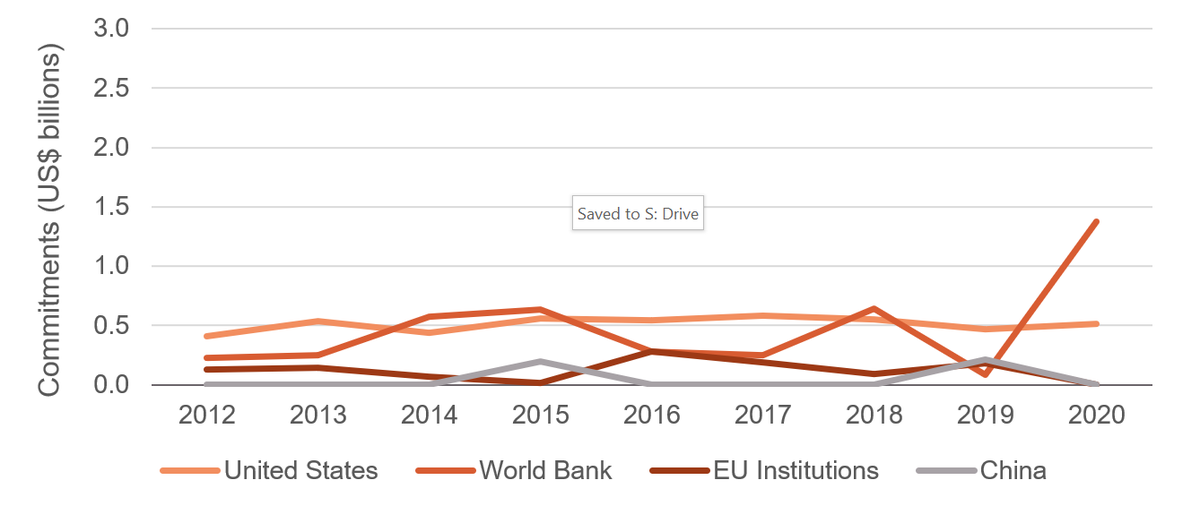

Comparing DAC and non-traditional donors: Spotlight on China

It is challenging to compare DAC donors with non-traditional donors like China due to the flow data available. While the OECD provides both commitment and disbursement flow data for DAC donors, there is only commitment data available for China. Therefore, this section compares commitment flows from China – a non-traditional donor – to three key OECD-DAC donors, namely the World Bank, the United States and EU institutions. It is important to note that Chinese development finance data for the three focus countries is only available up to 2020. This chapter thus compares data for the 2012–2020 period.

Of the three countries, Kenya receives the highest number of commitments from China, while Ethiopia receives the most from DAC donors. In the period reviewed, commitments to Kenya accounted for 57.2% of total funding from China to as opposed to 27% for Ethiopia and 15.8% for Uganda. [14] Conversely, in the same time period, Ethiopia received the greatest proportion of total aid from DAC donors (42.7%), followed by Kenya (35.2%) and Uganda (22.1%). This could be attributed to the fact that DAC donors ascribe greater importance to economic and social challenges while China focuses on transport and power needs (Figure 13).

Sectoral concentration slightly differs between the DAC donors and China. While the focus of the DAC donors is mainly on health, China focuses more on power and transport. China’s contribution to the social sectors of the three focus countries is insignificant. We could also find no evidence of its involvement in the social sectors other than education in Kenya.

Analysis shows that while there’s some consistency in the provision of aid from DAC donors, there are huge inconsistencies in the commitments provided by China in the 2012–2020 period with some sectors seeing significant reductions in aid and others not receiving funding for several years. For example, both Ethiopia and Uganda received funding from China in only two of the years under review.

Figure 13: Kenya receives the most ODA from China out of the three countries while Ethiopia receives the most from DAC donors

13a) Commitments to Ethiopia, 2012–2020

13b) Commitments to Kenya, 2012–2020

13c) Commitments to Uganda, 2012–2020

| 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | |

|---|---|---|---|---|---|---|---|---|---|

| United States | 0.41 | 0.54 | 0.44 | 0.56 | 0.54 | 0.58 | 0.55 | 0.47 | 0.51 |

| World Bank | 0.23 | 0.25 | 0.57 | 0.64 | 0.28 | 0.25 | 0.65 | 0.08 | 1.37 |

| EU Institutions | 0.13 | 0.14 | 0.07 | 0.02 | 0.28 | 0.19 | 0.09 | 0.18 | 0.01 |

| China | 0.00 | 0.00 | 0.00 | 0.19 | 0.00 | 0.00 | 0.00 | 0.21 | 0.00 |

Source: Development Initiatives based on OECD DAC data and SAIS-CARI data.

Notes: The graphs present comparison between commitments from China and commitments from select traditional OECD DAC donors: the US, World Bank and EU institutions.

China provides an average of 3.3% of the total aid allocated to the three focus countries, providing 5.4% in Kenya, 2.4% in Uganda and 2.1% in Ethiopia. China is not among the top 10 donors to Uganda and Ethiopia but is the fifth biggest donor to Kenya after the World Bank, the US, Japan and France. This indicates that China’s contribution to the three focus countries – particularly its financing of the Kenyan infrastructure sector – is not negligible, despite its lack of DAC membership.

Nevertheless, concerns over the debt repayment of some of Chinese loans and the opacity of some loan contracts continue to plague not only the focus countries, but the entire African continent. [15] The runaway borrowing carried out by some African nations – including Ethiopia, Kenya and Uganda – has increased the debt burden already incurred by these countries. [16]

South–South cooperation

Comparing China’s contributions to those made by major South–South bilateral donors (Korea, UAE, Türkiye and Saudi Arabia) reveals significant differences in the quantities of aid provided. China has invested over three times the total contributions made by these four countries in Kenya, and more than twice the same figure in Uganda. In Ethiopia, China provided the second highest amount of concessional loans behind Korea and ahead of Saudi Arabia, the UAE and Türkiye. It is important to note that while China’s commitments were the highest among the South–South cooperation countries analysed here, the share of total commitments as a percentage of the country’s gross national income (0.0004%) was less than that committed by Saudi Arabia (0.0007%). The percentage share for the other countries was significantly lower at 0.0003% for the UAE, 0.00004% for Türkiye and 0.00001% for Korea.

Despite the vast differences in the amount of aid committed to the three focus countries, sectoral prioritisation is relatively similar for all the South–South donors.

Table 1: There are significant differences in the amount of aid provided by South-South cooperation countries with Chinese contributions far exceeding those made by other nations in Kenya and Uganda

| 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | |

|---|---|---|---|---|---|---|---|---|---|

| China | 0.0000 | 0.5327 | 0 | 0 | 0.1647 | 0 | 0 | 0 | 0 |

| Korea | 0.0223 | 0.1454 | 0.0320 | 0.0274 | 0.1527 | 0.0302 | 0.2726 | 0.2236 | 0.1220 |

| Saudi Arabia | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0.1474 | 0.0030 |

| United Arab Emirates | 0.0097 | 0 | 0 | 0.0016 | 0 | 0 | 0 | 0 | 0 |

| Türkiye | 0 | 0 | 0 | 0 | 0 | 0 | 0.0003 | 0.0028 | 0.0020 |

| 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | |

|---|---|---|---|---|---|---|---|---|---|

| China | 0.456 | 0.070 | 0.106 | 0.136 | 0.099 | 0.446 | 0.162 | 0 | 0 |

| Korea | 0.004 | 0.004 | 0.011 | 0.010 | 0.110 | 0.005 | 0.128 | 0.129 | 0.012 |

| Saudi Arabia | 0 | 0 | 0 | 0 | 0 | 0.011 | 0 | 0.002 | 0.003 |

| United Arab Emirates | 0.001 | 0.010 | 0 | 0.002 | 0 | 0 | 0 | 0 | 0 |

| Türkiye | 0 | 0 | 0 | 0 | 0 | 0 | 0.001 | 0.001 | 0.001 |

| 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | |

|---|---|---|---|---|---|---|---|---|---|

| China | 0 | 0 | 0 | 0.194 | 0 | 0 | 0 | 0.213 | 0 |

| Korea | 0.004 | 0.010 | 0.018 | 0.018 | 0.016 | 0.017 | 0.018 | 0.033 | 0.025 |

| United Arab Emirates | 0 | 0 | 0 | 0.001 | 0 | 0 | 0.011 | 0 | 0 |

| Türkiye | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0.001 | 0.001 |

| Saudi Arabia | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0.001 | 0.001 |

Source: Development Initiatives based on OECD DAC and SAIS-CARI data.

Conclusion

Aid – particularly to the core socioeconomic sectors – is important for the realisation of key development outcomes projected in annual country budget and planning documents. [17] This is because despite the concerted efforts to improve revenue mobilisation, there are still resource gaps occasioned by poor revenue mobilisation, fraud and wastage and debt repayments. From the analysis of trends in aid to the three countries – Ethiopia, Kenya and Uganda – between 2012 and 2021, we can draw the following conclusions:

- Ethiopia receives the highest amount of aid, probably due to the current crises it is experiencing, among other issues. Despite the country’s increasing needs, it saw a drop in aid in 2021, but this can be attributed to the cuts made during the Covid-19 pandemic.

- Bilateral donors are the main type of donor, contributing over half of the total aid to Uganda and Kenya and highlighting their importance in realising some of the nations’ development priorities. Multilateral donors contributed an average of 44.7% of aid to the three focus countries.

- ODA grants remain the main form of aid across all three countries, accounting for 61.1% of total aid on average. Most grants are allocated to social sectors, such as healthcare. Conversely, ODA loans account for an average of 38.6% of total cumulative aid, with the bulk of this money funnelled into infrastructure.

- Health, infrastructure, and governance and security are the top three recipient sectors in Kenya and Uganda, while agriculture and food security supplants infrastructure in Ethiopia due to ongoing food shortages. Together these sectors account for an average of 56.8% of total cumulative aid to the three countries.

- Most aid has been channelled through public sector institutions (67.4% in Ethiopia, 63.2% in Kenya and 56.4% in Uganda). Aid flowing through public sector institutions accounts for over four times the amounts flowing through NGOs and civil societies, and multilateral organisations.

- Most Chinese aid has been earmarked for the infrastructure sector (primarily the transport and power industries) while DAC donors have tended to invest heavily in socioeconomic sectors instead.

- China has provided over three times the amount of aid provided by four other major South–South cooperation nations (Korea, UAE, Saudi Arabia and Türkiye) in Kenya and more than twice that figure in Uganda. In Ethiopia however, Korea has provided more aid than China over the period analysed.

Downloads

Notes

-

1

For example, Kenya’s fiscal deficit for the FY 2021/22 budget is projected at Ksh 929.7 billion equivalent to 7.5% of GDP. 2021 BROP, National Treasury. Available here https://www.treasury.go.ke/wp-content/uploads/2021/10/2021-Budget-Review-and-Outlook-Paper.pdfReturn to source text

-

2

Inter-agency appeals, Southern and Eastern Africa, Global humanitarian overview. Available here https://2021.gho.unocha.org/inter-agency-appeals/southern-and-east-africa/Return to source text

-

3

Eastern Africa: Humanitarian Snapshot (December 2020), Relief web. Available here https://reliefweb.int/report/ethiopia/eastern-africa-humanitarian-snapshot-december-2020Return to source text

-

4

Sector budget proposal, National treasury Kenya. Available here https://www.treasury.go.ke/sector-budget-proposal-reports/ , Sector reports, Ministry of Finance Uganda. Available here https://www.finance.go.ug/publications/sector-reports and Macro-economic and fiscal framework 2015-2019, Ministry of Finance, Ethiopia. Available here https://www.mofed.gov.et/media/filer_public/ec/5d/ec5d8149-d329-4737-a6c9-351c18cff997/134.pdfReturn to source text

-

5

Kenya had US$0.7 million investment gap in the water and sanitation sectors as of 2021. Water and Natural resources sector budget proposal, National treasury. Available here https://www.treasury.go.ke/wp-content/uploads/2021/05/Environment-Protection-Water-Natural-Resources-Sector-Budget-Proposal-Report.pdf Ethiopia will require US$3.2 billion dollars per year to achieve the water, sanitation, and hygiene SDG targets. (6.1 & 6.2). UNICEF, WASH sector country brief. Available here https://www.sanitationandwaterforall.org/sites/default/files/migrate_default_content_files/ETHIOPIA_WASH_SECTOR_COUNTRY_BRIEF.pdfReturn to source text

Related content

Chinese lending to East Africa: What the numbers tell us

DI identifies key trends in Chinese lending to East Africa from 2015–2020 and examines China's rising influence in the region using SAIS-CARI and OECD data.

Analysis of aid flows to Uganda before and during Covid-19

This briefing analyses aid flows from key donors to Uganda before and during Covid-19.

Analysis of aid flows to Kenya before and during Covid-19

This briefing analyses aid flows from key donors to Kenya before and during Covid-19.