Do we need a common definition of climate finance? It depends who you ask

The diversity of climate finance definitions makes it difficult to know how much donors have truly spent, undermining accountability. As parties to the UN Framework Convention on Climate Change adopt a New Collective Quantified Goal on Climate Finance in 2024, they must agree on what should count towards it.

In 2009, at COP15 in Copenhagen, parties agreed that “developed” countries would provide “developing” countries (in the language of the UN Framework Convention on Climate Change, or UNFCCC) with US$100 billion in climate finance per year by 2020, an arbitrary figure that arose from negotiations, not estimates of need. Since then, there has been a heated, and highly political debate on how to measure it. Some countries claim that the target was met in 2022 (two years late) despite not agreeing on what counts towards it. It may seem intuitive that a common definition would be useful, but even this is contested. As part of this debate, the UNFCCC Standing Committee on Finance surveyed parties to the UNFCCC on the value of adopting a common definition to ensure consistent measurement.

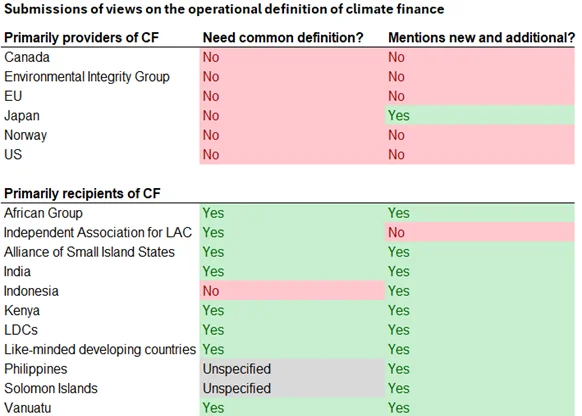

Views on these issues revealed stark divisions between developed and developing countries. Among developing country parties to the UNFCCC, there was near consensus that there should be a common definition, with Indonesia the only one to disagree (see Table 1). Many also highlighted the importance of climate finance being “new and additional”. A common theme in their responses was that inconsistent reporting was making progress towards climate finance targets difficult to track. This was also acknowledged in the first Global Stocktake, a comprehensive assessment of global climate action under the Paris Agreement which happens every five years. It noted that the lack of an agreed definition of climate finance means “it has not been possible to consistently track and report progress on climate finance.”

Submissions from civil society organisations also argued that climate finance should have some common features. For example, the Pan African Climate Justice Alliance stressed that it should be based on the “felt needs” of developing countries. And the International Institute for Environment and Development argued that it should be based on a functional definition and include certain characteristics, such as being innovative or doing no harm.

By contrast, every developed country's submission argued that no common definition was needed. According to the EU, for example, this would “impose a narrow view on climate finance that would not be adequate to cover the wide and dynamic range of climate-relevant finance”, implying that this would disincentivise actions that fall outside the definition but still contribute to climate goals.

Table 1: Schism between developed and developing countries on the need for a definition

Source: UN Framework Convention on Climate Change Standing Committee on Finance.

Notes: CF = climate finance; LAC = Latina America and the Caribbean; LDCs = least developed countries. The Environmental Integrity Group includes Switzerland, South Korea, Mexico, Liechtenstein, Monaco and Georgia.

The lack of a common definition could be seen to favour providers, because it makes it easier for them to appear to meet financial targets by including investments that are at best marginally related to climate goals. Goodhart’s law , named after British economist Charles Goodhart, states that “when a measure becomes a target, it ceases to become a good measure”. In other words, once policy-makers have set a target, they will have an incentive to cut corners to meet it at the expense of the intended outcome.

A popular example is soviet nail production . Lenin’s government reportedly gave bonuses to factories according to the number of nails produced. This led factories to reduce the size of nails to make production easier, which also made them less useful. A more recent example is the UK legislating to provide 0.7% of gross national income as official development assistance (ODA), which led to projects being “reclassified” as ODA to help meet the target, without actually increasing support. Some argue that recent changes to the Organisation for Economic Co-operation and Development (OECD) Development Assistance Committee’s rules for measuring ODA are another example.

The more flexible the definition, the more options developed countries have for taking shortcuts, which is clearly not always in the best interests of developing countries. While a definition that is too restrictive may disincentivize investments in some useful projects, the status quo is a free-for-all in which much of what is counted is manifestly not useful. This situation has led to an erosion of trust between developed and developing countries (often mentioned in submissions) which may well be a barrier to vital climate action.

“This lack of an agreed definition of climate finance compromises the accuracy and transparency of tracking progress of finance provision, mobilization and utilization, risking to undermine the trust between parties”

Senegal submission on behalf of LDCs, 2022

There’s another lesson that is equally relevant to discussions about the New Collective Quantified Goal on Climate Finance (NCQG): one measure isn’t enough. Lenin might have had more luck if he had specified sub-targets for different types of nails; separate bonuses for two-inch or three-inch nails perhaps. Using just one metric for a multi-faceted problem is never likely to incentivize optimal behaviour.

Climate change is clearly one such problem. Climate action has consistently been biased towards mitigation (reducing emissions) as opposed to adaptation (preparing and adapting to the impacts of climate change) as mitigation projects have comparatively low risk and high returns, and technology is more readily available .

If a provider can deliver climate finance in a way that benefits them, or relies on private investors providing capital on commercial terms, they will have an incentive to do so, even if it doesn’t align with developing country interests or even contribute to debt distress. Why give grants when you meet your targets with commercial loans that will earn you money, or benefit the private sector? At the very least, any new target should include sub-targets for adaptation and grant financing as suggested by some parties in discussions on the NCQG , especially in countries in debt distress.

This could address a sticking point with developing countries, with some dialing back ambitions in response to inadequate grant financing . Specifying sub-goals for adaptation and grant financing – as suggested by some parties in discussions on the NCQG – may not eliminate the problem but it could help. In addition, to avoid disincentivizing activities that fall outside a common definition, a core definition could be used to track progress towards new goals such as the NCQG while recognising other supporting actions, following similar models to the World Trade Organization. [1]

Trust will not be regained without genuine agreement on what should count

There may well be downsides to an overly strict definition. But given the need to repair trust between developed and developing countries, inflated claims about what is actually being provided and the questionable relevance of many projects that are counted, it is hard to imagine that a clearer definition than those used today would lead to climate finance being less effective. Developed countries should heed the call for a more rigorous climate finance definition, even if this means also adopting a ‘UNFCCC+’ category that allows parties to report on activities that are potentially relevant, but outside the core definition. But without more credible rules, the NCQG will be no more credible than the US$100 billion target.

Notes

- 1 For instance, at the WTO, ‘WTO plus’ (WTO+) and ‘WTO extra’ (WTO-X) refer to obligations to include a wide range of provisions that go beyond existing requirements of the WTO. See here for more details see the Global Value Chain Development Report 2017, Chapter 8: Preferential trade agreements and global value chains: Theory, evidence, and open questions. Available at: https://www.wto.org/english/res_e/publications_e/gvcd_report_17_e.htm

Related content

The conundrum of climate financing: Where is the money?

How can we ensure impactful climate action, mobilising greater funding for low-income and climate vulnerable economies, without compromising pathways for prosperity?

Missing baselines: have recent increases in climate finance been exaggerated?

To what extent might increases in climate finance since 2009 be due to changes in reporting practices? We used a natural language processing model and backcast the results to find out.

Climate finance: Accounting and accountability

Inadequate reporting and tracking of climate finance data leads to reduced donor accountability. Ahead of COP27, this briefing examines five major issues.