Wealthy countries may be contributing less to global climate finance than we think

DI’s Euan Ritchie examines Japan's climate finance reporting, and why it shows that transparency is vital to understanding how much is really being spent

At COP15 in Copenhagen in 2009, wealthy countries committed to providing new and additional climate finance worth US$100 billion per year by 2020. But they didn’t agree on any consistent mechanism to track progress towards this target. Right from the outset, there have been concerns about transparency , inflated claims , and whether the finance provided is additional , or eating into other worthwhile causes . The one thing that everyone seems to agree on is that the target has been missed.

There is no reason for the lack of transparency, especially with respect to climate finance funded from official development assistance (ODA). Donors publish detailed, project-level data on ODA projects in the Organisation for Economic Co-operation and Development's (OECD) Creditor Reporting System (CRS), at just over one year’s lag (currently available up to 2020). This contains rich information on sector, modality, recipient, channel of delivery, and it is usually possible to find project documentation.

By contrast, and despite being based on the same underlying projects, the official source of climate finance data – submissions to the United Nations Framework Convention on Climate Change (UNFCCC) – is biennial. At the time of writing, the latest available data pertained to 2018. Reporting is often highly aggregated, project codes are not reported, and reported modalities are often vague. While the CRS data provides the terms on ODA loans, the UNFCCC data doesn’t, making it impossible to assess how concessional climate finance loans are. Even if this data already exists in the CRS, reporting to the UNFCCC is important: wealthy countries should be accountable to the UNFCCC for the finance they provide and having a separate dataset should allow reporting in more detail.

Generally, trying to join up the CRS and UNFCCC data to better analyse climate finance is a thankless task, but data published by Japan is an exception. In its latest submission to the UNFCCC, Japan reported data of sufficient quality that we were able to match most of the projects to the CRS. The exercise highlights how important it is that we have more detail on how climate finance is being provided.

Smoke, mirrors and Japan’s climate finance

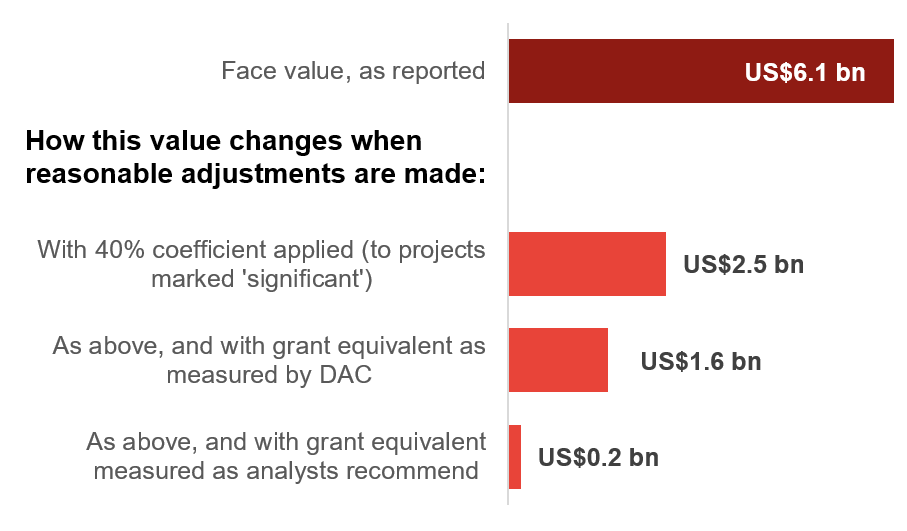

Officially, Japan appears to be one of the largest suppliers of bilateral climate finance, providing US$9.6 billion in 2017, 36% more than Germany, the next-largest bilateral reporter (possibly excluding the US who didn’t report their climate finance data to UNFCCC in the latest round of submissions). In this blog we focus on Japan’s ODA loans, partly because these are the easiest to identify, but also, they account for 64% of Japan’s climate finance (US$6.1 billion – the remainder is mainly non-concessional loans). However, their value shrinks rapidly when certain accounting decisions are taken into account.

What gets counted

Firstly, Japan counted projects that only partially focus on climate change at their full value. Most donors use the Rio markers to label projects as being ‘climate finance ’. Developed by the OECD Development Assistance Committee (DAC), these markers are a way of tracking projects that address climate mitigation or adaptation (or biodiversity, although such projects are not reported to UNFCCC). Markers indicate a ‘significant’ or ‘principal’ focus on either adaptation or mitigation (or both). To score as having a ‘principal’ climate objective, adaptation or mitigation must have been the primary motivation for the project. A ‘significant’ focus means that responding to climate change is not the main motive, but that the project has been altered in some way to address the climate objective.

For projects marked as having a significant climate objective, most donors count only a share of the value of the project: for example, the EU institutions count 40%; this figure is most common among climate finance providers. By contrast, Japan counted the full value of its ODA loans. Given that nearly all of Japan’s climate finance projects had a significant (rather than principal) climate objective, measuring its climate finance in the same way as EU institutions would decrease Japan’s 2017 climate finance from US$6.1 billion to US$2.5 billion.

Face value versus grant equivalent

Secondly, these are all loans. Concessional loans are undoubtedly a useful tool, and the US$100 billion target did not specify that the amount should be provided in grants. Nevertheless, it is useful to consider the ‘grant equivalent’ of these loans (an estimate of the amount which is given away on each loan, relative to if the loan was given at market terms) to assess the actual fiscal effort in providing this finance. Generally, Japanese loans are more concessional than those of most other donors, and for the loans counted as climate finance in 2017, the average grant element was 62%. This means that the grant equivalent of Japan’s climate finance loans in 2017 was US$3.8 billion, (which would be US$1.6 billion, if measured in the same way as the EU institutions).

This is according to the DAC’s methodology for calculating the grant equivalent of loans. Since the methodology was agreed, it has come under strident criticism for greatly overstating the grant equivalent of loans by using excessively high discount rates. These rates are supposed to approximate the cost to donors of lending, taking into account the risk of losing money, but they have been criticised for greatly exaggerating this risk. Using discount rates preferred by most analysts (the ‘ Differentiated Discount Rates’ used by the OECD to measure the concessionality of export credits ) the grant equivalent is considerably lower: US$0.5 billion, ( or US$0.2 billion if measured in the same way as the EU institutions).

Figure 1: Value of Japan’s climate finance loans, different measurement choices

| $m | |

|---|---|

| Face value, as reported | 6069 |

|

How this value changes when

reasonable adjustments are made: |

|

|

With 40% coefficient applied (to projects

marked 'significant') |

2481 |

|

As above, and with grant equivalent as

measured by DAC |

1569 |

|

As above, and with grant equivalent

measured as analysts recommend |

200 |

Source: UNFCCC, CRS and OECD DDRs

So by making reasonable adjustments to how Japan’s climate finance concessional loans are recorded, their value falls from US$6.1 billion to US$0.2 billion . This would reduce Japan’s total climate finance (including non-ODA) by almost two-thirds, from US$9.6 billion to US$3.7 billion.

Disbursements versus commitments

What’s more, the above figures pertain to commitments. Focusing on 2017 allows us to assess how much has been disbursed against these loan commitments up to 2020, the latest year for which DAC data is available. Of the US$6.1 billion committed, four years on only US$1 billion (roughly 16%) has actually been disbursed. The US$100 billion target pertained to commitments, not disbursements. But it is the latter that matters to developing countries.

How climate relevant are these projects?

Finally, many project details cast doubt on either the relevance of projects for climate change, or their additionality. Japan’s single-largest climate finance project in 2017 is a loan of nearly US$1 billion to India, to help it develop its rail transport network. This is great for India’s development, but the project documents do not mention climate goals, and the quantitative and qualitative objectives make no reference to reducing greenhouse gas emissions, or how such progress could be tracked. Japan has long invested in rail transport and there is no indication that the project has changed at all to reflect its climate objective, casting doubt on its additionality. Despite this, the programme has a ‘significant’ mitigation objective (in fact, some projects appear to have been re-labelled part way through )

Other projects highlight difficult trade-offs: many road transport projects have been marked as adaptation. This infrastructure may well help countries to adapt to the impact of climate change, perhaps by making it easy to provide help in emergencies or for people to escape disasters , but it will surely also increase CO2 emissions. In addition, around US$100 million is committed for coal plants, innocuously described as ‘energy’ projects in Japan’s data submission to UNFCCC.

Future climate finance targets must be underpinned by transparency and accountability

A closer inspection of Japan’s climate finance reporting reveals that the headline figure is at best controversial, and at worst highly misleading. Some climate finance projects don’t have any climate objectives, only a fraction of commitments has actually been disbursed, and the full value of projects is recorded regardless of the importance of climate change as a motive. But the point of this blog is not to single out Japan’s questionable reporting practice. On the contrary, Japan’s unusually transparent reporting demonstrates that when donors provide data of sufficient quality, much richer analysis is possible, making it easier to evaluate claims of progress towards the US$100 billion target.

The current accounting system gives donors leeway to claim credit for generosity in international fora while expending as little fiscal effort as possible. At COP27 it is likely that new, ambitious financial targets will be set, but this time around more attention should be paid to how progress will be measured. A new measurement system should be agreed that is consistent for all donors, tackles the additionality question, and makes it possible to link climate finance data to other, project-level datasets. In the next few months, Development Initiatives will explore how this could be achieved. Without this, any promises made at COP27 will be no more useful than those made in 2009.

Related content

Climate finance: Accounting and accountability

Inadequate reporting and tracking of climate finance data leads to reduced donor accountability. Ahead of COP27, this briefing examines five major issues.

Climate finance to Africa: What we know about ODA

This blog explores how better climate finance to countries experiencing protracted crisis can contribute towards our global future.

To leave no one behind, we must use data to address climate inequalities

As climate change compounds and exacerbates global inequalities, DI’s Deborah Hardoon explains how data can be used to protect those most vulnerable to its impacts.