Scenarios for a 1% GNI external public finance target

How can we meet the complex and intersecting aims of the Sustainable Development Goals? DI's Euan Ritchie investigates the feasibility of a combined development and climate-finance target funded by additional investment from high-income countries worth 1% of their GNI.

DownloadsAbout this discussion paper

What is the scale of additional investment needed by 2030 to meet both development and climate goals? This discussion paper suggests an answer to this question using estimates compiled for the financing needs of the Sustainable Development Goals (SDGs) – which ostensibly capture both goals. It argues that while meeting this depends in part on trends in private finance and domestic resource mobilisation, these needs could be roughly met if high-income countries provided an average of 1% of their gross national income (GNI) over the next seven years. However, targeting climate and development under the same input target poses risks as well as benefits.

Read this online summary, or download the full discussion paper .

► Read more from DI about ODA (aid)

► Share your thoughts with us on Twitter or LinkedIn

► Sign up to our newsletter

Summary

The Sustainable Development Goals (SDGs) are interconnected, and achieving some will depend on progress towards others. Climate change risks reversing progress towards a zero-poverty world, while countries’ ability to adapt to climate change is closely related to their level of economic development. Both climate and development are underfunded, and while there are concerns that increasing climate finance is coming at the expense of development finance, this is difficult to assess, in part because they are targeted separately. A combined development and climate finance target could address the challenges of additionality that have plagued finance tracking to date. But there are also risks that by combining these targets, providers have an incentive to focus excessively on mitigation at the expense of poverty reduction, given that they benefit more directly from the former. In this discussion paper, we discuss the risks and benefits of such a target and assess what size it should be to raise sufficient finance to meet the SDGs.

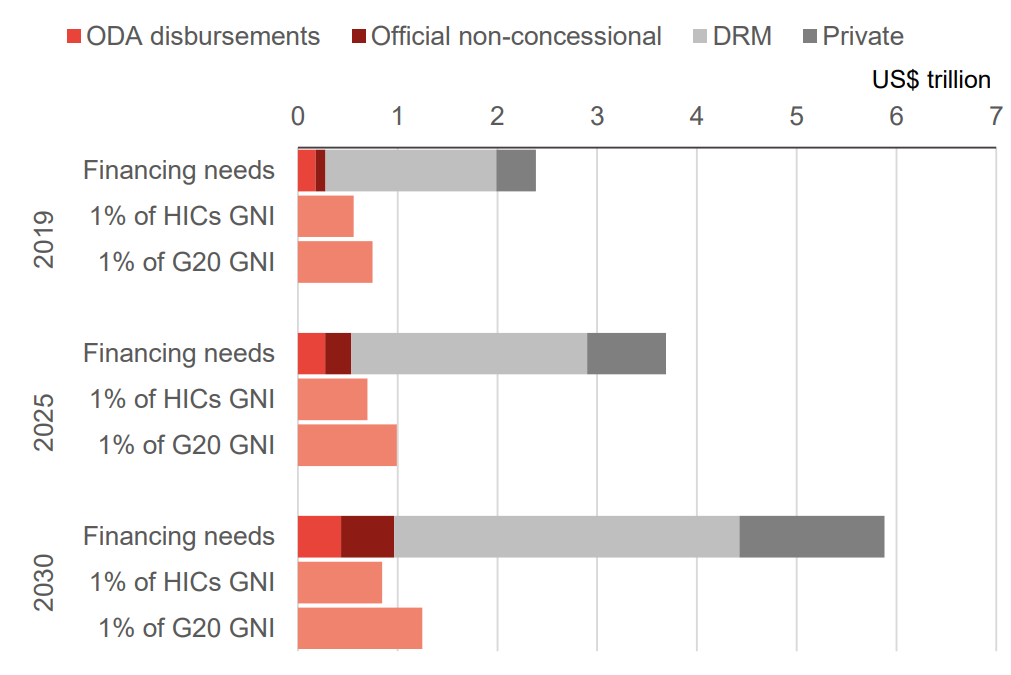

There is considerable uncertainty about how much additional investment is needed to meet the Paris/Glasgow targets and the SDGs, but it is almost certainly in the trillions of dollars. One prominent estimate [1] claims that by 2025, the additional annual investment needed to meet the SDGs (including action on climate change and relative to 2019) in developing countries, excluding China, will be US$1.3 trillion, rising to US$3.5 trillion by 2030. This gap will need to be filled by a mix of additional domestic resource mobilisation (DRM), private investment, and concessional and non-concessional international flows. These numbers are consistent with the climate finance needs reported, [2] which are primarily built on the analysis of Bhattacharya et al.

One plausible breakdown of these financing needs (again from Bhattacharya et al., 2022) suggests that in 2025, an additional US$257 billion from the total would need to come from official external finance, [3] rising to US$688 billion in 2030. Given that total external public finance in 2019 was around $300 billion (including flows from non-DAC countries), this implies total official external financing needs of US$557 billion in 2025 and US$988 billion in 2030.

According to International Monetary Fund (IMF) forecasts, [4] these figures will equate to roughly 0.80% of high-income country (HIC) GNI in 2025, and 1.17% of HIC GNI In 2030. Conversely, total external public finance in 2021 from members of the Development Assistance Committee (DAC) – which includes most HICs – was equal to 0.46% of GNI, although this also includes non-concessional flows.

Based on these estimates, total financing needs are expected to rise faster than GNI in HICs. However, a reasonable approximation is that HICs would need to consistently provide roughly 1% of GNI in external public finance over the next seven years to fill the SDG-financing gap. Given the considerable uncertainty around the estimates of need, the benefits of setting the target as a round, memorable number may outweigh any benefits of further precision, especially given track records of meeting previous targets. However, covering these needs in full would also require significant increases in private-sector investment relating to SDGs and DRM.

Applying the target to the G20 could increase the funds raised. A 1% GNI target for the G20 would raise a total of US$992 billion in 2025, rising to US$1,248 billion in 2030 and surpassing estimated external public-finance needs. However, this would require countries with income levels well below the DAC average, such as China, India and Indonesia, to meet the same target.

Figure 1: A 1% GNI target could approximately cover estimated external official finance needs (US$ trillion)

Bar chart showing that A 1% GNI target could approximately cover estimated finance needs in 2025 and 2030

Source: DI analysis of Bhattacharya et al (2022), Development Initiatives calculations based on International Monetary Fund’s World Economic Outlook (IMF WEO), OECD DAC

While it is beyond the scope of this paper to define what would count towards a 1% target, we note that this target does not need to be limited to traditional definitions of DAC concessional ODA. The scale of increases this implies for DAC countries depends on how the baseline is set. In 2021, total gross ODA from DAC countries was equal to US$199 billion in current prices. This is 0.36% of GNI and is US$356 billion short of the US$555 billion that would have been raised through a one-percent target. The gap narrows when non-concessional flows – export credits and other official flows (OOFs) – are included: total official flows from DAC countries in 2021 were US$255 billion, or 0.46% of GNI, indicating a gap of US$303 billion. This measure takes into account DAC countries’ contributions to multilaterals but the gap would narrow further if outflows were included instead (disbursements from multilaterals are higher than contributions in any year as some multilaterals can leverage their balance sheets). However, this could give rise to issues of how to attribute these flows to individual countries (discussed in the full paper).

Increasingly, public finance is being directed to raise additional private finance. In 2021, total private finance mobilised by DAC countries and multilaterals was estimated at US$41 billion. If this was included in the 1% target for DAC countries, development finance flows attributable to the DAC would be 0.53% of GNI and the 1% target shortfall would shrink to 0.47%. How much the inclusion of mobilised private finance could raise towards a 1% target in 2025 and 2030 is uncertain, but it has grown significantly over since 2012, at a compound average growth rate of 11%. If this continues, its inclusion would add an extra US$64 billion towards the target in 2025 and US$113 billion in 2030.

The actions of a few large countries would be key, including those such as the US, which has historically not adhered to internationally agreed targets. The US alone accounts for over half of the gap between 2021 DAC official flows and a notional 1% of DAC GNI.

The features of a target combining development and climate finance are significant in terms of the incentives created and its inherent strengths and risks. More finance is needed for both development and climate goals, and – given the degree of interdependence – creating artificial boundaries for these targets can be counterproductive. For example, having separate targets (0.7% of GNI for ODA and US$100bn for climate finance) obscures the extent to which spending is additional, as projects can be counted towards both . [5] Combining the targets could help ensure that there is less focus on labelling financing, and more focus on it being additional. Conversely, efforts would be needed to minimise incentives that may exacerbate the decreasing focus on poverty reduction. Donors are more likely to benefit from mitigation finance given that their economies may also be adversely affected by climate change. Accordingly, they might be incentivised to focus on mitigation at the expense of poverty reduction if both counted towards the same target. Although there are some synergies, focusing on mitigation implies less aid to the Least Developed Countries (LDCs), who emit very little in the way of greenhouse gases.

One option would be a tiered target – as suggested by Rogerson and Ritchie in 2020 [6] – that includes subsidiary targets for poverty reduction/economic development on one hand and global public goods (GPGs) on the other. This would preserve the benefit of combining the targets as individual projects could not be counted towards both tiers (although the value could potentially be split if counting the bulk of the cost under one tier and the incremental cost of aligning it with the Paris Agreement under the second). Nevertheless, it would ensure that visibility of spending on poverty reduction was not lost. The most appropriate split between the two tiers should be subject to further research.

This is similar in principle to the Organisation for Economic Co-operation and Development’s (OECD’s) Total Official Support for Sustainable Development (TOSSD) [7] initiative that aims to measure development flows under two ‘pillars’ (capturing ‘cross-border flows’ under pillar one, and ‘regional and global expenditures’ under pillar two) while reporting separately on mobilised private finance. However, after concern from some researchers in the Global South that it would distract attention away from ODA, [8] [9] for example), the OECD explicitly abandoned the ‘donor perspective’, [10] meaning it may not be appropriate as a basis for a donor target.

Get in touch

Join the conversation. If you would like to respond to this paper you can contact the author, Euan Ritchie .

Notes

-

1

Bhattacharya et al. (2022), ‘Financing a big investment push in emerging markets and developing countries for sustainable, resilient and inclusive recovery and growth’, LSE. Available at: https://www.lse.ac.uk/granthaminstitute/publication/financing-a-big-investment-push-in-emerging-markets-and-developing-economies/ Needs in this paper are assessed relative to 2019 and for total needs, we use this year as the baseline.Return to source text

-

2

Songwe et al. (2022) ‘Finance for climate action: scaling up investment for climate and development’, LSE. https://www.lse.ac.uk/granthaminstitute/publication/finance-for-climate-action-scaling-up-investment-for-climate-and-development/Return to source text

-

3

Public external finance refers to concessional and non-concessional finance (ODA, OOFs and export credits) from both official donors and multilateral organisations.Return to source text

-

4

IMF World Economic Outlook https://www.imf.org/en/Publications/WEO/weo-database/2022/OctoberReturn to source text

-

5

Beecher and Ritchie (2022), ‘Climate finance: Accounting and accountability’, Development Initiatives. Available at: /resources/climate-finance-accounting-and-accountability/Return to source text

Related content

Tracking aid and other international development finance in real time

This interactive data tool lets you track commitments and disbursements of aid and other global development finance between January 2018 and April 2023.

The DAC debates: why aid measurement matters for development

The way we measure aid affects the type and quantity provided as well as our perceptions of it. Why are the DAC's rules controversial?

Climate finance: Accounting and accountability

Inadequate reporting and tracking of climate finance data leads to reduced donor accountability. Ahead of COP27, this briefing examines five major issues.