Climate adaptation finance to Africa: Key facts

This factsheet summarises climate-related funding flows to African countries, highlighting the major donors and recipients and the mix of financing across countries.

DownloadsThis factsheet summarises bilateral and multilateral climate-related ODA flows to African countries, highlighting both the major donors and recipients and the mix of financing across countries.

You can read more of DI's work relating to climate change here .

Introduction

Under the 2015 Paris Agreement, parties to the UN Framework Convention on Climate Change (UNFCCC) committed to providing US$100 billion annually to the countries least responsible for, and most impacted by, climate change. This finance was meant to avert climate change impacts through emissions reductions (commonly referred to as mitigation finance) and to minimise harm (commonly referred to as adaptation). [1] Additionally, the UNFCCC requires that countries create national adaptation plans (NAP) which would outline medium- and long-term adaptation needs and develop strategies required to address them. Official development assistance (ODA) tagged as adaptation finance should be reflecting these NAP priorities. [2]

Adaptation finance specifically seeks to reduce the risks to communities and people posed by climate change and is urgently needed in the face of accelerating climate impacts. Adaptation finance is dynamic, as well as context- and scale-specific: good practice is informed by factors that change over time such as weather or population size, as well as the actors involved and the level – community, national, regional or international government – at which they are making policy. Ultimately, adaptation finance is meant to address the specific risks caused by climate, and so must be new and additional to existing development commitments. [3] [4]

Finance to climate-vulnerable countries is insufficient

The UNFCCC US$100 billion goal has not been met; to date countries have failed to fulfil their climate finance commitments. Tracking climate finance is challenging . The most recent measurement suggests that US$83.3 billion of the goal has been met, though some estimates calculate the value at around a third of what was reported. [5] Public climate finance can largely be captured by looking at climate-related ODA and multilateral climate change finance. Data for climate-related adaptation finance shows that climate-vulnerable countries have not received sufficient support for adaptation to climate change.

The African continent is highly susceptible to the accelerating impacts of climate change. 16 of the 20 most climate-vulnerable countries are African . [6] Identifying the objectives, form and amounts of climate adaptation finance reaching African countries is critical to ensuring that such finance is effectively targeted and provided in sufficient volumes, and that governments are held to account for their commitments within the UNFCCC.

Adaptation finance is a critical component of resilience-building to climate change impacts, yet climate-vulnerable countries are not receiving it in significant or sufficient amounts. Without it, and with no current finance mechanism to adequately address climate change impacts, Africa and African countries will not only experience economic and non-economic disadvantages, but also be at increased risk of fragility and crisis overall.

Key facts

- Climate-related ODA to Africa is not well distributed. While Africa received close to 25% of all climate-related ODA from 2018–2020, just three countries account for 27.3% of all African climate-related ODA.

- The responsibility to provide climate finance is not equally shared among donor countries. Three quarters of all climate-related ODA to Africa is provided by just five donors. The amounts of mitigation and adaptation finance vary by country.

- To date, multilateral adaptation financing is not reaching those most in need. Overall, fragile and conflicted affected states (FCAS) [7] receive a small proportion of multilateral adaptation finance.

- Most multilateral climate finance to Africa is in the form of grants , but there is currently no funding to address the losses and damages from climate change.

Climate-related ODA to Africa is not well distributed

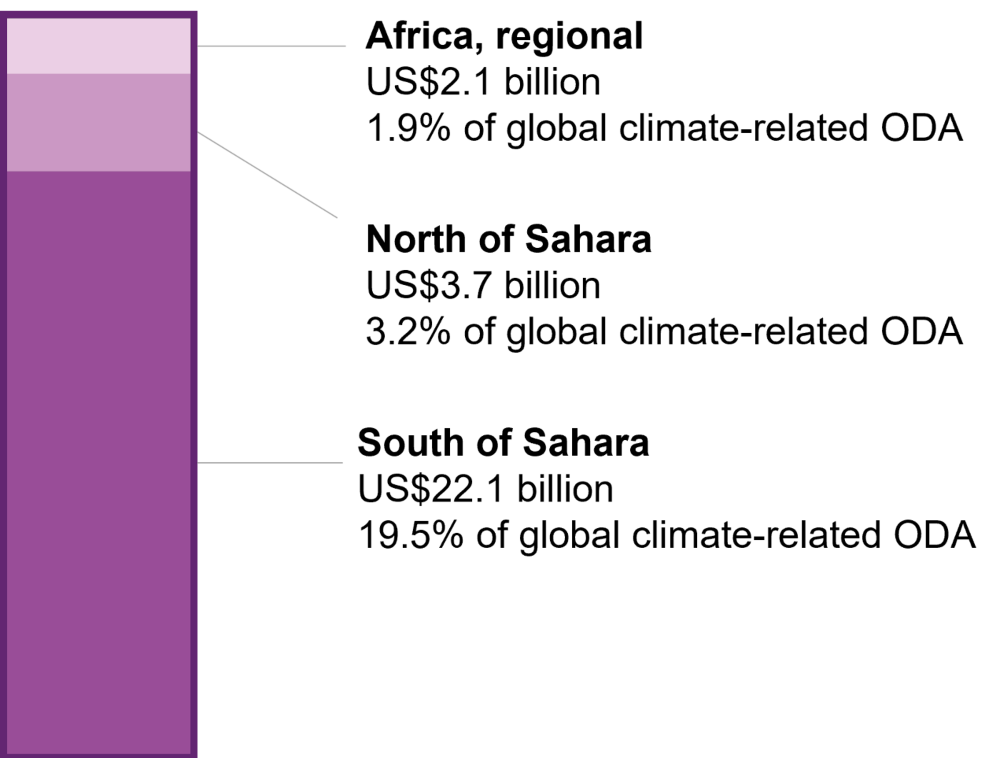

Figure 1a: Countries south of the Sahara receive most of the climate-related ODA to Africa

Areas of Africa that receive climate-related ODA

lorem ipsum

Source: Development Initiatives based on OECD DAC CRS.

Notes: Amounts are presented as US$ billions based on gross commitments marked either significant or principal using the OECD DAC’s Rio Markers for climate change adaptation or climate change mitigation, 2018-2020.

Climate -related ODA is a key source of international public climate finance for eligible countries, tracked using the Rio Markers. [8] Overall, between 2018 and 2020, bilateral climate-related ODA for mitigation, adaptation and dual purposes grew. However, it still falls short of the US$100 billion annual commitment and volumes vary greatly between individual countries.

- For the years 2018–2020, a cumulative total of US$113.1 billion of climate-related ODA was reported to the OECD DAC. Just under a quarter (24.6%) of this was aimed at countries in Africa, equal to US$27.8 billion, primarily toward countries south of the Sahara. This compares to 42.6% toward Asia, 9.7% to the Americas, 5.8% to Europe, 1.4% to Oceania, plus 15.9% toward projects with a global, or unspecified geographic focus.

- Total reported climate-related ODA has grown by 34% (US$11.3 billion) from US$32.9 billion in 2018 to US$44.3 billion in 2020.

- In the same period, climate-related ODA to Africa specifically has grown by 37% (US$2.9 billion) from US$7.8 billion to US$10.7 billion. US$22.4 billion of the climate-related ODA committed to Africa between 2018 and 2020 was country-allocable – committed to projects in specified countries. The remaining US$5.5 billion was committed to projects at a regional level.

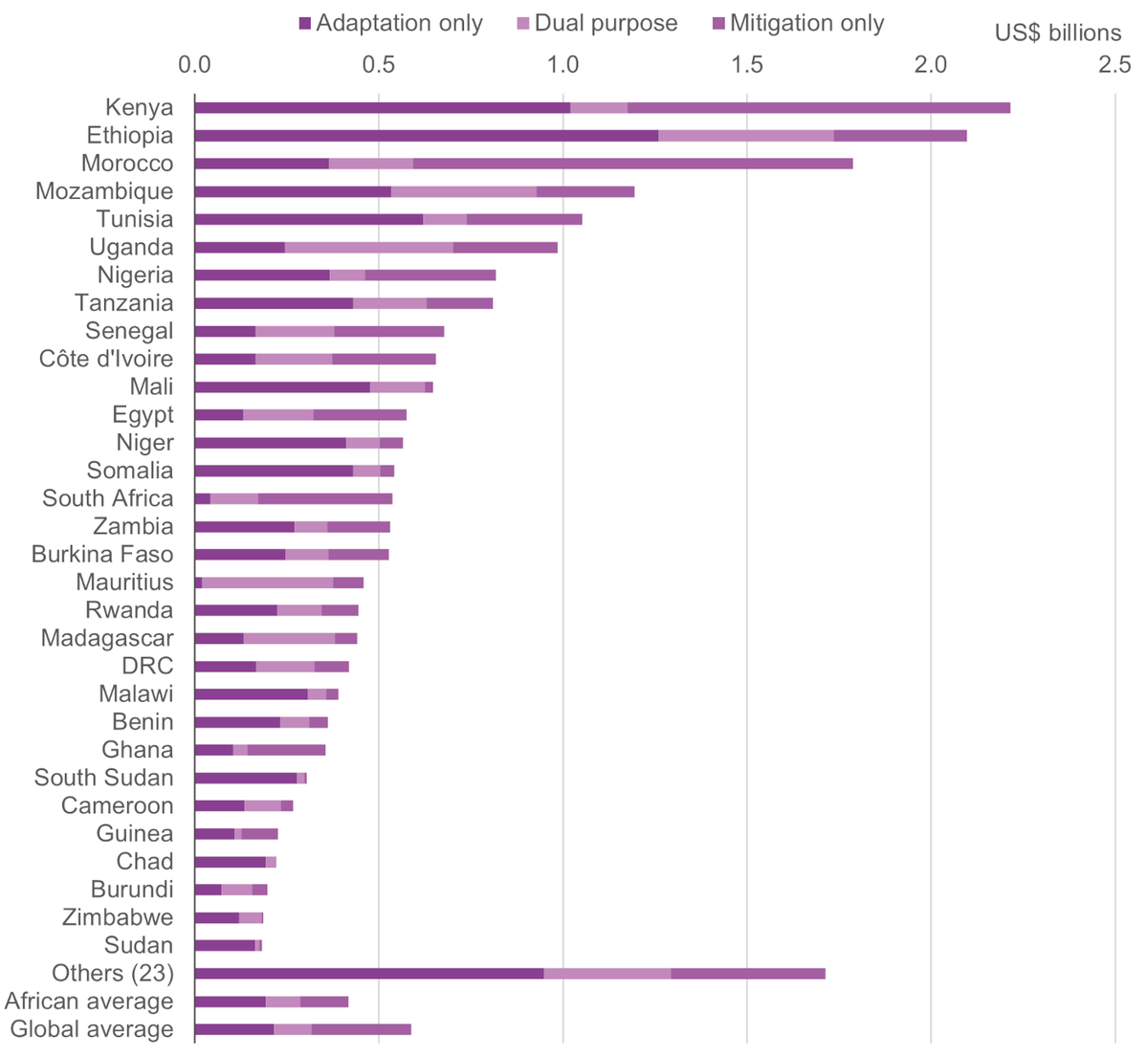

- Of all African countries, Kenya, Ethiopia and Morocco were allocated the greatest amounts, equal to 9.9%, 9.4% and 8.0% percent of the country-allocable total respectively, together accounting for over a quarter of commitments (27.3%).

Figure 1b: Kenya, Ethiopia and Morocco together were allocated over a quarter of the total amount of country-allocable climate-related ODA in Africa between 2018 and 2020

Climate-related ODA volumes to countries in Africa, 2018–2020

lorem ipsum

Source: Development Initiatives based on OECD DAC CRS.

Notes: Amounts are presented as US$ billions based on gross commitments marked either significant or principal using the OECD DAC’s Rio Markers for climate change adaptation or climate change mitigation, 2018–2020.

Most climate finance is provided by few donors and the mix of financing varies

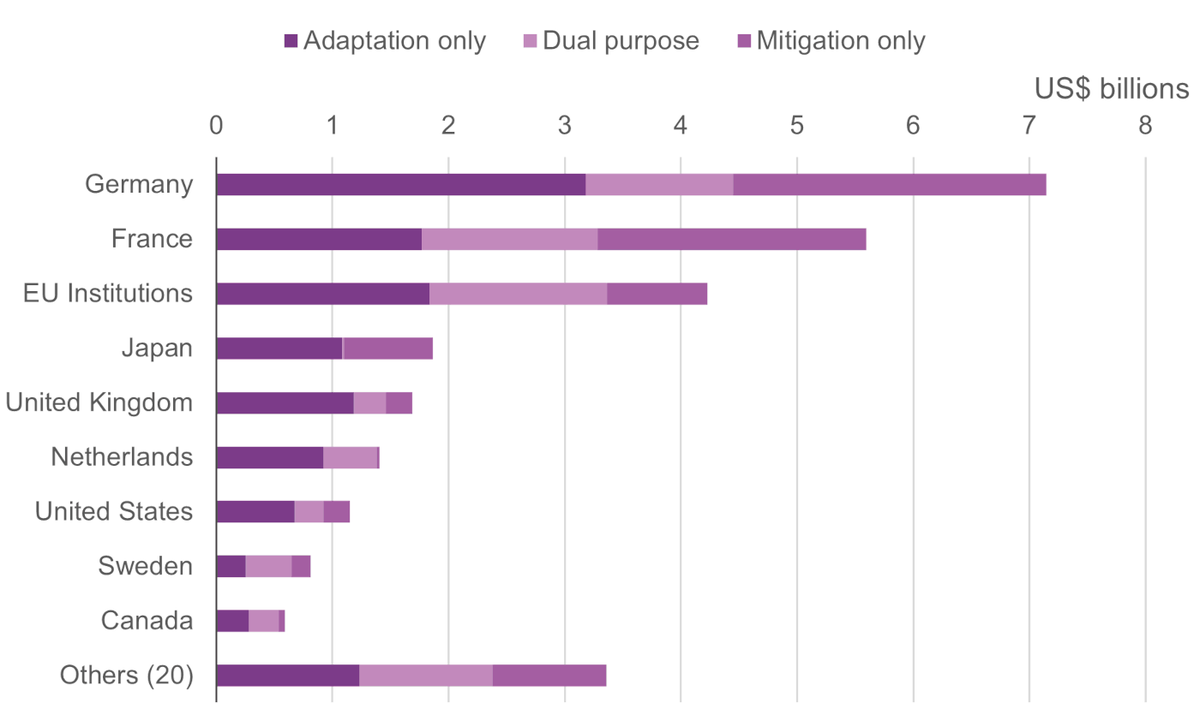

Figure 2: Just five DAC donors – Germany, France, the EU, Japan and the UK – together account for 73.7% of climate-related ODA commitments to Africa between 2018 and 2020

Largest donors of climate-related ODA to Africa, 2018–2020

lorem ipsum

Source: Development Initiatives based on OECD DAC CRS.

Notes: Amounts are presented as US$ billions based on gross commitments marked either significant or principal using the OECD DAC’s Rio Markers for climate change adaptation or climate change mitigation, 2018–2020.

Between 2018 and 2020, 29 DAC donor countries reported climate-related ODA commitments to Africa or African countries. Three quarters of Africa’s climate-related ODA is provided by just five of these donors.

- The three largest donors of climate-related ODA between 2018 and 2020 were Germany, France and EU institutions, together accounting for 61% of all funding.

- Of the total amount committed over the period (US$27.8 billion), German agencies accounted for 25.7% (US$7.1 billion), with major commitments to mitigation projects in North Africa (specifically Morocco and Tunisia) plus regional adaptation projects south of the Sahara.

- French agencies account for 20.1% (US$5.6 billion) with commitments to mitigation projects in Morocco, Nigeria, Senegal, Kenya and Tunisia, alongside major adaptation commitments to Nigeria and Kenya.

- The EU also accounts for 15.2% (US$4.2 billion), spending a greater proportion on adaptation interventions, with major commitments to projects in Mozambique, Tanzania, and Malawi, plus some mixed-purpose commitments also to Mozambique and the entire South of Sahara region.

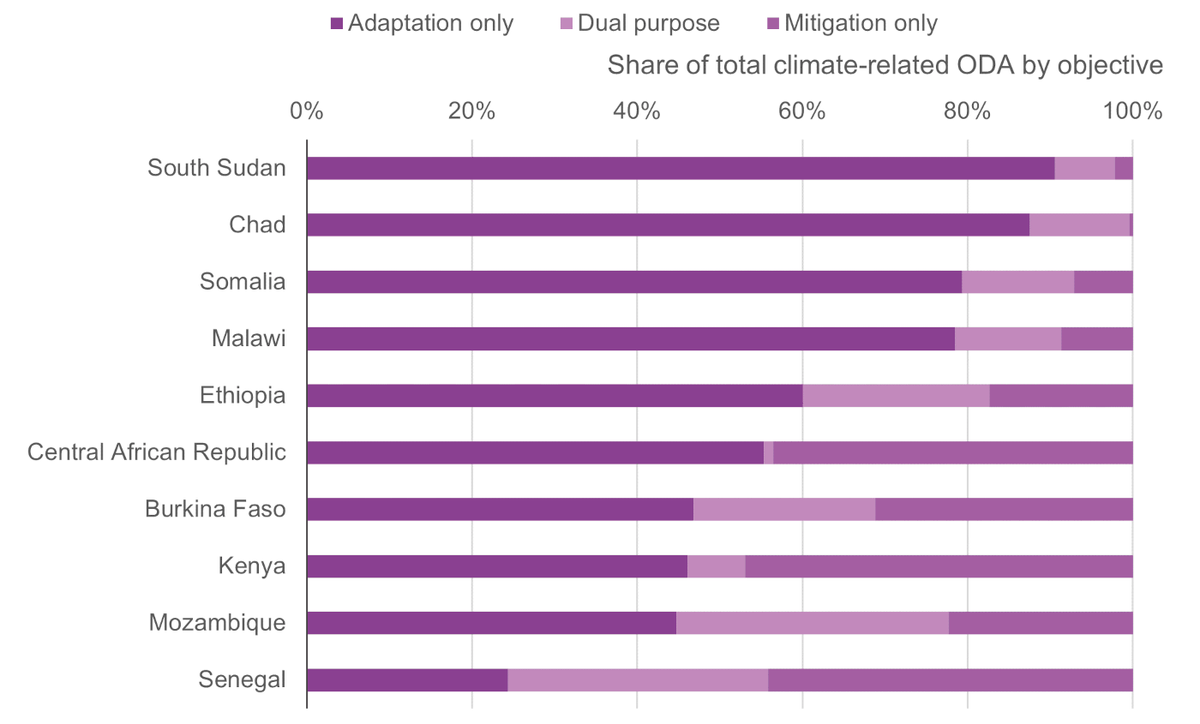

The mix of financing by objective (adaptation or mitigation) is different across countries and funded adaptation projects should reflect priorities in both the nationally determined contributions (NDCs) [9] and national adaptation plans of the country receiving finance. In South Sudan, adaptation accounts for over 90% of commitments, compared to Kenya, for which mitigation accounts for 47%.

Adaptation finance requires a stable implementing infrastructure to have impact over time. It is possible that this mix of financing is also indicative of more general vulnerabilities, such as those related to fragility and conflict. There is a need to understand the impact of these vulnerabilities on the mix of financing and whether financing is meeting objectives; if it is provided in sufficient volumes, and how it is being utilised at each level of government. It should also be noted that commitments made in 2020 may have been affected by the Covid-19 pandemic.

Figure 3: The mix of financing across countries suggests opportunities for, and challenges facing, financing

Proportion of climate-related ODA to African countries by purpose, 2018–2020

lorem ipsum

Source: Development Initiatives based on OECD DAC CRS.

Notes: Shares based on gross commitments marked either significant or principal using the OECD DAC’s Rio Markers for climate change adaptation or climate change mitigation, 2018-2020.

Box 1

IATI data

Of the top three large donors to climate in Africa across the period 2018–2020, the IATI data from Germany and the European Commission is of sufficient quality to consider the likely trends in climate-related ODA.

In Germany, the main development agency Bundesministerium für Wirtschaftliche Zusammenarbeit und Entwicklung (BMZ) report commitments to IATI. They reported year-on-year increases in climate-related commitments to Africa from US$1.2 billion in 2018 to US$1.7 billion in 2020. However, the near real-time data published to IATI shows a 43% reduction into 2021 in commitments with direct climate-relevance to Africa. This is compared to an 18% decrease globally. It is not yet clear whether the reduction shown in the IATI data is due to decreased financing to this area or a decrease in the quality of reporting and marker use, however, it certainly appears that BMZ’s climate financing to Africa has been hit the hardest.

The majority of the European Commission funding comes from the Directorate-General for International Partnerships (INTPA) and Directorate-General for Neighbourhood and Enlargement Negotiations (NEAR). In 2020, the European Commission reported year-on-year drops in climate-marked commitments to Africa from $1.7 billion in 2018 to $1.2 billion in 2020 to the OECD DAC, a decrease also clear within their IATI reporting from the two major directorates. However, in 2021, there was a considerably larger amount (over US$3.5 billion) committed. This is largely due to two new large projects from INTPA: on regional infrastructure and sustainable development. This increase is not seen from INTPA across geographies but instead seems specific to regional projects in Africa. Whether this is a different approach to marking or a change towards more climate-sensitive financing in the region remains to be seen.

The picture of commitments to climate-related projects into 2021 is mixed and it is not yet clear whether it is being prioritised. DI will continue to monitor sources of near real-time data to gain earlier insight to the patterns in financing for climate.

Disbursed multilateral adaptation finance is not reaching those in need

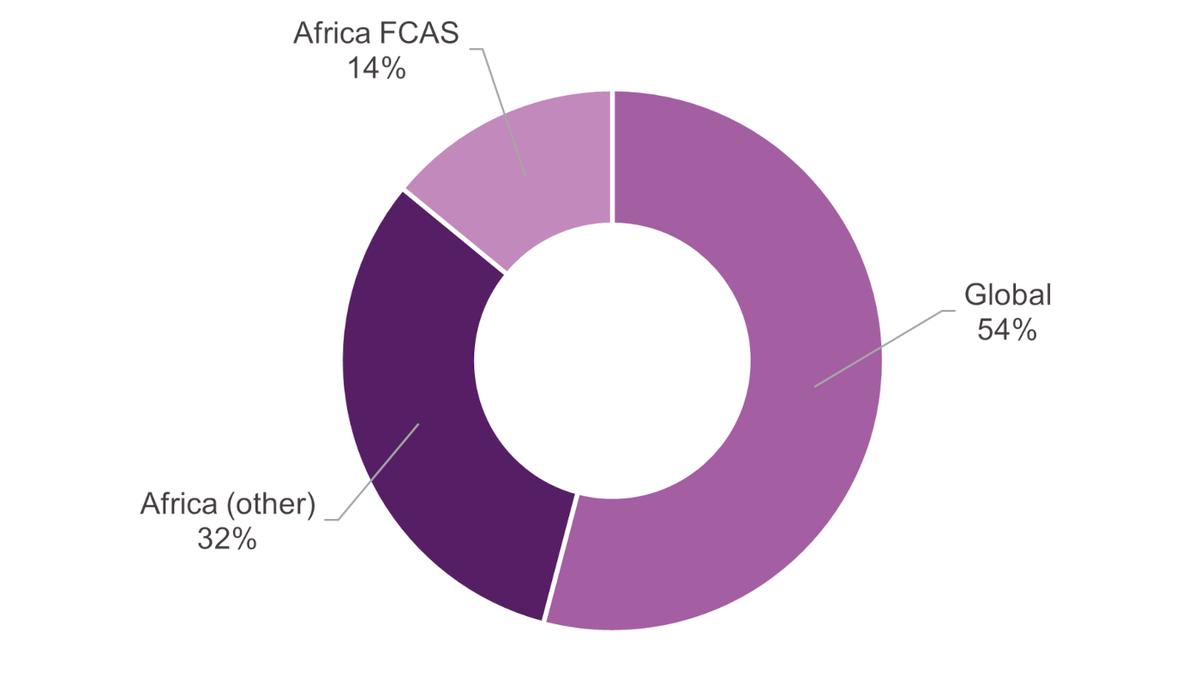

Figure 4: Globally, fragile and conflict-affected states in Africa have received only 14% of disbursed adaptation funding from multilateral climate funds

Proportion of finance from multilateral climate funds for adaptation to Africa (to date)

lorem ipsum

Source: Development Initiatives based on Climate Funds Update.

Notes: Data represents all disbursed funding to date, according to CFU database.

Another source of finance, in addition to bilateral finance, is multilateral climate funds, such as the Green Climate Fund (GCF). Looking at this data allows us to gain more insight into climate change finance flows to Africa. [10] [11]

Most of the world’s most climate-vulnerable countries are in Africa. In total, Africa has received 46% of adaptation finance disbursed from multilateral funds globally (to date). In the context of shortfalls in financing towards the UNFCCC US$100 billion target, Africa has not received sufficient resources.

- Globally, US$2.95 billion has been disbursed for adaptation activities from multilateral climate funds. [12] This represents 28% of total global disbursed funding ($10.66 billion).

- Africa has received 32% of total climate finance disbursed from multilateral climate funds – US$3.42 billion.

- US$2.46 billion in multilateral climate finance has been approved from the Green Climate Fund (GCF), but only US$475 million disbursed to Africa so far. This equates to only 19% of approved funding being disbursed.

FCAS in Africa are often more vulnerable to the impacts of climate change. [13] These countries are characterised by limited capacity to respond to and manage shocks, both climate-related and those stemming from wider and intersecting social, economic and political instability. Adaptation finance, especially for projects with cross-border approaches, [14] is therefore of particular importance in contexts of wider fragility, where capacity to manage risks of all kinds is low, and climate shocks can be drivers of wider protracted crisis, which in turn can heighten vulnerability to climate related disasters.

- FCAS in Africa have received only 14% of global multilateral climate finance and receive less adaptation finance on average than non-FCAS countries.

- FCAS in Africa have received only 8% of climate finance disbursed from multilateral climate funds (US$903 million). FCAS have a slightly higher proportion of finance for adaptation, at 46% or US$415 million.

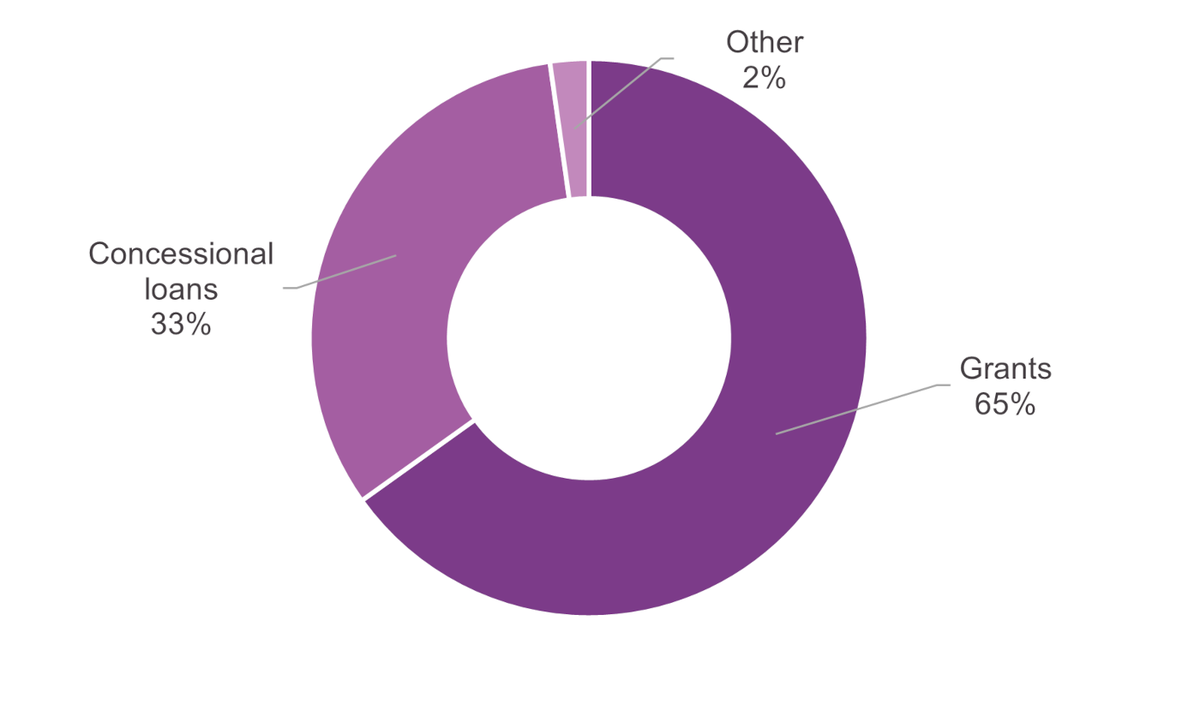

Most multilateral climate finance to Africa is in the form of grants

Figure 5: 65% of climate finance approved for Africa was in the form of grants (US$5.36 billion)

Proportion of approved funding from multilateral climate funds to Africa as grants vs loans (to date)

lorem ipsum

Source: Development Initiatives based on Climate Funds Update.

Notes: Data represents all approved funding to date, according to CFU database, as only approved funding is broken down by finance type (i.e. loan or grant).

The majority of climate finance to African countries from multilateral climate funds is in the form of grants. However, 33% is given as concessional loans. Allocation in the form of loans can be harmful to climate-vulnerable countries where levels of debt distress are high. Large debt repayments can limit the capital governments have available to fund recovery after climate disasters. This in turn can increase a country’s vulnerability to climate change. Climate change finance should be primarily provided as grants, and exclusively in cases where levels of debt distress are high or there is a risk of contributing to unsustainable debt burdens. This is critical in ensuring climate-vulnerable countries are not caught in cycles of crisis .

- 65% of climate finance approved for Africa was in the form of grants (US$5.36 billion) and 33% as concessional loans (US$2.68 billion). The remainder accounts for equity, guarantees, etc.

- 92% of approved adaptation finance is in the form of grants (US$2.60 billion), with only 7% concessional loans (and 1% representing guarantees and equity).

- For FCAS in Africa, 91% of all approved funding was in the form of grants and 9% concessional loans. 96% of approved funding for adaptation in FCAS was grants and 4% concessional loans.

What isn’t shown here is most important: there is no funding to address the impacts of climate change, and that funding, when it comes, is mostly in the form of loans or humanitarian assistance. The picture emerging is one of little investment (mitigation), insufficient preparation (adaptation) and the wrong kind of support for recovery and rebuilding. This is producing cycles of crisis, the effects of which are increasingly severe.

Read more about cycles of crisis and vulnerability in climate-vulnerable countries .

This page was updated on 16 November 2022.

Notes

-

1

The global goal on adaptation aims “to enhance adaptive capacity and resilience; to reduce vulnerability, with a view to contributing to sustainable development; and ensuring an adequate adaptation response I the context of the goal of holding average global warming well below 2 degrees C and pursuing efforts to hold it below 1.5 degrees C.” https://unfccc.int/topics/adaptation-and-resilience/the-big-picture/new-elements-and-dimensions-of-adaptation-under-the-paris-agreement-article-7Return to source text

-

2

UNFCCC, 2021. National Adaptation Plans. Available at: https://unfccc.int/topics/adaptation-and-resilience/workstreams/national-adaptation-plansReturn to source text

-

3

What is climate change adaptation? https://www.lse.ac.uk/granthaminstitute/explainers/what-is-climate-change-adaptation/Return to source text

-

4

The difficulty of defining adaptation finance. Available at: https://www.wri.org/insights/difficulty-defining-adaptation-financeLondon School of Economics, 2021.Return to source text

-

5

Oxfam, 2022. Climate finance short-changed: The real value of the $100 billion commitment in 2019–20. Available at: https://www.oxfamamerica.org/explore/research-publications/climate-finance-short-changed-the-real-value-of-the-100-billion-commitment-in-20192020/Return to source text

Related content

Filling the gap: Addressing climate-driven crises in Pakistan

This briefing demonstrates how critical funding gaps in addressing climate change impacts must be filled to ensure resilience for vulnerable communities and countries.

Climate finance: Accounting and accountability

Inadequate reporting and tracking of climate finance data leads to reduced donor accountability. Ahead of COP27, this briefing examines five major issues.

Climate finance to Africa: What we know about ODA

This blog explores how better climate finance to countries experiencing protracted crisis can contribute towards our global future.