-

Key facts

There is US$1.94 trillion of international financing flowing to developing countries, with commercial resources dominating the overall landscape. Beyond the aggregate picture, how does the mix vary across regions and different country groupings? And where is official development assistance (ODA) still a significant source of financing compared to other resources?

- In aggregate, commercial flows dominate the international financing landscape.

- Beyond the aggregate level, the resource mix varies across different regions.

- Commercial flows tend to be concentrated in a smaller number of countries compared to other types of finance, including ODA.

- As a proportion of other flows, ODA remains particularly significant in African countries.

- Least developed countries (LDCs) and countries in fragile situations rely on ODA much more than other developing countries.

-

In aggregate, commercial flows dominate the international financing landscape

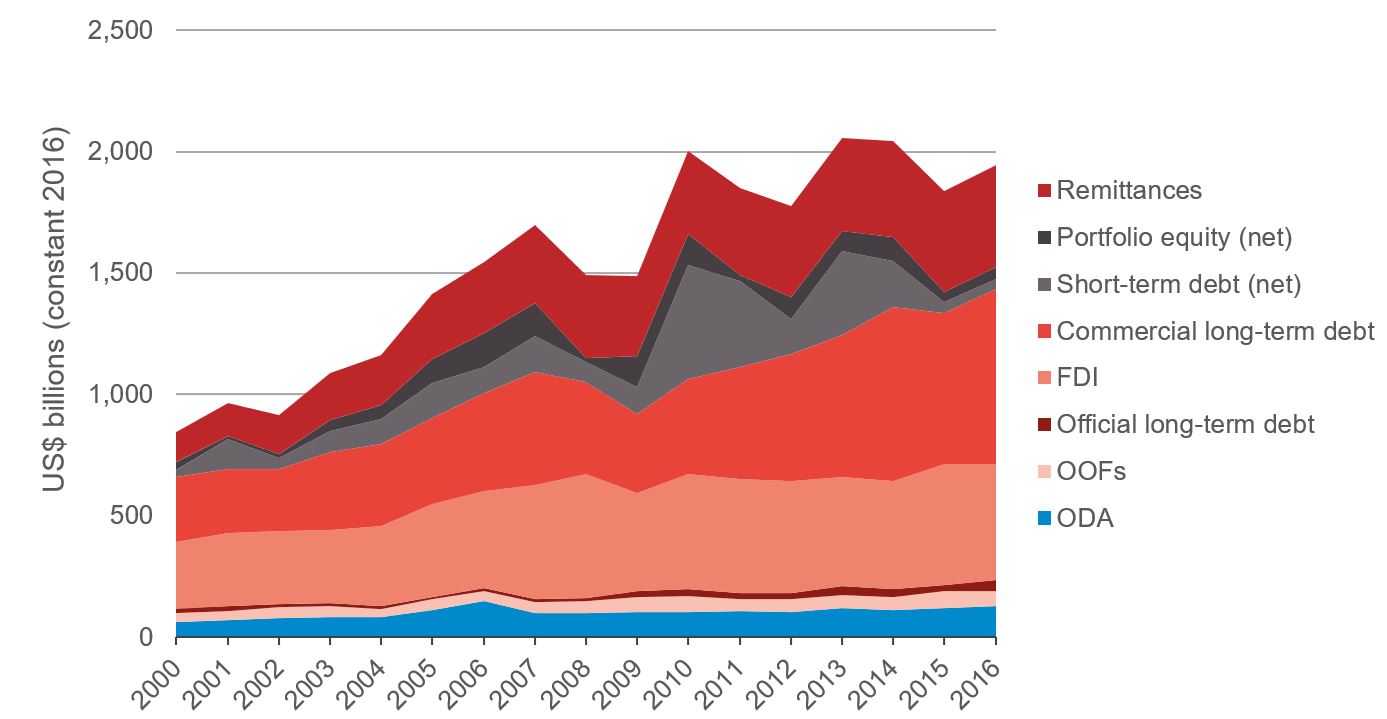

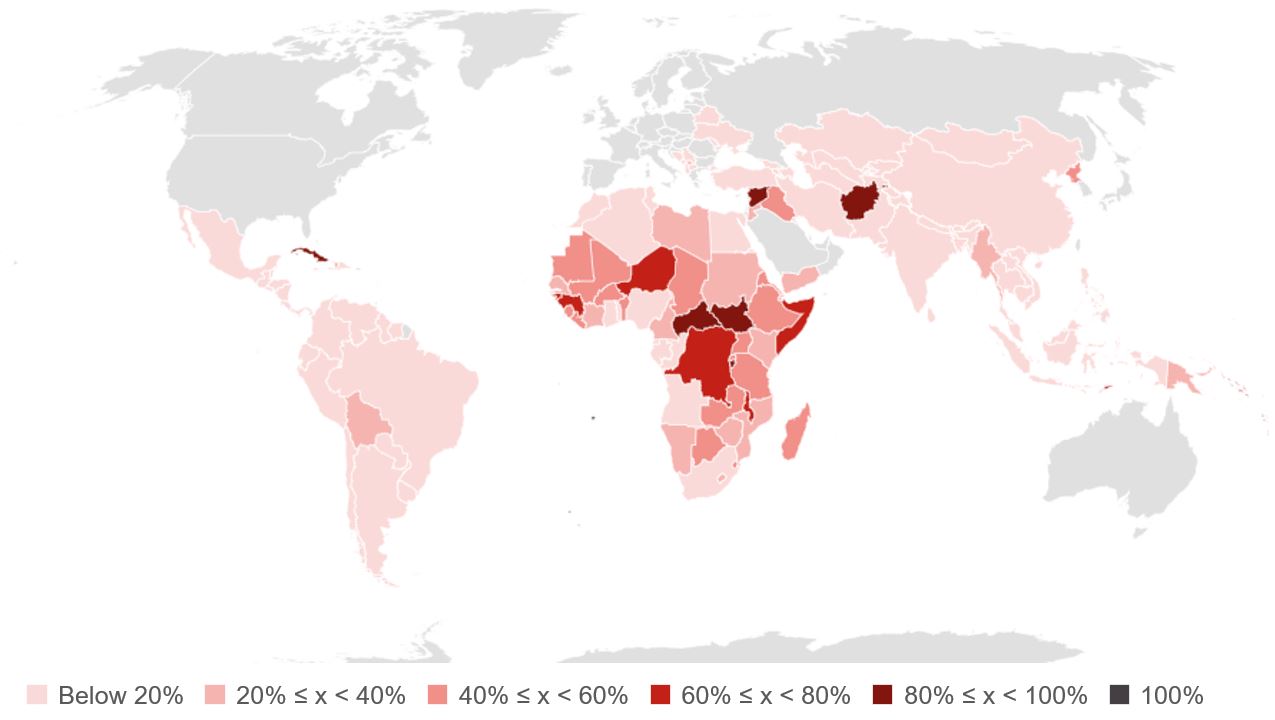

Figure 1. International inflows to developing countries, 2000–2016

Source: Development Initiatives based on OECD DAC, UNCTAD and World Bank data

Note: FDI: Foreign direct investment; OOFs: other official flowsAll types of international financing to developing countries have grown since 2000, reaching an aggregate US$1.94 trillion in 2016. Although private flows (remittances) have grown the fastest (242% over 2000–2016, compared to 113% of commercial flows and 101% of official flows), commercial flows continue to dominate the overall landscape. More specifically, commercial long-term debt was the largest single resource flow in 2016 at US$723 billion. This is equivalent to almost six times ODA, which in 2016 accounted for just 6% of all international flows analysed (down slightly from 7% in 2000). Remittances, which totalled US$418 billion, represented 22% of international financing in 2016.

-

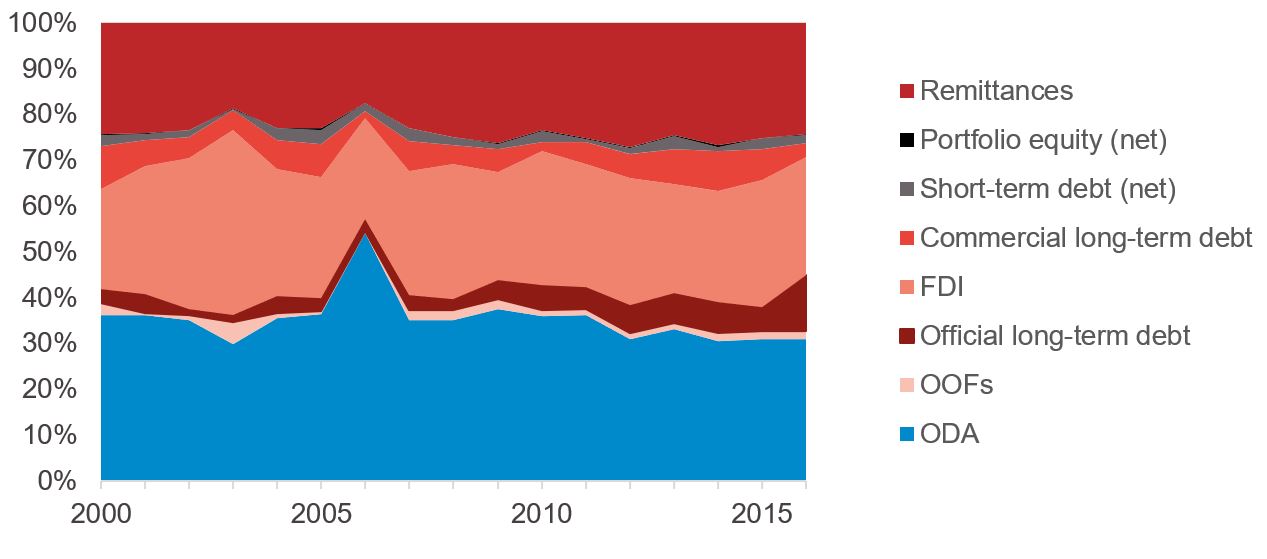

Beyond the aggregate level, the resource mix varies across different regions

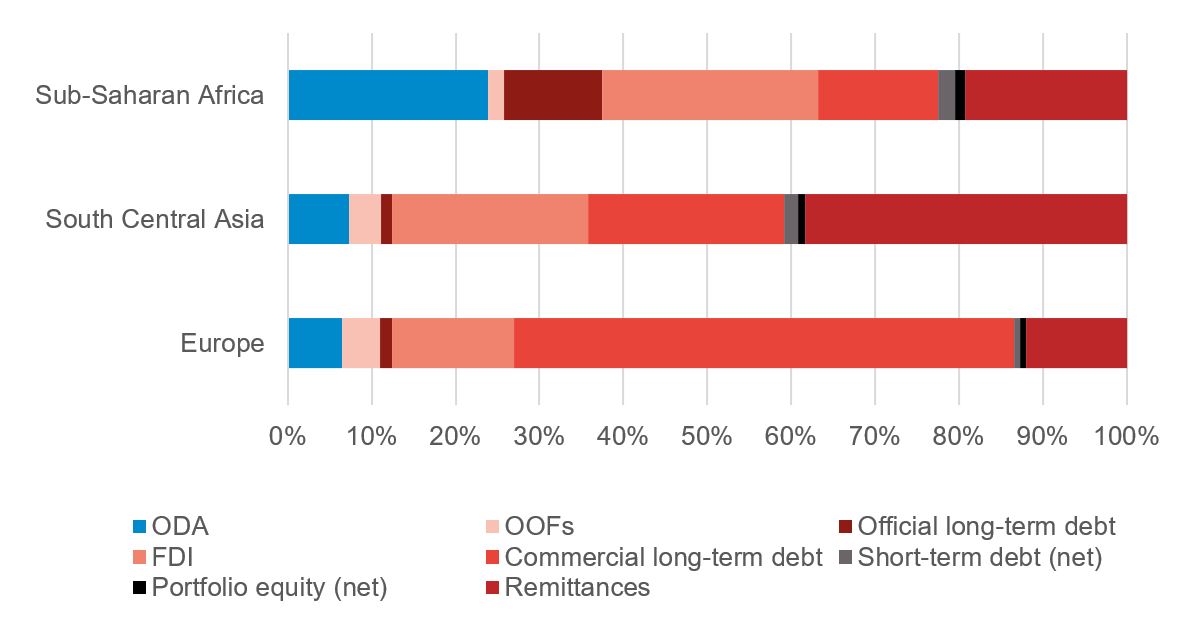

Figure 2. Regional international resource mixes, 2016

Source: Development Initiatives based on OECD DAC, UNCTAD and World Bank data

While commercial flows are increasing and represent the largest source of finance to developing countries overall, the mix of resources can vary quite substantively across different regions. Commercial long-term debt is not equally important in all developing countries, despite its significance on the aggregate level. In developing countries in Europe, for example, commercial long-term debt alone accounts for 60% of all international financing – compared to 14% in Sub-Saharan Africa and 24% in South Central Asia. In contrast, developing countries in South Central Asia receive, in aggregate, a higher proportion of remittances (US$121 billion, or 38% of all inflows in 2016). Official flows meanwhile, especially ODA, play a more significant role in the financing mix of Sub-Saharan African countries (accounting for 37% of all flows, compared to 10% across other regions).

-

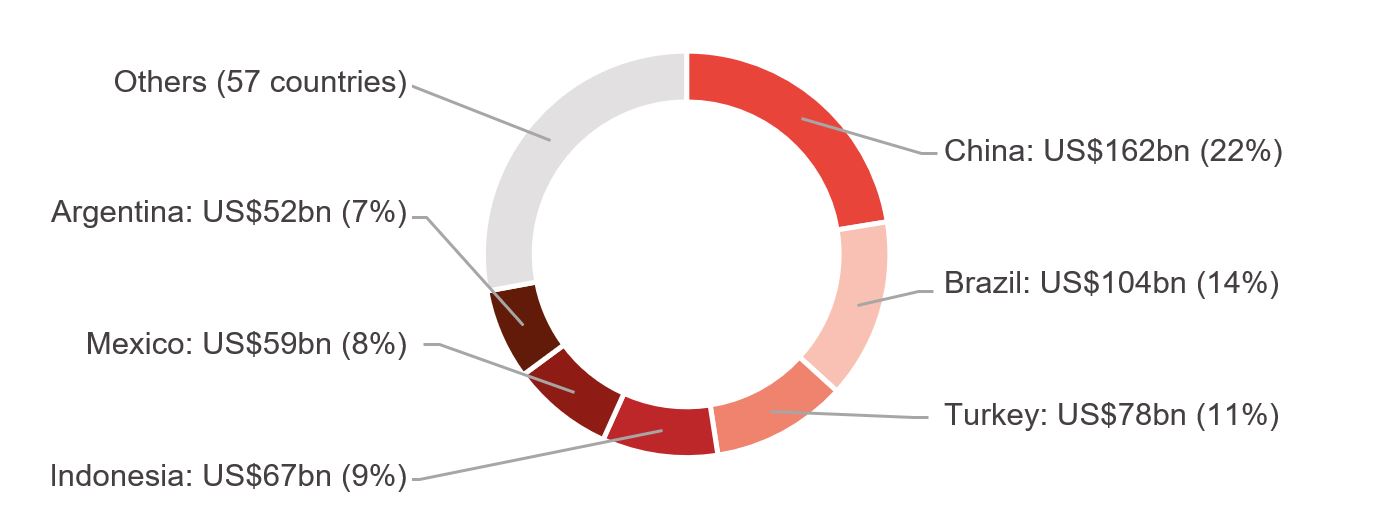

Commercial flows tend to be concentrated in a smaller number of countries compared to other types of finance, including ODA

Figure 3. Countries receiving commercial long-term debt, 2016

Countries receiving ODA, 2016

Source: Development Initiatives based on OECD DAC, UNCTAD and World Bank data

Note: See excel file for more detailAdditionally, commercial sources of finance, like FDI and commercial loans, tend to be concentrated in a few countries when compared with official flows, like ODA. For example, in 2016 China accounted for almost a quarter of all commercial long-term debt to developing countries, and five countries accounted for another half. On the other hand, ODA was more evenly spread across a larger number of developing countries with three-quarters of it going to 39 countries, although Sub-Saharan Africa accounted for 22 of the top 50 ODA recipients in this year.

-

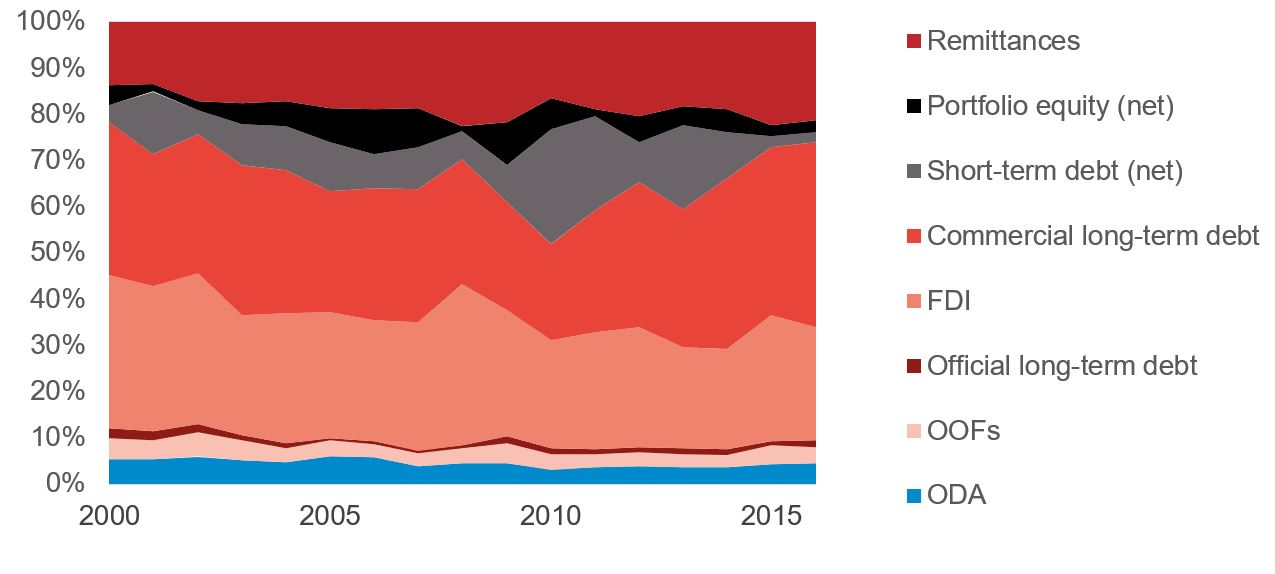

As a proportion of other flows, ODA remains particularly significant in African countries

Figure 4. ODA as a percentage of all international inflows to each developing country, 2016

Source: Development Initiatives based on OECD DAC, UNCTAD and World Bank data

Note: Country borders do not necessarily reflect Development Initiatives’ position. powered by Bing / copyright GeoNames, MSFT, Microsoft, NavInfo, Navteq, Thinkware Extract, WikipediaWhile ODA is a relatively evenly-spread resource, it continues to play a particularly important role in some countries, notably in Africa. Overall, ODA was the largest inflow to 49 countries in 2016, 30 of which were in Sub-Saharan Africa. In this region, ODA was relatively more significant than other flows in a high proportion of countries, compared with South America and Asia. There is a slight variation between the different areas of Africa, with many countries in the west and centre of the continent receiving a higher proportion of ODA.

-

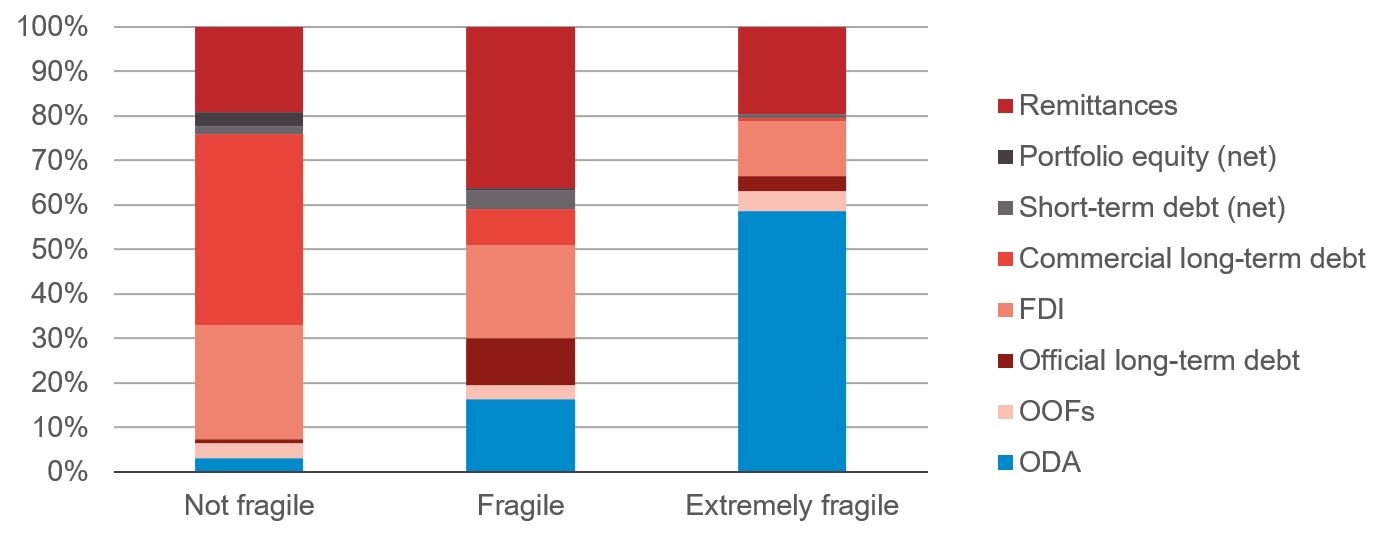

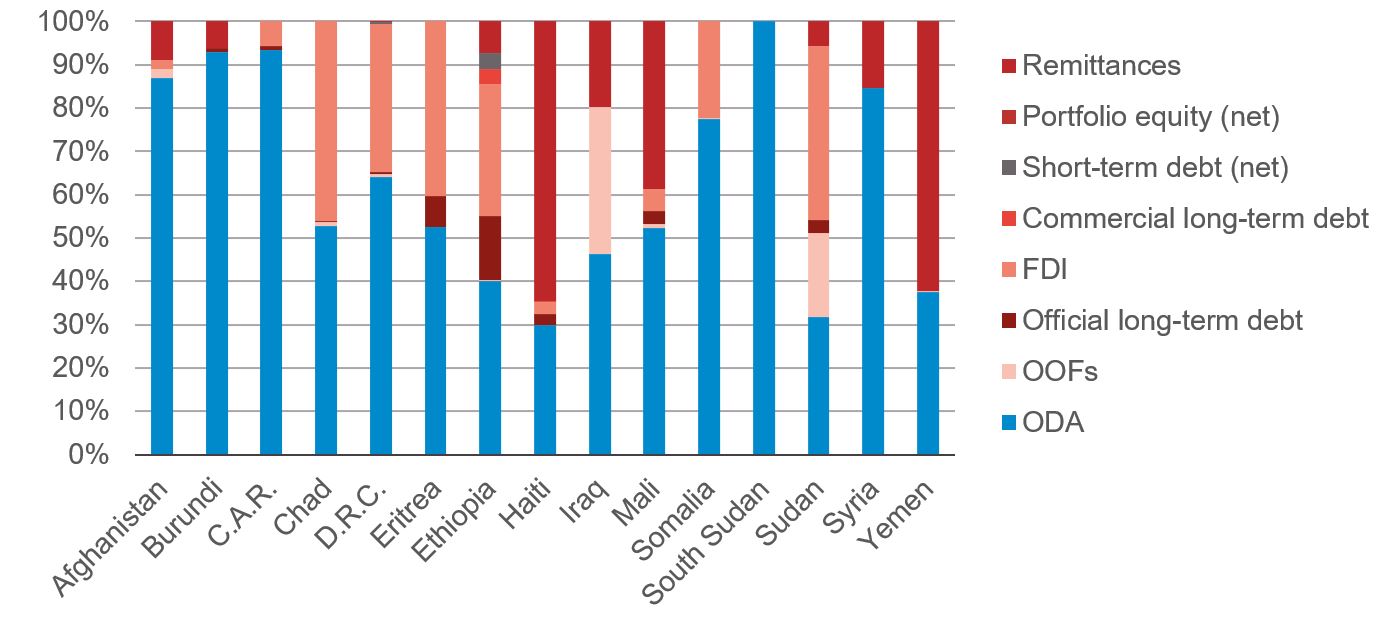

LDCs and countries in fragile situations rely on ODA much more than other developing countries

Figure 5. The mix of international resources in different country contexts

LCDs

Other developing countries (non-LDC)

The mix of resources in extremely fragile countries, 2016

The mix of resources in countries facing different levels of fragility, 2016

Source: Development Initiatives based on OECD DAC, UNCTAD and World Bank data

Notes: CAR: Central African Republic; DRC: Democratic Republic of CongoWhen considering country groupings, the resource mix is also particularly different to the aggregate picture in LDCs and countries in fragile situations. In these contexts, commercial flows are strikingly less significant and official flows play a more important role, especially ODA. For example, in 2016 ODA was the largest inflow to the LDC grouping and at US$46.2 billion accounted for 31% of total international inflows – compared to 4% in non-LDCs, where commercial resources dominated the mix. Countries in fragile situations, especially countries classified as ‘extremely fragile’, also rely on ODA (particularly, humanitarian aid ) more than other developing countries; while commercial sources of finance, despite dominating the overall landscape, have historically been relatively low.

-

Note on methodology

Official flows include ODA, OOFs, official long-term debt. Commercial flows include FDI, commercial long-term debt, short-term debt (net), portfolio equity (net). Private flows include remittances. Research for our forthcoming Investments to End Poverty Report will build on this.