Uganda’s loans from international financial institutions (IFIs), 2018–2021

Analysis of loans to Uganda from key IFIs (the African Development Bank, the IMF and the World Bank) considering lending terms, sector focus and debt sustainability.

DownloadsIntroduction

Donor agencies are an important source of the financial resources that are helping Uganda address revenue shortfall in the face of economic shocks amid efforts to contain the spread of Covid-19 and mitigate its negative impacts.

Between 2018 and 2021, donor aid to Uganda has been a blend of both grants and loans. Grants from bilateral donors remain the most significant source of aid to Uganda; however, evidence from our recent analysis on aid flows to Uganda before and during Covid-19 revealed that the overall profile of official development assistance (ODA) to the country is switching. Uganda now receives an increased proportion of concessional loans, as key international financial institutions (IFIs) lend significantly increased loan disbursements to Uganda. [1]

This briefing presents in-depth analysis of the loans advanced to Uganda from January 2018 and until the end of June 2021 by three key IFIs (the African Development Bank (AfDB), the International Monetary Fund (IMF) and the World Bank). The analysis assesses trends, lending terms, targeting (sector focus) and debt sustainability.

Box 1

Important note about the aid data used in this briefing

In this paper, we look at loans to show what funding has crossed into Uganda and how activities on the ground are affected.

This analysis uses data published by donors to the International Aid Transparency Initiative (IATI) – a major source of near real-time disbursements of aid. The data in this briefing comprises all loan disbursements made by a consistent set of donors to all sectors, from January 2018 up to and including June 2021. The assessment did not consider loans from bilateral lenders, particularly China, which does not publish the terms and volumes of loans.

Not all donors publish to IATI (for example, the IMF has not published data to IATI since 2018 and so this study relied on the limited loan information published on its website). Our analysis focuses on how disbursements have changed, rather than total flows.

It is possible that more loans made in 2020 and 2021 will be published to IATI after this briefing; however, this is likely to have minimal impact on the findings based on the publishing habits of donors to date.

Key findings

The following findings are drawn from analysis of aid flows from three key IFIs (the African Development Bank (AfDB), the International Monetary Fund (IMF) and the World Bank) between January 2018 and June 2021 (inclusive). For more information about the data, see our box on the data used in this briefing.

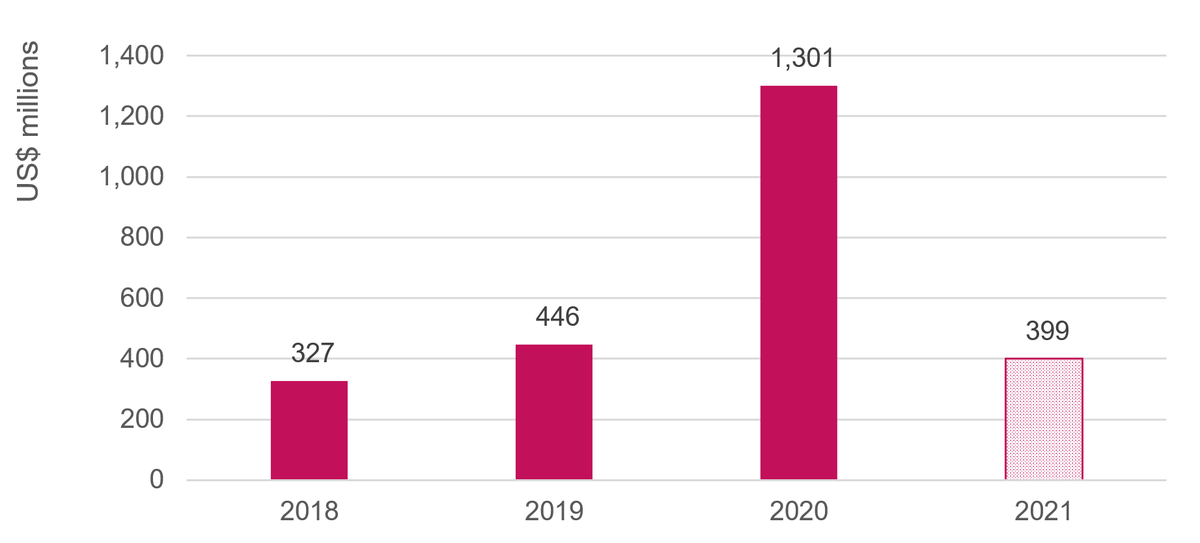

- The financial strain linked to the impact of the Covid-19 pandemic has resulted in a significant increase in the disbursement of loans from IFIs. For instance, loan disbursement to Uganda increased by 36% from 2018 to 2019, and by 192% from 2019 to 2020 (see Figure 1). The change from 2020 to 2021 cannot be accurately estimated because the data for 2021 is incomplete.

- More than half (56%) of the total loans disbursed in volume terms during the period under review were from new loan commitments and disbursements from the World Bank and IMF in 2020 and 2021 alone (see Figure 1). The rest included disbursement from old loan commitments made earlier.

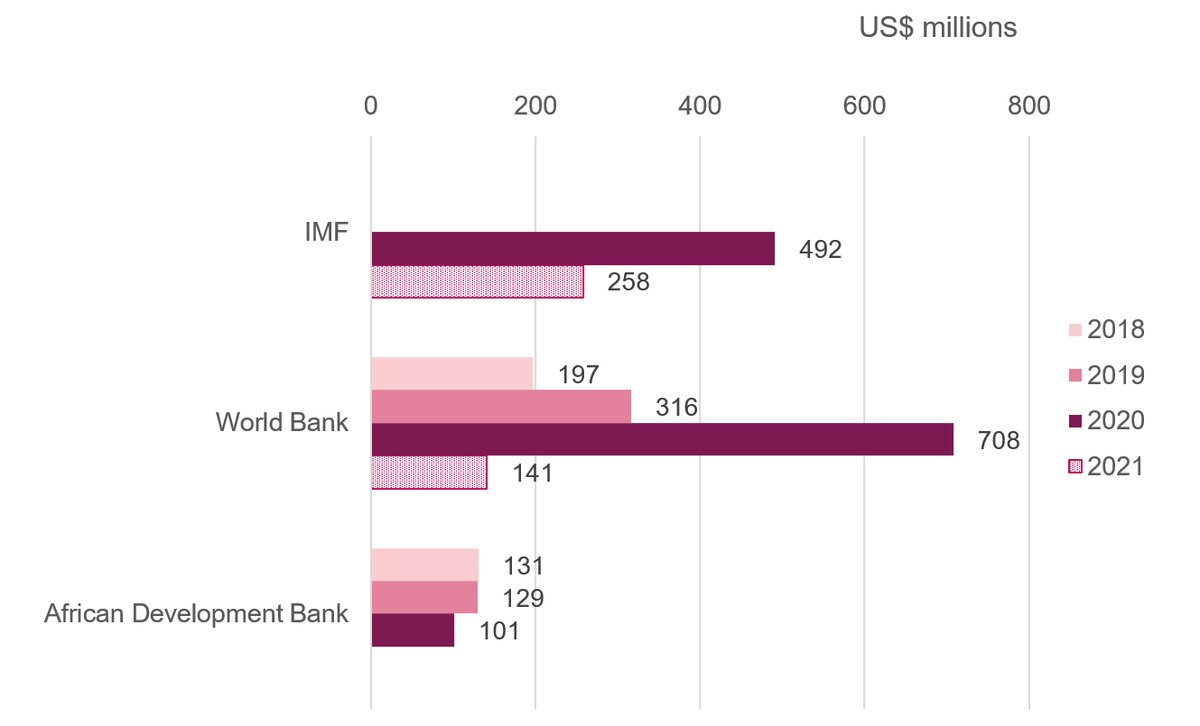

- The World Bank, Uganda’s biggest lender, advanced a total of US$1.4 billion to the country: 50% of the loans disbursed by the three IFIs from January 2018 to June 2021. The World Bank substantially increased loans made in 2020, compared to 2018 and 2019 (see Figure 2).

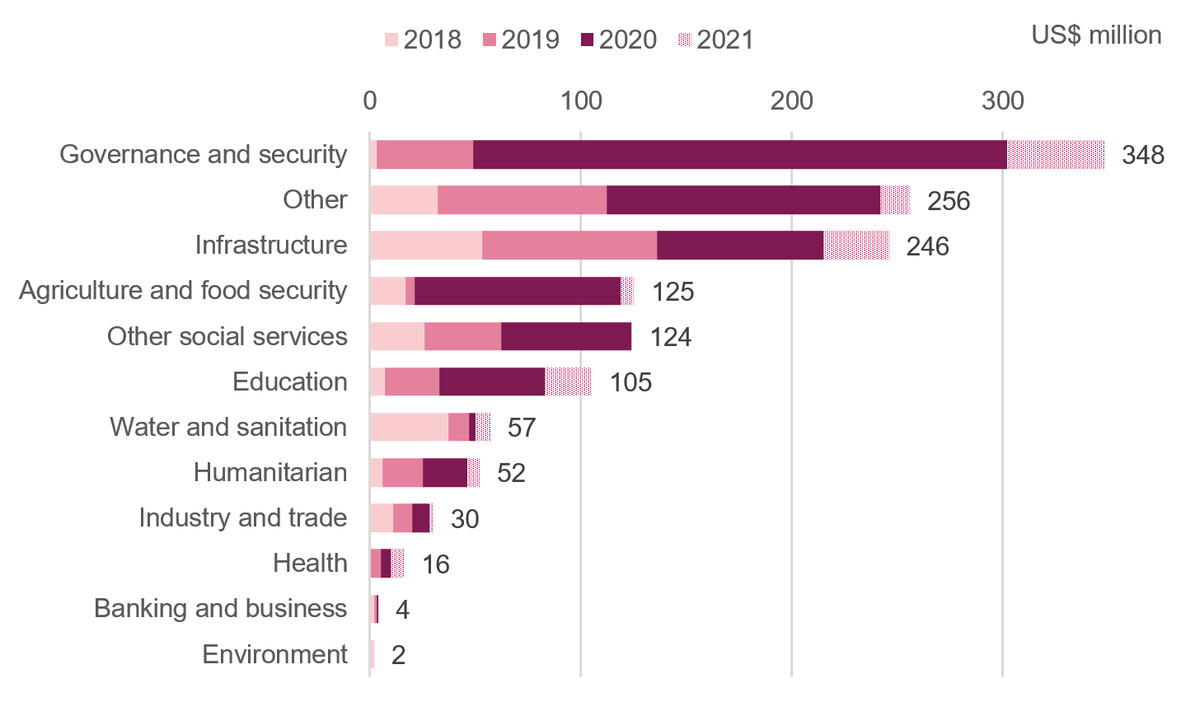

- The governance and security sector was the biggest beneficiary of these loans. Allocations to the sector increased significantly, by 1,433% from 2018 to 2019, and by 450% from 2019 to 2020 (see Figure 4) mainly as a result of the World Bank’s disbursements to the Uganda Covid-19 Economic Crisis and Recovery Development Policy project.

- During the pandemic, there has been no change in sector focus towards the health sector, which was not prioritised by IFIs during the period under review (see Figure 4).

- The IMF disbursed loans under the Rapid Credit Facility and the Extended Credit Facility, in 2020 and 2021 respectively. These were targeted at cushioning Uganda from the pandemic’s economic shock.

- The AfDB’s lending focus was on pro-poor sectors such as infrastructure, education, and water and sanitation (which have long-term impacts) and the agriculture and food security sector (which have short- to medium-term impacts) – see Figure 7.

- The IMF and World Bank lending rates to Uganda for ODA have historically been below market rates (concessional). This trend has continued during increased lending in 2020 and 2021 (when all loans were concessional).

- The World Bank maintains its budget support reform conditions on loans linked to the Covid-19 crises, yet many of these reforms are focused on the World Bank’s long-term reform agenda and not directly relevant to the Covid-19 crisis.

- The IMF is routing much of its Covid-related loans through programmes with little to no conditionality.

- New IFI loans are adding to Uganda’s debt burden. However, most of Uganda’s non-concessional loans come from domestic borrowing. Recent growth in domestic borrowing has contributed much of the increase in public debt.

- In May 2020 the IMF and World Bank maintained that Uganda’s debt was sustainable, with a low risk of external and overall debt distress under the Covid-19 pandemic macroeconomic framework. [2] However, there are growing concerns among local actors over high debt levels and in June 2021 the IMF warned that Uganda’s high debt burden had caused multiple indicators to breach their indicative thresholds under stress tests. [3]

Trends in financing from major international financial institution donors

The government of Uganda borrowed a significantly higher amount in loans in 2020 compared to 2019 and 2018. Total loans in 2020 were over three times the average for 2019 and 2018.

Figure 1: Total loans disbursed from three key international financial institutions, January 2018 to June 2021

A column chart showing total volume of loans disbursed to Uganda by the African Development Bank, World Bank and International Monetary Fund from

| Year | 2021 | 2020 | 2019 | 2018 | Grand Total |

|---|---|---|---|---|---|

| Disbursed loans | 399 | 1,301 | 446 | 327 | 1,725 |

Source: Development Initiatives based on IATI and project documents from IFI lenders.

Notes: Data for 2021 does not include all the loans that will be advanced this year: only loans made up to and including June 2021 were counted.

Between January 2018 and June 2021, the World Bank disbursed the largest volume of loans, amounting to US$1,362.6 million (55% of the total), followed by the IMF’s US$750 million (30% of the total) while the AfDB disbursed US$361.1 million (15% of the total).

In 2021, by the end of June, a total of US$399.4 million in loans had been disbursed by the three key IFIs, of which US$258 million was from the IMF’s US$1 billion Extended Credit Facility to Uganda (June 2021 to 2024).

Figure 2: Loans disbursed from three key international financial institutions by lender, January 2018 to June 2021

A bar chart showing amount of loans disbursed to Uganda by the African Development Bank, World Bank and IMF from January 2018 to June 2021 in US$, million

| 2021 | 2020 | 2019 | 2018 | Grand Total | |

|---|---|---|---|---|---|

| African Development Bank | - | 101 | 129 | 131 | 363 |

| World Bank | 141 | 708 | 316 | 197 | 1,363 |

| IMF | 258 | 492 | - | - | |

| Grand Total | 399 | 1,301 | 446 | 327 | 1,725 |

Source: Development Initiatives based on IATI and project documents from international financial institution lenders.

Notes: Data for 2021 does not include all the loans that will be advanced this year: only loans made up to and including June 2021 were counted. No IMF data available for 2018 and 2019; no AfDB data available for 2021.

Lending terms

Normally, IFI leading terms to countries are determined on the basis of several factors, including the borrowing country’s risk of debt distress, the level of GNP per capita, creditworthiness, as well as project-specific parameters where loans go to financing development projects.

While it is important to consider the terms at which loans are provided, both concessional and non-concessional loans increase a government’s debt burden and need to be repaid. Public external debt (also known as foreign debt) makes up the largest share (61%) of total public debt. While there is growing concern over increasing debt and the negative impact of debt servicing on Uganda’s fiscal space, most of Uganda’s non-concessional loans come from domestic borrowing. Recent growth in domestic borrowing has contributed to much of the increase in public debt. [4]

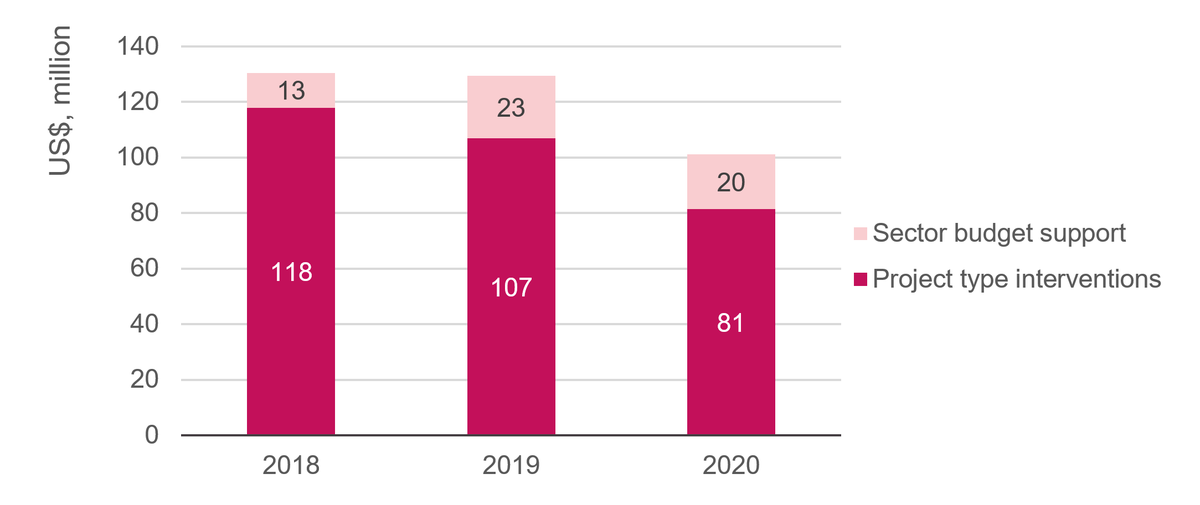

The World Bank and IMF’s lending rates to Uganda for ODA have historically been below market rates (concessional). This trend has continued with increased lending in 2020 and 2021, when all loans were concessional. However, not all AfDB lending to Uganda between January 2018 and June 2021 has been concessional.

The lending terms for the World Bank are updated and published every quarter. All World Bank loan transactions for Uganda for the period under review were concessional. [5] The specific terms may differ depending on when the loans were acquired. For example, the loans acquired in 2018 came with fixed rates (including service and interest) ranging from 2.8% to 2.9%, in 2019 they ranged from 2.9% to 3.0%, the loans in 2020 had the lowest terms ranging from 2.6% to 2.8%, and in 2021 terms ranged from 2.8% to 3.1%. [6]

The two most recent IMF loans disbursed to Uganda are a US$492 million commitment under the Rapid Credit Facility in May 2020 and a US$1 billion commitment begun in June 2021 under the Extended Credit Facility (ECF). According to the IMF, the loans under the ECF have an interest rate of zero, with a grace period of five and a half years, and a final maturity of 10 years. [7] Uganda’s ECF commitment will be disbursed in semi-annual tranches over a period of three years, and subject to six-monthly reviews assessing the government’s progress in implementing economic reforms. [8]

Besides the lending rates, the World Bank maintains its budget support reform conditions on loans linked to the Covid-19 crises, even when many of these reforms are focused on the World Bank’s long-term reform agenda and not directly relevant to the Covid-19 crisis at hand. [9]

AfDB lending to Uganda from January 2018 to June 2021 can be categorised into project type interventions and sector budget support. The budget support to Uganda comes from the African Development Fund (ADF) which is the concessional arm of the African Development Bank. [10] For example, in 2020 the ADF approved a loan of US$31.6 million in support of the Ugandan government’s Covid-19 response. [11] However, this is more than the sector budget support loans reported as disbursed on IATI for 2020, implying that either the loans disbursed in 2020 are from approvals made in previous years or data is incorrectly reported in IATI.

Figure 3: African Development Bank loans that are concessional (sector budget support) and non-concessional (project type interventions), 2018–2020

A stacked column chart showing concessional and non concessional loans disbursed to Uganda by the African Development Bank from January 2018 to June 2021 in US$, million

| 2018 | 2019 | 2020 | Grand Total | |

|---|---|---|---|---|

| Project-type interventions | 118 | 107 | 81 | 306 |

| Sector budget support | 13 | 23 | 20 | 55 |

| Grand Total | 131 | 129 | 101 | 361 |

Source: Development Initiatives based on IATI and project documents from international financial institution lenders.

IMF lending is usually accompanied by terms, a set of corrective policy actions linked to conditions such as implementation of appropriate policies by borrowers. [12] The corrective policy actions applied to the new loans to Uganda are Covid-19 specific and targeted at increased transparency, accountability and efficiency in implementation of loan-financed activities. [13] However, the IMF is lauded for routing much of its Covid-19 financing through programmes with little to no conditionality. [14] Ideally, borrowing for Covid-related interventions would be subject to fewer conditionalities, so that the funds needed to meet urgent and pressing needs can be disbursed without the need to fulfil additional and often lengthy requirements.

IFIs apply terms and conditions to their loans, but loans can be made before these conditions are satisfied, which means that some conditionalities could become higher priorities than the original need that caused the government to borrow. [15] Moreover, the terms and conditions related to sectoral needs that developing countries often failed to meet in normal times (such as social protection, environmental sustainability, equity of public resource use, health and education) now present a bigger burden for countries like Uganda that would benefit from more speed and flexibility in loan disbursement during the Covid-19 crisis. [16]

World Bank: focus of loans

Sectors: prioritising governance and security

The World Bank provides the highest volume of loans to Uganda, and is the country’s biggest donor. More than a quarter of World Bank loans disbursed in the period under review are to the governance and security sector, which was driven by the Covid-19 Economic Crisis and Recovery Development Policy Financing loan in 2020. Allocations to the sector increased significantly: by 1,433% from 2018 to 2019, and by 450% from 2019 to 2020.

Figure 4: Sector allocation of World Bank loans to Uganda, January 2018 to June 2021

A stacked bar chart showing the sector focus of World Bank loans disbursed to Uganda from January 2018 to June 2021 in US$, million

| Sector | 2018 | 2019 | 2020 | 2021 | Total |

|---|---|---|---|---|---|

| Governance and security | 3 | 46 | 253 | 46 | 348 |

| Other | 32 | 80 | 130 | 14 | 256 |

| Infrastructure | 53 | 83 | 79 | 31 | 246 |

| Agriculture and food security | 17 | 4 | 98 | 6 | 125 |

| Other social services | 26 | 36 | 62 | 0 | 124 |

| Education | 7 | 26 | 50 | 22 | 105 |

| Water and sanitation | 37 | 10 | 3 | 7 | 57 |

| Humanitarian | 6 | 19 | 21 | 6 | 52 |

| Industry and trade | 11 | 9 | 8 | 2 | 30 |

| Health | 5 | 5 | 6 | 16 | |

| Banking and business | 2 | 1 | 1 | 4 | |

| Environment | 2 | 2 |

Source: Development Initiatives sectoral analysis of World Bank and African Development Bank commitments published through IATI. No sectoral breakdown is available for the International Monetary Fund. Other includes multisector allocations which could not be uniquely disaggregated by sector

Note: Data for 2021 does not include all the loans that will be advanced this year: only loans made up to and including June 2021 were counted.

The health sector, despite the pandemic, is among the sectors that are least targeted by the World Bank; however, allocations to the sector increased by 20% from 2020 to June 2021. Moreover, a number of loans were multisectoral and incorporated health components: our assessment of project-level detail identifies health among the largest project activities, even in sectors other than health. Separate analysis from Development Initiatives shows that, of aid flows reported to IATI by a set of key bilateral donors, the health sector in Uganda has been the top recipient of health grant aid from bilateral donors . [17]

Between 2018 and 2021, the World Bank’s loans to Uganda totalled US$1.4 billion (US$196.8 million in 2018; US$316.5 million in 2019; US$707.9 million in 2020; and US$141.4 million by June 2021). The loans were allocated to 18 projects, across 10 sectors, over those years. The largest share, US$348.2 million (26% of the loans) went towards governance and security, followed by US$246.3 million (18%) to infrastructure. Education and other social services were allocated a combined US$228.3 million (17%), while agriculture and food security received US$124.1 (9%). During Covid-19, the health sector was among the sectors that received the least priority with an allocation of US$15.7 million (1%).

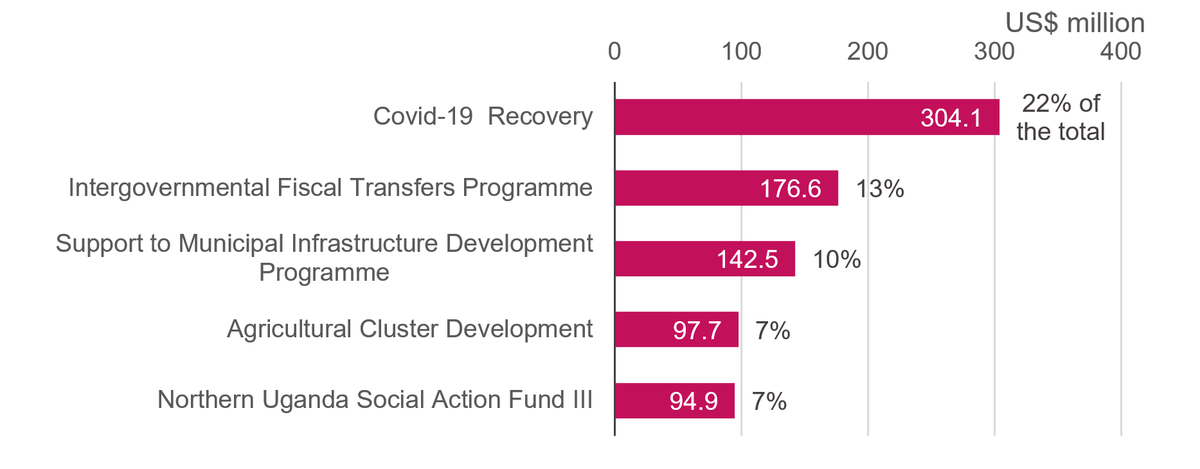

Key projects funded by World Bank loans

Between January 2018 and June 2021, the project that received the most loan financing from the World Bank was the Covid-19 Economic Crisis Recovery and Development Policy Financing, [18] which took US$304.1 million (22% of the total funding from January 2018 to June 2021, and 100% of total loan disbursements for 2020).

Figure 5: The five highest-funded World Bank loan-financed projects, January 2018 to June 2021

A bar chart showing the top five projects funded by World Bank loans disbursed to Uganda from January 2018 to June 2021 in US$, million

| Name | Disbursed loans ($US million) | Percent of total disbursement |

|---|---|---|

| Northern Uganda Social Action Fund III | 95 | 7% |

| Agricultural Cluster Development | 98 | 7% |

|

Support to Municipal Infrastructure

Development Programme |

143 | 10% |

|

Intergovernmental Fiscal Transfers

Programme |

177 | 13% |

|

Covid-19

Recovery |

304 | 22% |

Source: Development Initiatives based on IATI and project documents from international financial institution lenders.

Note: Data for 2021 does not include all the loans that will be advanced this year: only loans made up to and including June 2021 were counted.

The project that received the second-greatest amount of World Bank loans was the Intergovernmental Fiscal Transfers Program. [19] Funding for this project amounted to US$176.5 million (13% of total World Bank loans during the period under review, and disbursed as US$70.3 million by June 2021, US$55.7 million in 2020 and US$50.5 million in 2019). The objective of the project is to improve the adequacy and equity of fiscal transfers, and to improve fiscal management of resources by local governments for health and education services. According to the World Bank, this funding enables Uganda to address the binding constraint of low and inequitable levels of funding for health and education at the local government level.

The third-highest allocation of World Bank loans went to financing support for the Municipal Infrastructure Development Program. [20] This project received a total disbursement of US$142.5 million between January 2018 and June 2021. US$82.6 million was disbursed in 2020, US$57.7 million in 2019 and US$2.2 million in 2018. No disbursement had been made by June in 2021. The objective of this project is to enhance the institutional performance of local governments to improve urban service delivery. The project is exclusively targeted at subnational governments across five themes (finance; public sector management; social development and protection; urban and rural development; and environmental and natural resource management).

Other projects financed by World Bank loans between January 2018 and June 2021 include the Agriculture Cluster Development Project (allocated US$97.7 million – 7% of total loans from the Bank to Uganda during the period), followed by the Third Northern Uganda Social Action Fund (allocated US$94.9 million – 7%) and the Uganda Reproductive, Maternal and Child Health Services Improvement Project (allocated US$88.9 million – 7%). Details of all other projects financed by World Bank loans are shown in Annex able A1.

2021 breakdown

Between January and June 2021, the World Bank had disbursed a total of US$141.4 million in loans; half of these funds (US$70.4 million) were allocated to Uganda’s Intergovernmental Fiscal Transfers Program. [21]

Other projects funded by World Bank loan disbursements between January and June 2021 include the Uganda Reproductive, Maternal and Child Health Services Improvement Project, [22] the Albertine Region Sustainable Development Project, Uganda Grid Expansion and Reinforcement, and the Integrated Water Management and Development Project. A complete list appears in Table A1 in the annex.

2020 breakdown

The World Bank’s US$707.9 million loan in 2020 represents the largest loan disbursement to Uganda between January 2018 and June 2021 (equivalent to over half of the Bank’s total disbursement to Uganda in that period). Of this, US$304.1 million (43%) went to Uganda Covid-19 Economic Crisis and Recovery Development Policy Financing, the largest single-project allocation of World Bank loans during the period under review. This project aimed to strengthen Uganda’s crisis response, protect the most vulnerable, and support faster economic recovery and debt transparency. [23]

The second most financed project by the World Bank in 2020 was the Uganda Support to Municipal Infrastructure Development Program, to which US$82.6 million of loans was disbursed (12% of the Bank’s loans to Uganda that year). This was followed by the Agriculture Cluster Development Project, which was allocated US$70.4 million (10%), followed by the Uganda Intergovernmental Fiscal Transfers Program, allocated US$55.7 million (8%) and the Uganda Reproductive, Maternal and Child Health Services Improvement Project, allocated US$37.2 million (5%). The rest of the nine World Bank loan projects funded in 2020 received a combined total of US$157.8 million (22% of total World Bank loans disbursed that year).

2019 breakdown

In 2019 the World Bank disbursed to Uganda a total of US$317.2 million in loans, this was spread across 14 projects. More than 60% of the disbursements in 2019 went to financing four projects, with the largest allocation of US$57.7 million (18% of the total disbursement) going to the Uganda Support to Municipal Infrastructure Development Program. This was followed by US$50.5 million (16%) to the Uganda Intergovernmental Fiscal Transfers Program. US$46.8 million (15%) went to the Third Northern Uganda Social Action Fund, and US$36.7 million went to the Energy for Rural Transformation III project. The rest of the 10 projects funded in 2019 were allocated a combined total of US$125.6 million (40% of the disbursed loans).

2018 breakdown

In 2018, the World Bank disbursed a total of US$197.1 million in loans to Uganda, which was allocated to 13 projects. The Water Management and Development Project received the largest allocation of US$38.9 million (20% of the total disbursement) followed by the Third Northern Uganda Social Action Fund, which was allocated US$34.8 million or 18%, followed by the Uganda North Eastern Road-corridor Asset Management Project, allocated US$27.6 million or 14%. The Competitiveness and Enterprise Development Project received US$22.8 million (12%) of total the disbursement for 2018. The other eight projects financed by World Bank loans were allocated a combined US$73 million (37% of total disbursement that year).

International Monetary Fund: focus of loans

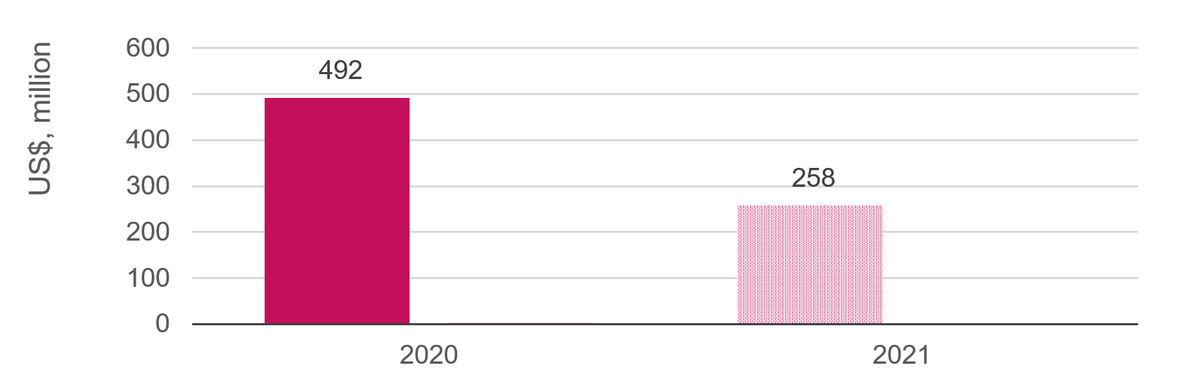

Cushioning Uganda from the pandemic shock

The data used for this analysis was obtained from the IMF website as the institute does not currently publish to IATI. In May 2020, the IMF disbursed US$492 million to Uganda under the Rapid Credit Facility to support the ongoing recovery from Covid-19. [24] The IMF also committed to offer Uganda another US$1 billion loan under the Extended Credit Facility (ECF), US$258 million of which was disbursed in June 2021. The loans under the IMF’s ECF aim to boost Uganda’s recovery from the Covid-19 pandemic, while generating strong and inclusive private sector-led growth in the short term. [25]

Figure 6: IMF loans to Uganda, January 2020 to June 2021

A clustered column chart showing loans disbursed to Uganda by the IMF from January 2018 to June 2021 in US$, million

| Year | 2020 | 2021 |

|---|---|---|

| Disbursed loans ($US, million) | 492 | 258 |

Source: Development Initiatives based on IMF.

Note: Only US$258 million out of the US$1 billion from the IMF’s Extended Credit Facility to Uganda in 2021 was disbursed by June 2021 Data for 2021 does not include all the loans that will be advanced this year: only loans made up to and including June 2021 were counted.

The IMF lending is premised on the Ugandan government ensuring increased spending on social programmes (including on health, education, and social assistance) arising from greater public sector efficiency. The IMF’s lending requirements include a greater transparency in public accounts and a strong anticorruption framework that aims to lead to higher financial sector resilience and more inclusive growth. [26]

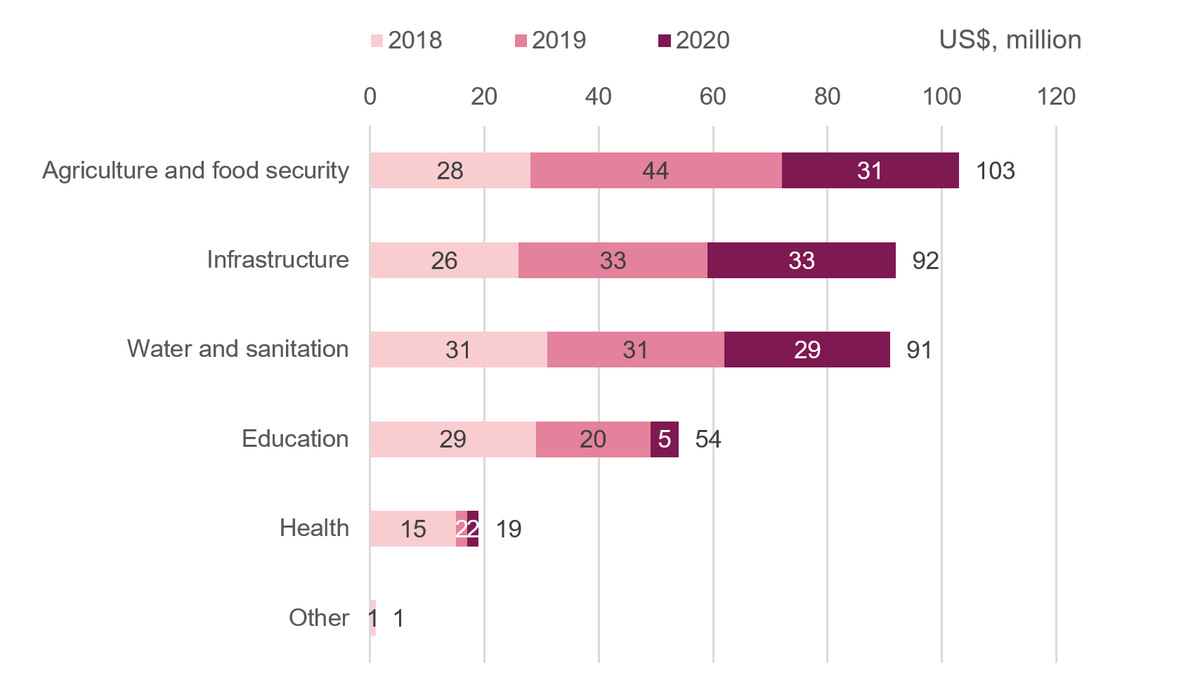

African Development Bank: focus of loans

Sectors: targeting long-term impacts in pro-poor sectors

In general, between January 2018 and June 2021, the focus of AfDB loans to Uganda has been on sectors that can most directly benefit people living in poverty. These sectors include infrastructure, education, and water and sanitation (providing long-term impacts) and the agriculture and food security sector (providing short- to medium-term impacts). Following the outbreak of Covid-19 in 2020, there was no major change in the sector focus of AfDB loan disbursements to Uganda.

However, there has been a declining trend in loan disbursement over that time. The total of US$361.1 million disbursed during the period was distributed as follows: US$130.5 million in 2018, US$129.5 million in 2019, and US$101.1 million in 2020. No disbursements for 2021 had been published to IATI as of June that year.

Figure 7: Sector allocation of African Development Bank loans to Uganda, 2018–2020

A stacked bar chart showing the sector focus of African Development Bank loans disbursed to Uganda from January 2018 to June 2021 in US$, million. Full data is available from Development Initiatives' datasets page.

| 2018 | 2019 | 2020 | Total | |

|---|---|---|---|---|

| Agriculture and food security | 28 | 44 | 31 | 103 |

| Water and sanitation | 31 | 31 | 29 | 92 |

| Infrastructure | 26 | 33 | 33 | 92 |

| Education | 29 | 20 | 5 | 54 |

| Health | 15 | 2 | 2 | 19 |

| Other | 1 | - | - | 1 |

Source: Development Initiatives sectoral analysis of African Development Bank commitments published through IATI.

Note: Data for 2021 does not include all the loans that will be advanced this year: only loans made up to and including June 2021 were counted.

The loans were allocated to six sectors, with agriculture and food security getting the highest total of US$102.7 million (disbursed as US$31.3 million in 2020, US$43.6 million in 2019 and US$27.9 million in 2018 respectively). Allocations to agriculture and food security, infrastructure, and water and sanitation changed little between 2018 and 2020; however, there were significant reductions in allocations to health and education in 2019 and 2020.

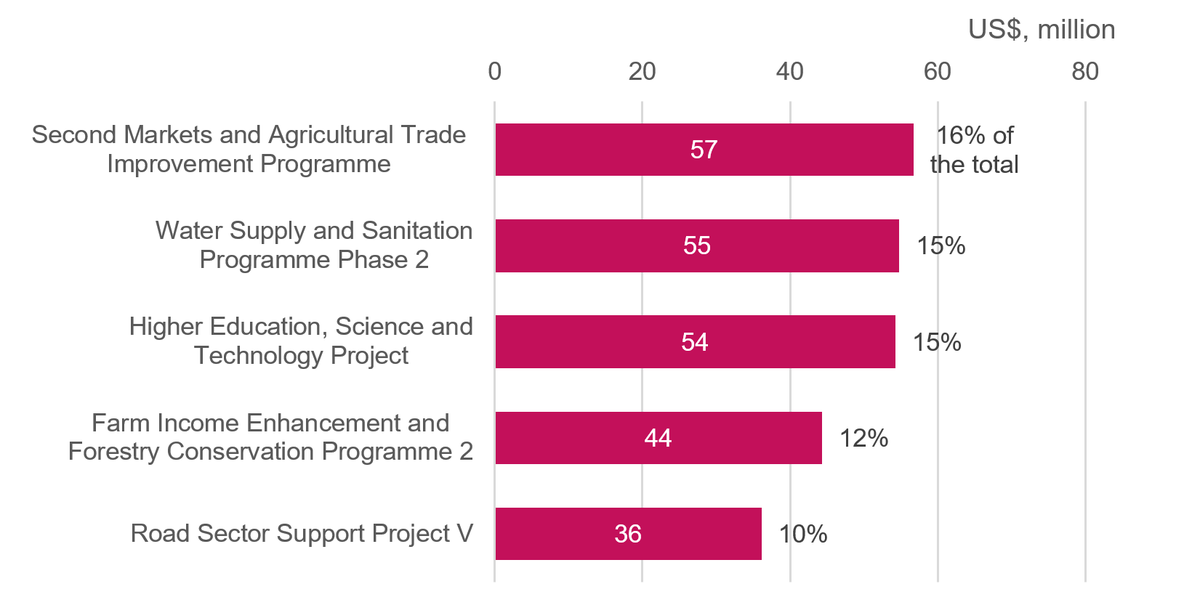

Key projects funded by African Development Bank loans

Between 2018 and 2020, AfDB supported 15 projects on agriculture and food security, infrastructure, education, health, and water and sanitation. Overall, the five loan-funded projects that received the highest amounts during that period were the second Markets and Agricultural Trade Improvement Programme, [27] [28] the Water Supply and Sanitation Programme Phase 2, [29] Support to Higher Education, Science and Technology Project, [30] the Farm Income Enhancement and Forestry Conservation Programme project 2, [31] and the Road Sector Support Project V. [32] Combined, these projects were allocated US$246.1 million (68% of total AfDB loans to Uganda for the period under review).

Figure 8: Five highest-funded African Development Bank loan-financed projects, January 2018 to June 2021

A bar chart showing the top five projects funded by African Development Bank loans disbursed to Uganda from January 2018 to June 2021 in US$, million

| A | B | C |

|---|---|---|

| Road Sector Support Project V | 36 | 10% |

|

Farm Income Enhancement and Forestry

Conservation Programme project 2 |

44 | 12% |

|

Support to Higher Education, Science and

Technology (HEST) Project |

54 | 15% |

| Water Supply and Sanitation Programme Phase II | 55 | 15% |

|

Markets and Agricultural Trade Improvement

Programme: Project – 2 |

57 | 16% |

| 361 |

Source: Development Initiatives sectoral analysis of African Development Bank loan disbursement published through IATI.

Note: Data for 2021 does not include all the loans that will be advanced this year: only loans made up to and including June 2021 were counted.

Other projects financed by the AfDB loans disbursed to Uganda between January 2018 and June 2021 include US$29.2 million to the Uganda Rural Electricity Access Project, US$24.7 million to the Supplementary Loan to Kampala Sanitation Program, US$24.3 million to Road Sector Support Project IV, US$19.0 million to Improvement of Health Services Delivery at Mulago Hospital and in the City of Kampala Project, US$8.3 million to Strategic Towns Water Supply and Sanitation Project, US$3.2 million to The Kampala Sanitation Programme – Phase I, US$2.0 million to the Mbarara Nkenda & Tororo Lira Power Transmission Lines Project, US$1.7 million to Agricultural Value Chain Development Programme Project I, US$1.4 million to Community Agricultural Infrastructure, and US$1.2 million to Water Supply and Sanitation Programme. Details on how these loans were allocated by year is presented in Annex table A2.

2020 breakdown

In 2020 the AfDB disbursed to Uganda US$101.1 million allocated to 11 projects, of which the top three recipients were the Water Supply and Sanitation Programme Phase 2 project (allocated US$19.7 million, 19% of the total for that year), followed by the Markets and Agricultural Trade Improvement Programme: Project – 2 (MATIP II) allocated US$18.1 million or 18%), and the Uganda Rural Electricity Access Project (allocated US$11.7 million or 12%). The rest of the eight projects funded by the AfDB in 2020 received a combined sum of US$51.6 million (50% of total loans disbursed in 2020).

2019 breakdown

In 2019 the AfDB disbursed US$129.5 million to Uganda. This was allocated to 12 projects, of which the top three recipients were the Water Supply and Sanitation Programme Phase II (allocated US$22.6 million, 17% of the total for that year), followed by MATIP II (allocated US$21.8 million, or 17%), and the Farm Income Enhancement and Forestry Conservation Programme project 2 (US$21.6 million, or 17%). The rest of the nine AfDB projects in 2019 were allocated a combined US$63.5 million (49% of the disbursed loans for the year).

2018 breakdown

Most (US$130.5 million) of the AfDB loans disbursed in the period under review came in 2018. The three top funded projects were the Support to Higher Education, Science and Technology Project (allocated US$29.1 million, 22% of the total for that year) followed by MATIP II (allocated US$16.8 million or 13%), and Improvement of Health Services Delivery at Mulago Hospital and in the City of Kampala Project (allocated US$14.7 million or 11%). Together, the remaining 10 AfDB loan-funded projects in 2018 were allocated a total of US$69.8 million (54% of disbursed loans for the year).

Debt sustainability

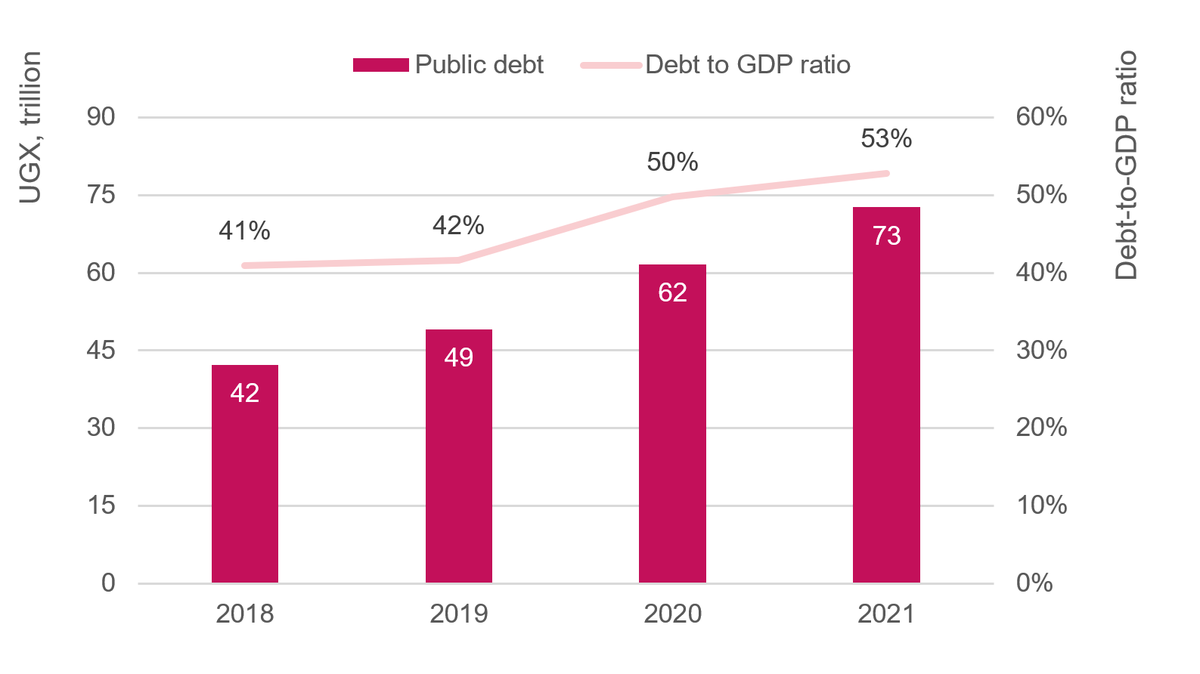

In 2018, the Government of Uganda put its own debt sustainability limit at 50% of debt-to-GDP ratio. [33] The 50% mark, which was thought to be high at the time, made the government less responsive to growing public debt. [34]

In 2021, Uganda’s nominal debt-to-GDP ratio [35] rose to 53%, surpassing the 50% limit (even after rebasing the national accounts in 2019, which increased the size of the economy by 20%). [36] The rapid growth in Uganda’s debt portfolio has caused concern, with widespread public outcry from sections of government. [37] [38] [39] Civil society has also warned the government over high debt levels and the resulting pressure that debt servicing exerts on Uganda’s budget. [40] [41]

Figure 9: Uganda’s public debt, 2018–2021

A combo chart showing Uganda's public debt in Uganda Shillings and Debt to GDP ration in percentage from 2018 to 2021 US%, million

| Public debt | Debt to GDP ratio | |

|---|---|---|

| 2018 | 42 | 41% |

| 2019 | 49 | 42% |

| 2020 | 62 | 50% |

| 2021 | 73 | 53% |

Source: Development Initiatives based on data from Bank of Uganda.

Notes: Data for 2021 based on provisional statistics for end of September 2021.

While concerns were raised over high debt levels by local actors, in May 2020 the IMF and World Bank maintained that Uganda’s debt was sustainable, with a low risk of external and overall debt distress under the Covid-19 pandemic macroeconomic framework. [42] However, in June 2021 the IMF warned that Uganda’s high debt burden had caused multiple indicators to breach their indicative thresholds under stress tests. [43]

Debt management

Even though the new borrowing is unavoidable, there is a need to do it sustainably. There are increasing calls for government to institute sustainable debt-management mechanisms, including: the prudent use of available public resources; better project appraisal, and restructuring or renegotiating loan terms on non-performing projects; [44] [45] and avoiding new loans before pre-existing debts are fully absorbed. [46]

Uganda’s Ministry of Finance unveiled its Medium-term Debt Management Strategy in March 2021 to increase value for money from the borrowed funds and reduce risk in the public debt portfolio by borrowing in the form of longer-dated instruments from the domestic market. [47]

To help with debt management, new loans from the IMF have come with safeguards to ensure proper use and accountability. [48] The World Bank maintains its pre-existing policy reforms as a condition of new loans to improve effectiveness in the use of public resources, arguing that better debt management is crucial to avoid debt distress. [49]

Summary

This briefing reviewed loans from IFIs published to IATI and on the IFIs’ websites between January 2018 and June 2021. The assessment did not consider loans from bilateral lenders, particularly China, which does not publish the terms and volumes of loans. The analysis also did not consider loans disbursed after June 2021.

The Covid-19 pandemic has seen Uganda borrowing more than before. This has contributed to the increase in Uganda’s debt-to-GDP ratio, which surpassed the government’s own 50% debt sustainability threshold at the end of the 2020/21 financial year. This has raised concerns over debt management and likely debt stress for Uganda.

The majority of the IFI loans disbursed during the three and a half years under review were approved before 2018; however, although fewer loans were committed and/or disbursed in 2020 and 2021, they exceed loans committed and/or disbursed in 2018 and 2019 in volume terms.

Uganda is increasingly relying on IFI lending modalities to offset external financing shortfalls and budget deficits arising from the impact of the pandemic on domestic resource mobilisation. [50] In our complementary analysis of domestic financial flows we find that Uganda’s domestic resource mobilisation capacity was greatly impacted by the Covid-19 pandemic, leading to a significant shortfall in revenues and resources. [51]

There is a financing gap in the health sector due to a decline in grants and increased pressure from the Covid-19 pandemic. [52] Findings from our analysis of foreign financial flows to Uganda indicated a significant decline in grants from key bilateral donors such as the US and the UK. [53] Allocation of Covid-targeted loans from IFIs has focused more on economic recovery and livelihoods than health systems.

Despite health and social sectors being a top priority for bilateral donors, diminishing bilateral grants combined with limited support from IFIs in some sectors has resulted in an overall decline in international assistance to these areas. [54] As the pandemic continues, Uganda’s additional borrowing (and the associated increase in allocations of resources to meet debt obligations) is shrinking the fiscal space and resources for spending on sectors with the most direct positive impact on the poorest and most vulnerable people. [55]

Uganda’s long-term financing plans focus on improving domestic resource mobilisation, premised on economic recovery from the economic shocks of the Covid-19 pandemic. This has also been the government’s major justification for new loans from the IMF under the Extended Credit Facility to Uganda.

The publication of information about loans (including details of terms and conditions regarding prudent use) by IFIs is a positive measure that improves transparency and means borrowers can be held to account, for instance by ensuring loan funds are not mismanaged or diverted. While more speed and flexibility are crucial in times of crisis, safeguards that guarantee accountability and curb wastage by the borrowers are equally important.

Annex

Table A1: World Bank loan-financed projects for the period from January 2018 to June 2021 (US$ million)

| Project | 2018 | 2019 | 2020 | 2021 | Total |

|---|---|---|---|---|---|

|

Uganda Covid-19 Economic Crisis and

Recovery Development Policy Financing |

304.1 | 304.1 | |||

|

Uganda Intergovernmental Fiscal Transfers

Program |

50.5 | 55.7 | 70.4 | 176.6 | |

|

Uganda Support to Municipal Infrastructure

Development Program |

2.2 | 57.7 | 82.6 | 142.5 | |

| Agriculture Cluster Development Project | 22.5 | 4.7 | 70.4 | 97.7 | |

|

Third Northern Uganda Social Action Fund

(NUSAF 3) |

34.8 | 46.8 | 13.4 | 0.0 | 94.9 |

|

Uganda Reproductive, Maternal and Child

Health Services Improvement Project |

6.0 | 17.2 | 37.2 | 28.5 | 88.9 |

| Energy for Rural Transformation III | 6.4 | 36.7 | 36.4 | 2.1 | 81.5 |

|

Uganda: Albertine Region Sustainable

Development Project |

21.2 | 25.4 | 21.9 | 11.8 | 80.3 |

| Skills Development Project | 6.6 | 13.3 | 35.9 | 4.5 | 60.4 |

|

Second Kampala Institutional and

Infrastructure Development Project |

24.4 | 33.7 | 58.0 | ||

|

Competitiveness and Enterprise Development

Project (CEDP) |

22.8 | 9.1 | 7.4 | 39.3 | |

| Water Management and Development Project | 38.9 | 38.2 | |||

|

Uganda Grid Expansion and Reinforcement

Project |

1.9 | 15.0 | 2.9 | 11.3 | 31.1 |

|

Uganda North-eastern Road-corridor Asset

Management Project (NERAMP) |

27.6 | 3.2 | 30.8 | ||

|

Integrated Water Management and Development

Project |

10.3 | 3.1 | 6.6 | 20.1 | |

| Electricity Sector Development Project | 5.9 | 6.2 | 12.1 | ||

| Irrigation for Climate Resilience Project | 6.3 | 6.3 | |||

|

Agricultural Technology and Agribusiness

Advisory Services |

0.2 | 0.2 | |||

| Total | 197.1 | 317.2 | 707.9 | 141.2 | 1,362.8 |

Source: Development Initiatives based on IATI and project documents from IFI lenders.

Note: Data for 2021 does not include all the loans that will be advanced this year: only loans made up to and including June 2021 were counted.

Table A2: African Development Bank loan-financed projects for the period from January 2018 to June 2021

| Project | 2018 | 2019 | 2020 | Total |

|---|---|---|---|---|

|

Markets and Agricultural Trade Improvement

Programme: Project – 2 |

16.8 | 21.8 | 18.1 | 56.7 |

|

Water Supply and Sanitation Programme Phase

II |

12.5 | 22.6 | 19.7 | 54.8 |

|

Support to Higher Education, Science and

Technology Project |

29.1 | 19.7 | 5.4 | 54.2 |

|

Farm Income Enhancement and Forestry

Conservation Programme project 2 |

11.1 | 21.6 | 11.6 | 44.3 |

| Road Sector Support Project V | 14.1 | 11.2 | 10.8 | 36.1 |

| Uganda Rural Electricity Access Project | 3.5 | 14.0 | 11.7 | 29.2 |

|

Supplementary Loan to Kampala Sanitation

Programme |

14.4 | 7.0 | 3.3 | 24.7 |

| Road Sector Support Project IV | 6.4 | 7.8 | 10.1 | 24.3 |

|

Improvement of Health Services Delivery at

Mulago Hospital and in the City of Kampala Project |

14.7 | 1.8 | 2.4 | 19.0 |

|

Strategic Towns Water Supply and Sanitation

Project |

1.8 | 6.5 | 8.3 | |

| The Kampala Sanitation Programme – Phase I | 3.2 | 0.1 | 0.0 | 3.2 |

|

The Mbarara Nkenda & Tororo Lira Power

Transmission Lines Project |

2.0 | 2.0 | ||

|

Agricultural Value Chain Development

Programme Project 1 |

0.2 | 1.5 | 1.7 | |

| Community Agricultural Infrastructure | 1.4 | 1.4 | ||

| Water Supply and Sanitation Programme | 1.2 | 1.2 | ||

| Total | 130.4 | 129.6 | 101.1 | 359.9 |

Source: Development Initiatives based on IATI and project documents from IFI lenders.

Data for 2021 does not include all the loans that will be advanced this year: only loans made up to and including June 2021 were counted.

This briefing was updated on 4 March 2022.

Notes

-

1

Development initiatives, July 2021. Analysis of aid flows to Uganda before and during Covid-19. Available at: https://www.devinit.org/f398ebReturn to source text

-

2

World Bank, 2020. Joint World Bank-IMF Debt Sustainability Analysis. Available at: https://documents1.worldbank.org/curated/en/687621596233318202/pdf/Uganda-Joint-World-Bank-IMF-Debt-Sustainability-Analysis.pdfReturn to source text

-

3

World Bank, 2021. Joint World Bank-IMF Debt Sustainability Analysis. Accessed 23/09/2021. Available at: https://documents.worldbank.org/en/publication/documents-reports/documentdetail/693991625855172394/uganda-joint-world-bank-imf-debt-sustainability-analysisReturn to source text

-

4

Bank of Uganda, Oct 2021.Monetory policy report. Available at: https://www.bou.or.ug/bou/bouwebsite/MonetaryPolicy/mpreports.htmlReturn to source text

-

5

World Bank, Uganda loans from the World Bank. Accessed. 06/10/2021, Available at: https://finances.worldbank.org/Loans-and-Credits/Uganda-Loans-from-World-Bank/i7jh-e6ryReturn to source text

Related content

Kenya’s increasing use of loans from international financial institutions

This briefing presents in-depth analysis of the loans advanced to Kenya between 2018 and 2021 by international finance institutions and the purpose of this financing.

Analysis of aid flows to Uganda before and during Covid-19

This briefing analyses aid flows from key donors to Uganda before and during Covid-19.