What are the ongoing impacts of the pandemic on development finance?

We provide data and projections for Covid-19's continuing impacts on both domestic and international financing flows to countries with high levels of poverty

DownloadsIntroduction

The Covid-19 pandemic is contributing to financing challenges in all countries. Countries face enormous pressure to tackle the public health emergency, fund growing social protection programmes and invest in recovery plans while continuing to work out their day-to-day and long-term priorities. The situation is particularly worrying in developing countries and more so in the places with the most poverty, such as least developed countries (LDCs) and fragile states. Many of these have lower domestic resources, less capacity to mobilise more at sufficient rates, and rely to a larger degree on international sources of finance.

This briefing aims to assess disparate trends and projections of different types of financing (domestic and international) up to 2025, contrasting pre- and post-Covid 2020 data while focusing on particular country groups. Understanding how the development finance landscape will continue to evolve – particularly in the countries with the highest levels of poverty – is critical. There are significant differences in the capacity to respond to the impacts of the crisis between different groups of countries – such as LDCs, small island developing states (SIDS), fragile countries and countries facing protracted crisis. This is accelerating the ‘ Great Divergence ’ [1] and pushing the world further off track in meeting the Sustainable Development Goals (SDGs).

While so much is uncertain in such unprecedented times, we can use current economic projections and reforecasts in light of Covid-19 to estimate what the potential impact of the pandemic will be on financing for developing countries as a wider group and for different country groupings in the coming years. For official development assistance (ODA) specifically, which we focus on in this briefing, these projections have been developed in conjunction with a review of donor policy announcements and adjusted based on consultations with key experts including donor agencies.

This briefing unpacks those projections to evidence what the future is likely to hold and therefore where we need to focus our efforts to ensure the poorest people and countries are supported to manage the ongoing effects of the crisis.

An important note about the data in this paper

The data used in this briefing comes from a variety of sources and covers different donors, time periods and country groupings. The decision on which data to use for each analysis shown is based on how methodologies were constructed and on the availability of data and information at the time of writing, as well as a prioritisation of focusing on larger donors.

On time periods, non-grant government revenue projections in this briefing extend to 2025 because this data is available from the International Monetary Fund (IMF) covering that period, and similarly ODA projections here go to 2025 because IMF economic growth forecasts data has been used in constructing these. Meanwhile, international resource flows estimates on foreign direct investment (FDI), tourism and remittances extend just to the end of 2021 as they are based on existing evidence and 2019 and/or 2020 data (which is the latest available at the time of writing). Projecting these flows beyond this period, particularly at a disaggregated level, is uncertain.

On levels of aggregation, data on domestic expenditure and international resource flows are provided at the country level, enabling projections to be shown by a number of country groupings as well as individual country cases to be considered. Our methodology for ODA is based on 2020 ODA baseline data, which is provided at donor level. While this data allows us to see 2020 estimates on aid to LDCs, it does not provide other country groupings. Focus has been given to G7 donors and a handful of others, as the largest providers of ODA, to give the greatest coverage using a selection of donor countries.

For ODA projections we consider two scenarios (high growth and low growth); however, based on a review of donors’ commitments and interviews with certain donors, we focus on the high-growth scenario as this seems to be the expected outcome at the time of writing. The ODA projection scenarios are based on the application of DAC donor ODA as a percentage of GNI ratios to forecasted GNI levels. The forecasted GNI data is based on the latest International Monetary Fund World Economic Outlook October 2021 data update. Estimates on projected ODA to GNI ratios (bespoke by donor) are used in the projected data to determine the high- and low-growth scenarios. The high-growth scenario is based on a number of key donors achieving policies outlined around meeting the ODA to GNI target in the future and all other donors maintaining the 2020 ODA to GNI ratio. The low-growth scenario is based on donor policy targets not being met and donors reverting to 2019 ODA/GNI targets where the 2020 ratio was higher than the 2019 one. For full details on the methodology used for the high- and low-ODA projection scenarios, see the Projections Methodology section on official development assistance in the Appendix .

The data shown in the paper up to 2025 for ODA and non-grant government revenue is based on projections and scenarios. The estimates shown up to 2021 for remittances, FDI and tourism are based on data of regional estimates applied to individual countries. This data should therefore be considered estimates.

Innovative aspects of the methodology applied in this paper include the analysis on country groups, the comparison between different sources of international and domestic finance and the input from consultations with key stakeholders on ODA projections, which to the best of our knowledge has not been done before.

For more information on coverage and approach, see the Appendix : Projections methodology.

Summary

Fragile states saw the largest decrease in non-grant government revenue between 2019 and 2020 (18%) and their projected growth by 2025 is lower than in developing countries overall

- The projected growth in non-grant government revenue between 2020 and 2025 is at different levels for different country groupings varying between 32% and 48% over the five-year period. Of the country groupings in focus – LDCs, SIDS, fragile states and protracted crisis countries – LDCs are projected to have the highest growth between 2020 and 2025, at 48%.

ODA is projected to increase from 2020 into 2025, however support to the poorest countries has grown relatively slowly

- In a high-growth scenario (where donors achieve high ODA to GNI ratios) total ODA could reach US$185 billion in 2025, up from US$157 billion in 2020. [2]

- However, ODA to the poorest countries has continued to grow more slowly than ODA to other developing countries even in the context of the pandemic. Since 2010 aid to fragile states and LDCs grew 17% and 16% respectively, while total aid grew by 24%.

The impact of the Covid-19 pandemic on a number of international flows going into developing countries will have a clear and pronounced effect on volume levels in 2021

- To developing countries as a whole, tourism and FDI are estimated to decline between 2019 and 2021. [3] Tourism is predicted to decrease by 71%, with levels showing a recovery in 2021. FDI is estimated to decline between 2019 and 2020 and further into 2021 (by 25% respectively). Remittances to all developing countries are estimated to have declined by 1% between 2019 and 2020, before recovering in 2021 with a 3.2% increase.

- In LDCs, only remittances are estimated to increase between 2019 and 2021, and only by 4%.

Domestic financing

Domestic resources are the primary source of finance in developing countries and are a key driver in country-level investments to end poverty and support the recovery from the Covid-19 pandemic . However, compared to high-income countries, domestic revenues in developing countries and in particular groups (such as LDCs and fragile states) have taken a serious hit in 2020 and recovery is likely to take time. Low domestic resources in the poorest countries leave significant funding shortfalls to respond to the poverty challenge and support critical SDGs.

Non-grant government revenue fell by 7% in developing countries between 2019 and 2020, a greater percentage decrease than in high-income states (5%)

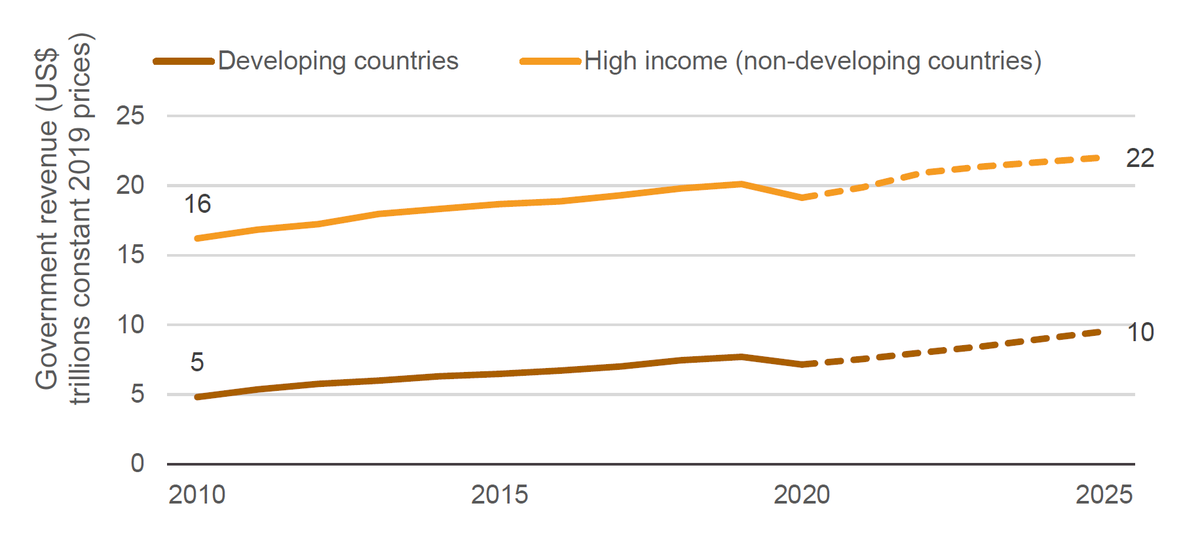

Figure 1: Government revenue (non-grant) for developing and high-income countries, 2010–2025

| 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | 2025 | |

|

Developing

countries |

4580 | 5142 | 5519 | 5720 | 5969 | 6229 | 6486 | 6780 | 7247 | 7497 | 6974 | |||||

| High income (non-developing) | 16205 | 16834 | 17238 | 17958 | 18319 | 18671 | 18874 | 19302 | 19801 | 20108 | 19129 | |||||

|

Developing

countries (estimate) |

6974.34296 | 7541 | 8018 | 8467 | 9008 | 9532 | ||||||||||

|

High income (non-developing)

(estimate) |

19128.863 | 19877 | 20921 | 21374 | 21700 | 22026 |

Source: Development Initiatives (DI) based on International Monetary Fund (IMF) Article IV

Notes: Countries for which no government revenue data is available in any year from 2010 onwards have been excluded.

- Domestic public finance in developing countries decreased in 2020, but projections show a recovery back to 2019 levels by 2022.

- Between 2020 and 2025 non-grant government revenue from developing countries is projected to grow at a faster rate than in high-income countries (33% compared to 15%); this follows pre-pandemic trends where between 2015 and 2019 non-grant government revenue grew by 19% in developing countries and 8% in high-income countries.

- However, the availability of government revenue per capita remains significantly higher in high-income countries than in developing countries. In 2020 per capita government revenue in high-income countries was US$14,050, over 12 times larger than per capita non-grant government revenue in developing countries of US$1,130.

- Furthermore, even though the post-2020 growth in developing countries may be higher, the impact of the 2020 decreases will likely be felt long term and sufficient acceleration to catch up to other countries is unlikely. A lack of fiscal space, limited access to financing and pre-existing vulnerabilities together with low vaccine coverage in developing countries increase the likelihood of a great divergence. According to IMF analysis most low-income countries (58 of 69) are not expected to reach their pre-Covid convergence path by 2025. [4]

Fragile states saw the largest decrease in non-grant government revenue between 2019 and 2020 (18%) and their projected growth by 2025 is lower than in developing countries overall

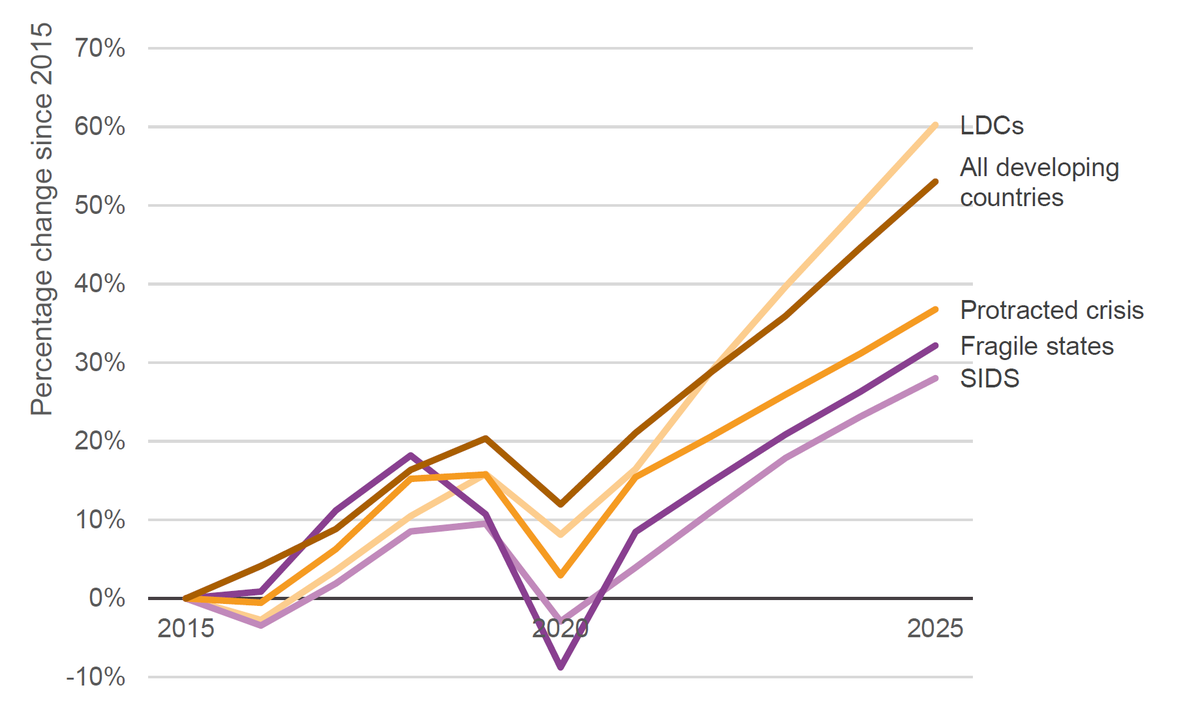

Figure 2: Non-grant government revenue projections by country grouping (LDCs, SIDS, fragile states and protracted crises)

| 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | 2025 | |

| LDCs | 0% | -3% | 4% | 10% | 16% | 8% | 16% | 29% | 40% | 50% | 60% |

| SIDS | 0% | -3% | 2% | 9% | 10% | -3% | 4% | 11% | 18% | 23% | 28% |

| Fragile states | 0% | 1% | 11% | 18% | 11% | -9% | 8% | 15% | 21% | 26% | 32% |

| Protracted crisis | 0% | -1% | 6% | 15% | 16% | 3% | 15% | 21% | 26% | 31% | 37% |

| All Developing countries | 0% | 4% | 9% | 16% | 20% | 12% | 21% | 29% | 36% | 45% | 53% |

Source: DI based on IMF Article IV, Organisation for Economic Co-operation and Development (OECD) and UN

Note: Groups of countries shown are based on categories made by respective sources for each country group. LDCs: least developed countries, as classified by the UN, are low-income countries with severe structural impediments to sustainable development. SIDS: small island developing states. SIDS are a distinct group of 38 UN member states and 20 non-UN members/associate members of UN regional commissions that face unique social, economic and environmental vulnerabilities. Fragile states are based on the OECD’s States of Fragility 2020 report. Protracted crisis countries are based on DI’s definition of countries with five or more consecutive years of UN-coordinated appeals. Countries with missing data across any of the 2015–2025 time period are not included in the chart.

- Growth projections suggest that while domestic financing in all groupings was impacted in 2020, they are all expected to recover fairly quickly with their growth predicted to accelerate back past pre-pandemic levels.

- The projected growth in non-grant government revenue between 2020 and 2025 is at different levels for different country groupings. Of the country groupings in focus – LDCs, SIDS, fragile states and protracted crisis countries – LDCs are projected to have the highest growth between 2019 and 2025, at 38%. LDCs also showed the lowest fall, among country groupings, in revenue levels between 2019 and 2020, at 6.7%.

- Before the pandemic the disparity in growth rates across the different country groupings was not as wide as the period between 2020 and 2025. SIDS and fragile states recorded the lowest growth rate between 2015 and 2019 of the focus country groups (10% and 11%, respectively), and LDCs and protracted crisis countries both recorded 16%. Between 2020 and 2025 the growth rates range between 32% (SIDS) and 48% (LDCs), with other groupings between this range.

- LDCs have seen a return to pre-pandemic growth in 2021 while fragile states, protracted crisis countries and SIDS will not see a return until 2022.

- Fragile states saw the largest decrease between 2019 and 2020 in non-grant government revenue, of 18%, and are not projected to see positive growth on 2019 levels until 2022. Their growth by 2025 (from 2019) (19%) remains lower than among developing countries overall (27%). Fragile oil-exporting countries were expected to be hit hard by the pandemic and due to a collapse in the price of oil, which they depend on for their exports and revenues. [5]

- SIDS are forecast to grow by 28% between 2015 and 2025 and recorded the lowest growth rate in both the pre- and post-pandemic periods. SIDS face a challenging Covid-19 recovery, with tourism expected to take up to four years to recover to levels seen in 2019 and trade levels also impacted. [6]

- The trend for a country grouping is driven by the data for all individual countries forming the group. Patterns of change are not uniform across all countries, and countries with larger volumes of non-grant government revenue can often play a greater part in shaping the overall trend for a group.

- For example, in LDCs, projected increases between 2020 and 2025 from Ethiopia (85%), Bangladesh (72%) and Angola (28%) can have a more pronounced effect on overall volumes due to the relative size of these economies. However, the vast majority of LDCs (39 of 47) have a growth rate of over 20% between 2020 and 2025, while only four countries have negative projected growth over the period (Chad, Timor-Leste, Tuvalu and Zambia).

- Of fragile states – a diverse group containing 57 countries (52 with data available on government revenue) – the vast majority report a positive projected growth rate between 2020 and 2025, with only 5 showing a negative rate (Chad, Congo, Equatorial Guinea, Zambia and Zimbabwe). Zooming into individual countries, key drivers of the aggregate decreases in non-grant government revenue in fragile states following the pandemic include Iraq, Libya and Nigeria. Together these accounted for 72% of the overall decline in non-grant government revenue in fragile states between 2019 and 2020. Meanwhile Mozambique, the Solomon Islands, Sudan and Zimbabwe also recorded notable decreases in non-grant government revenue in the same period.

- Of the 36 countries classified as both fragile and LDCs, the vast majority (34) record positive projected growth rates between 2020 and 2025.

- Between 2019 and 2020 the majority of fragile states and LDCs saw declines in government revenues. For fragile states, most saw a decline in government revenues between 0 and 30% between 2019 and 2020, while outliers such as Libya, Sudan and Zimbabwe saw greater decreases (65%, 40% and 68% respectively).

- While the forecasts suggest a recovery to pre-Covid levels of non-grant government revenue by 2025 for all country groupings, the pandemic has adversely impacted significant volumes of government revenue which would likely have resulted in greater growth in a scenario without Covid-19. [7] Furthermore, while domestic financing is expected to recover over the coming years in the countries of greatest poverty, it starts from such a low base that despite high growth rates, divergence in absolute per capita terms will continue. The IMF estimates that US$200 billion is needed to step up the spending response to the pandemic while an additional US$250 billion would accelerate convergence to advanced economies. [8]

International financial flows

The impact of the Covid-19 pandemic on a number of international flows going into developing countries will have a clear and pronounced effect on volume levels in the future, constraining the finance available to respond to the crisis and finance development in the countries with the highest levels of poverty.

Remittances are an important source of finance in developing countries – particularly in supplementing and increasing income at household level. Tourism is another major source of international financing, and has clearly taken a significant hit during the pandemic. For economies that rely on one form of economic activity and income, like tourism, this will have a harsh impact with jobs and livelihoods lost as well as critical domestic revenue. The uncertainty caused by the pandemic has also anticipated reduced growth in FDI, particularly in the poorest countries where markets are increasingly unpredictable and there is reduced risk tolerance of private investments.

The pandemic has underlined and strengthened the critical role of ODA in sustainably building the resilience of the people living in the greatest poverty and most left behind. Aid will be fundamental part of financing the recovery in the short to medium term, particularly in places where poverty is greatest. In these places domestic resources are lower and international flows limited, while ODA plays a critical role in supporting the recovery of basic services and goods, more so than in other countries.

This section looks at estimates in international financial flows up until 2021 and allows a perspective on how the Covid-19 pandemic has impacted these flows. It also explores projection scenarios of aid up to 2025 based on potential donor allocation scenarios.

ODA and remittances to developing countries are estimated to increase while FDI and tourism are projected to decrease by the end of 2021

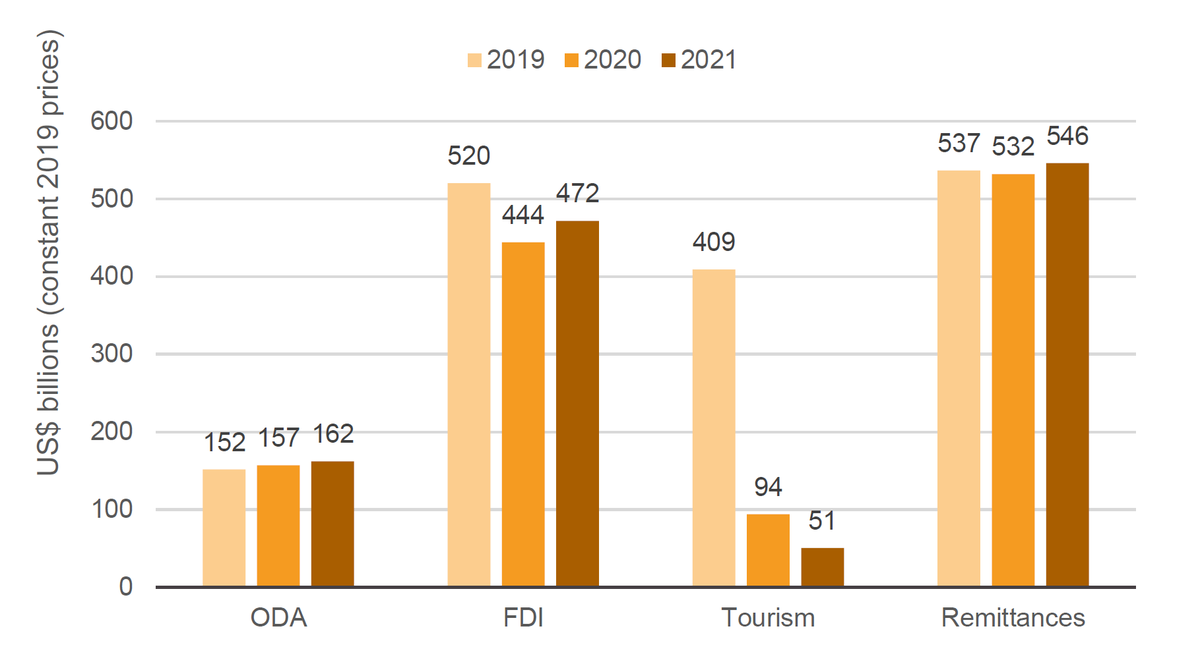

Figure 3: International resource flows to developing countries, 2019 and 2021

| 2019 | 2020 | 2021 | ||

| ODA | 152 | 157 | 162 | |

| FDI | 520 | 444 | 472 | |

| Tourism | 409 | 94 | 51 | |

| Remittances | 537 | 532 | 546 |

Source: DI based on IMF, World Bank, OECD Development Assistance Committee (DAC) and UN Conference on Trade and Development (UNCTAD)

Notes: 2020 values for tourism are DI estimates and 2021 values for all flows are DI estimates.

- Tourism and FDI to developing countries are all estimated to decline between 2019 and 2021. Tourism receipts are projected to decrease by 60–80% in many developing countries between 2019 and 2020, and reduce still further into 2021 – to over 90% in some cases. [9]

- FDI is projected to fall between 2019 and 2020 and further decline into 2021 (by 25%).

- Remittances to all developing countries are estimated to have fallen by 1% between 2019 and 2020, before recovering in 2021 with a 3.2% increase.

- ODA is predicted to grow between 2019 and 2021 by 6.8% under a high-growth projection scenario and fall by 2% in a low-growth projection scenario. For details on the methodology used for the high- and low-ODA projection scenarios, see the Projections Methodology section on official development assistance in the Appendix .

- In developing countries, tourism and FDI represented substantial resource flows in 2019: the two flows were each over two and a half times the size of ODA in 2019. The cumulative decrease of these flows between 2019 and 2021 is close to a trillion dollars (US$835 billion), over five times ODA in 2019.

- In LDCs, ODA is projected to fall between 2019 and 2021 from US$47 billion to US$44 billion, while FDI and tourism are also estimated to decline. ODA to LDCs is based on the methodology of factoring an estimate for bilateral and imputed multilateral ODA. The estimate for imputed multilateral ODA to LDCs decreasing in 2020 and 2021 is a driver of the decrease shown in total ODA to LDCs.

- The cumulative decrease of FDI and tourism flows to LDCs between 2019 and 2021 is US$44 billion, approximate to ODA levels in 2019.

- In LDCs, remittances are estimated to increase from US$51 billion to US$53 billion.

- In fragile states, tourism revenue is estimated to have decreased by 69% between 2019 and 2021, from US$33 billion to US$10 billion and FDI in fragile states is estimated to have fallen from US$42 billion in 2019 to US$34 billion in 2021 (a 19% decrease). Remittances in fragile states are estimated to fall 0.7% from 2019 into 2020 before recovering by 3.2% in 2021 to reach an all-time high.

Global ODA has increased slightly in 2020 and is projected to increase by between 7 and 21% by 2025

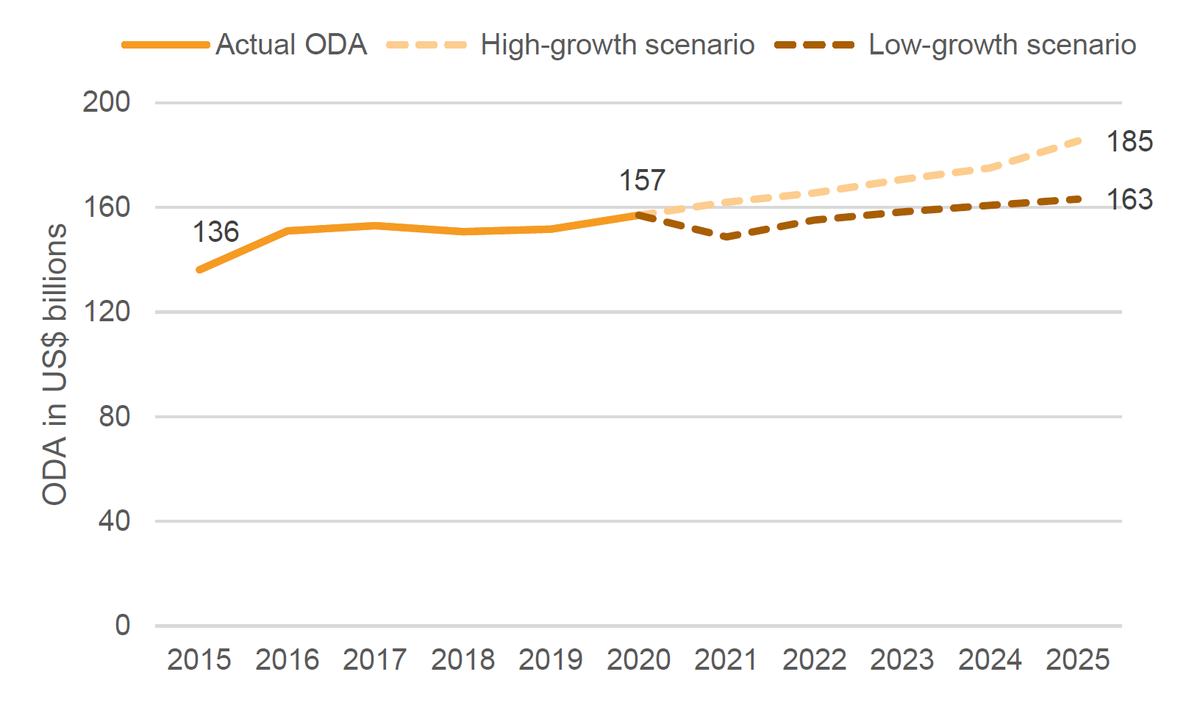

Figure 4: ODA from 2015 to 2020, with projections to 2025

| 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | 2025 | ||

| Total DAC upside | 136180 | 151045 | 153027 | 150763 | 151683 | 157026 | ||||||

| Total DAC downside | 136180 | 151045 | 153027 | 150763 | 151683 | 157026 | ||||||

| Upside scenario projections | 157026 | 161970 | 165540 | 170776 | 175087 | 185426 | ||||||

| Downside scenario projections | 157026 | 148742 | 155205 | 158321 | 160833 | 163183 |

Source: DI based on OECD, IMF (WEO) and government sources

Notes: ODA pre-2017 is net, and 2017 and onwards is based on grant equivalents. Dotted lines indicate projected data. Projections methodology: high-growth scenario projections based on 2020 ODA/gross national income (GNI) rates maintained and applied to projected GNI. The low-growth scenario is based on 2019 ODA/GNI rate maintained where the 2019 ratio is higher than the 2020 ratio. Adjustments for policy statements on future ODA/GNI ratios have been used for France, Ireland, Sweden and the UK. Projected GNI is calculated by using forward-looking gross domestic product (GDP) growth rate figures from the IMF applied to GNI levels. One caveat is in cases where a future shock to GDP and/or GNI would cause a divergence to the estimates; this can be notably applicable in cases where countries face a significant difference between GDP and GNI and one of the measures is affected.

- ODA is projected to increase from 2020 into 2025. The low-growth scenario sees ODA reaching US$163 billion in 2025 from US$157 billion in 2020 (or growing 4% in that six-year period), while the high-growth scenario sees ODA reaching US$185 billion in 2025, from US$157 billion in 2020 (or growing 18%).

- Certain donors may see policy shifts which will impact the volume of their aid. The projections include a decrease in the UK’s ODA in 2021, with levels based on the UK providing 0.5% of ODA as a percentage of gross national income (GNI) in this year and forward to 2024. The low-growth UK aid scenario sees ODA maintained at 0.5% in 2025 while the high-growth scenario sees ODA increase to 0.7% in 2025.

- The high-growth scenario factors in the potential for France to hit the 0.7% ODA to GNI target by 2025 and for Ireland to hit this by 2030.

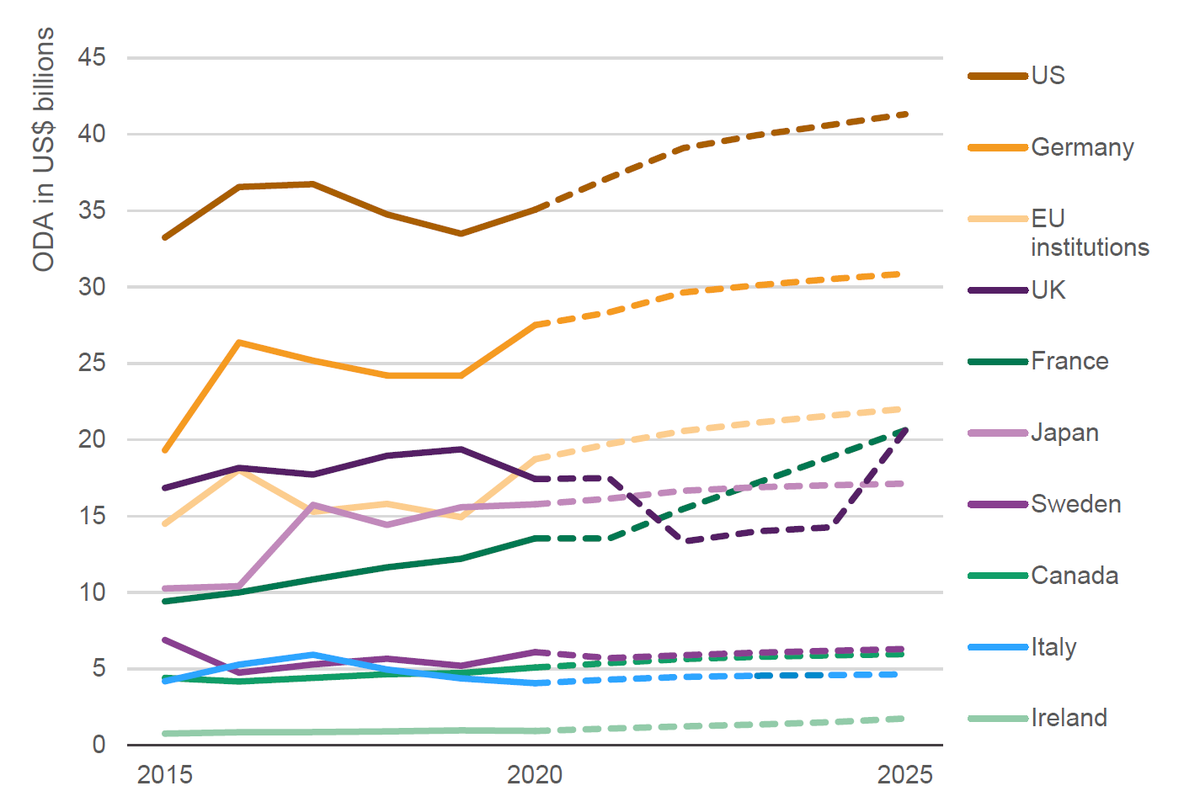

In a high-growth scenario there is a general rising trend in ODA for G7+ donors between 2015 and 2025

Figure 5: Projections of ODA levels in key donors, 2015–2025

| 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | 2025 | |

| Canada | 4413 | 4173 | 4411 | 4657 | 4725 | 5091 | |||||

| France | 9420 | 10006 | 10857 | 11652 | 12211 | 13545 | |||||

| Germany | 19319 | 26369 | 25181 | 24210 | 24198 | 27511 | |||||

| Ireland | 763 | 845 | 857 | 910 | 973 | 933 | |||||

| Italy | 4188 | 5278 | 5926 | 4957 | 4373 | 4062 | |||||

| Japan | 10266 | 10420 | 15744 | 14429 | 15588 | 15777 | |||||

| Sweden | 6889 | 4752 | 5287 | 5663 | 5205 | 6095 | |||||

| UK | 16846 | 18168 | 17727 | 18961 | 19377 | 17434 | |||||

| US | 33248 | 36551 | 36740 | 34762 | 33492 | 35071 | |||||

| EU Institutions | 14507 | 18041 | 15283 | 15802 | 14937 | 18730 | |||||

| Canada (estimate) | 5091 | 5380 | 5643 | 5792 | 5881 | 5965 | |||||

| France (estimate) | 13545 | 13533 | 15471 | 17185 | 18895 | 20632 | |||||

| Germany (estimate) | 27511 | 28350 | 29643 | 30115 | 30527 | 30878 | |||||

| Ireland (estimate) | 933 | 1094 | 1239 | 1362 | 1515 | 1753 | |||||

| Italy (estimate) | 4062 | 4297 | 4479 | 4551 | 4597 | 4644 | |||||

| Japan (estimate) | 15777 | 16149 | 16666 | 16894 | 17033 | 17130 | |||||

| Sweden (estimate) | 6095 | 5704 | 5897 | 6063 | 6182 | 6305 | |||||

|

United

Kingdom (estimate) |

17434 | 17490 | 13338 | 14006 | 14276 | 20616 | |||||

|

United

States (estimate) |

35071 | 37166 | 39098 | 39948 | 40627 | 41318 | |||||

|

EU

Institutions (estimate) |

18730 | 19733 | 20572 | 21128 | 21594 | 22034 |

Source: DI based on OECD, IMF (WEO) and government sources

Notes: ODA pre-2017 is net, and 2017 and onwards is based on grant equivalents. Dotted lines indicate projected data. Projections methodology is based on the high-growth scenario used in the figure above. Adjustments on future ODA/GNI ratios have been used for France, Ireland, Sweden and the UK based on policy statements and key informant interviews. Projected GNI is calculated by using forward-looking GDP growth rate figures from the IMF applied to GNI levels. One caveat is in cases where a future shock to GDP and/or GNI would cause a divergence to the estimates, this can be notably applicable in cases where countries face a significant distance between GDP and GNI and one of the measures is affected. For further details, see the Appendix.

- Looking into the high-growth scenarios of selected donor projections at the individual donor level we see a general rising trend for most, with France and possibly Japan surpassing the UK in 2022.

- The UK stands out here as one of the very few major donors making cuts in 2020 and already announced for 2021 too (US$2.1 billion in 2020).

- The high-growth scenario shows increases from all nine focus country donors between 2020 and 2025.

- The low-growth scenario shows decreases for six of the donors between 2020 and 2021: Canada, Germany, Japan, Sweden, the UK and the US.

- The low-growth scenarios for these focus donors also shows decreases in volumes of ODA from Germany, Sweden and the UK over the longer period of 2020 to 2025.

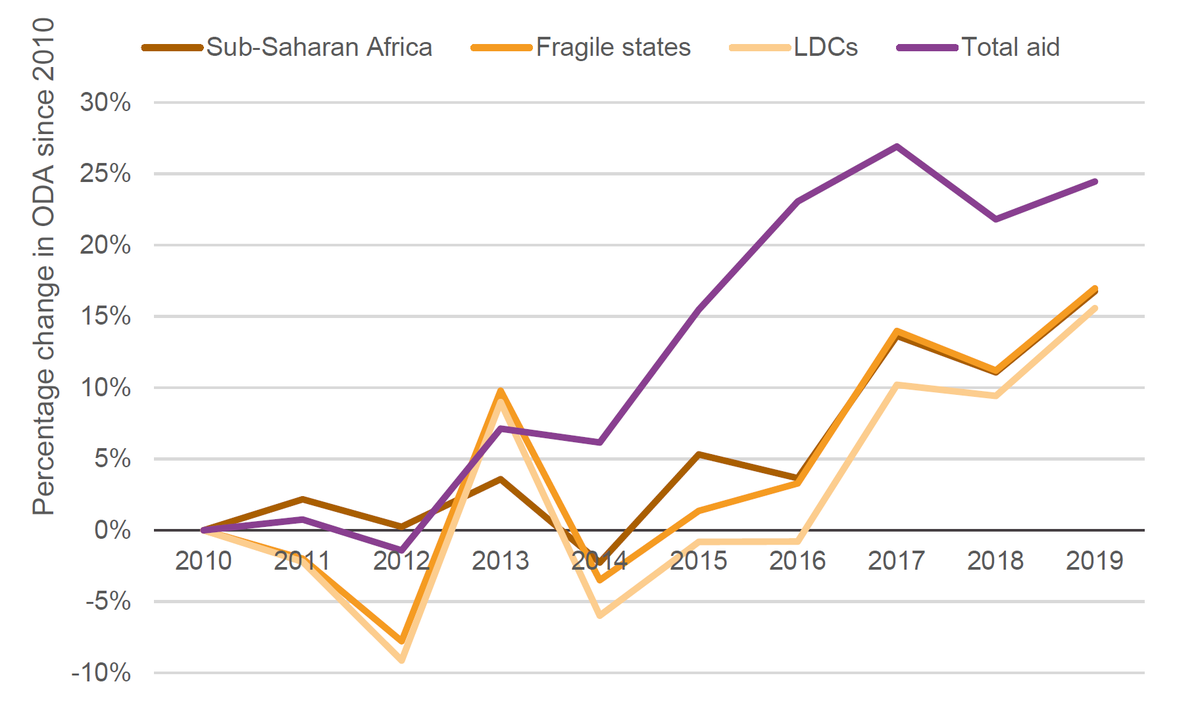

ODA to LDCs, sub-Saharan Africa and fragile countries has grown more slowly over time than ODA to all developing countries

Figure 6: Percentage change in ODA to country groupings and total ODA, 2010–2019

| 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | |

| Sub-Saharan Africa | 0% | 2% | 0% | 4% | -2% | 5% | 4% | 14% | 11% | 17% |

| Fragile | 0% | -2% | -8% | 10% | -3% | 1% | 3% | 14% | 11% | 17% |

| LDCs | 0% | -2% | -9% | 9% | -6% | -1% | -1% | 10% | 9% | 16% |

| Total aid | 0% | 1% | -1% | 7% | 6% | 15% | 23% | 27% | 22% | 24% |

Source: OECD DAC Creditor Reporting System

Notes: ODA is disbursements from DAC donors and multilateral organisations.

- ODA to the countries with the highest poverty levels has continued to grow more slowly than ODA to developing countries as a whole. Since 2010 aid to fragile states and LDCs grew 17% and 16% respectively while total aid grew by 24%.

- Aid to specific countries in the form of country allocable aid grew at a slower rate than aid which is not allocated to a specific country or region (17% versus 53%). This is behind some of the growth difference between aid to individual countries and all ODA.

- This trend is projected to continue. Bilateral aid grew at a lower rate to LDCs than to all developing countries between 2019 and 2020 (from US$33.0 billion to US$33.6 billion at 1.8% compared to 3.5% for all developing countries). Meanwhile aid to LDCs from OECD Development Assistance Committee (DAC) donors (including imputed multilateral aid) is estimated to have decreased from US$46.6 billion in 2019 to US$44.1 billion in 2021.

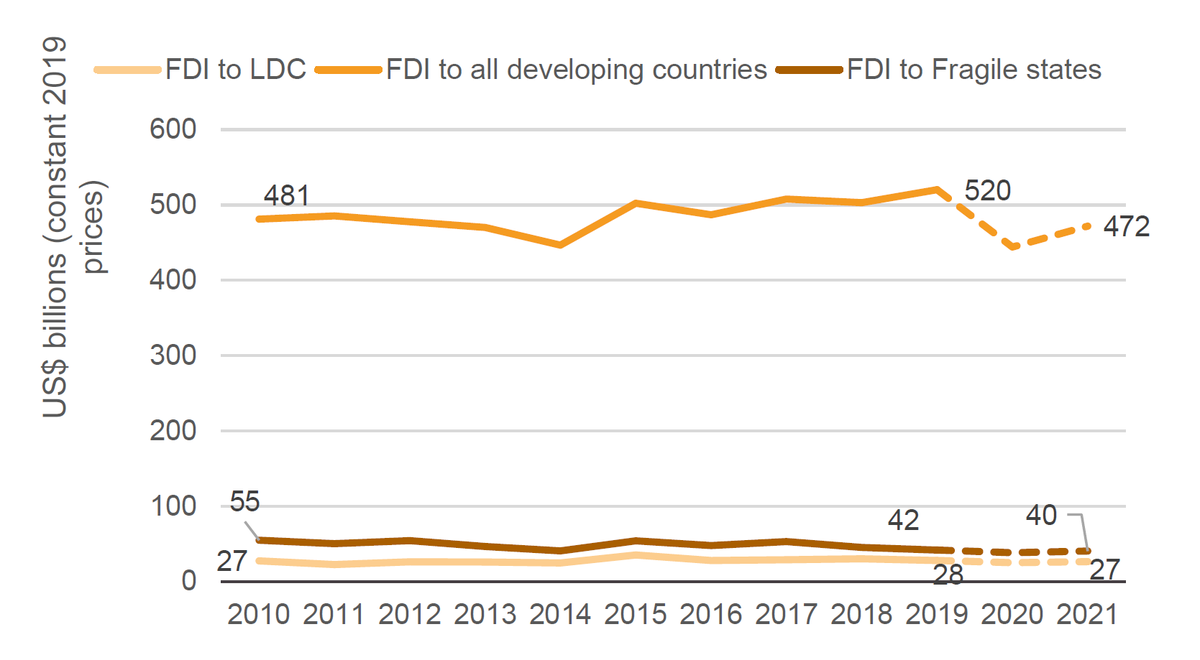

FDI to all developing countries is projected to fall by 25% in 2021

Figure 7: Estimates of FDI for all developing countries, LDCs and fragile states

| 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | |

| FDI to LDC | 27 | 23 | 26 | 26 | 25 | 35 | 28 | 29 | 30 | 28 | ||

| FDI to LDC (estimate) | 28 | 25 | 27 | |||||||||

|

All Developing

countries |

481 | 485 | 477 | 470 | 447 | 502 | 487 | 508 | 503 | 520 | ||

|

All Developing countries

(estimate) |

520 | 444 | 472 | |||||||||

| FDI to Fragile states | 54.9 | 50.3 | 54.4 | 46.5 | 40.7 | 54.1 | 47.8 | 53.1 | 45.3 | 41.9 | ||

|

FDI to Fragile states

(estimate) |

41.9 | 38.3 | 40.5 |

Source: DI based on UNCTAD

Notes: Country-level projection estimates were made by taking regional estimates and using examples of specific countries that UNCTAD named in the Investment Trends Monitor, January 2021 (available at: https://unctad.org/system/files/official-document/diaeiainf2021d1_en.pdf). This report was used to refine the estimates for any unnamed countries.

- Between 2010 and 2019, FDI to all developing countries increased by 8%, from US$481 billion to US$520 billion.

- FDI to all developing countries fell from US$520 billion in 2019 to US$444 billion in 2020, or by 15%. In 2021, FDI to all developing countries is estimated to have increased by 8% in a recovery to US$472 billion (9% lower than 2019 levels).

- FDI to LDCs fell by 21% between 2015 and 2019, and by a further 11% between 2019 and 2020 from US$28 billion to US$25 billion. Levels then increased by 6% in 2021 to US$27 billion. Covid was linked to the decline in FDI to LDCs as they remain heavily concentrated in the extractive industries, however, several LDCs have undergone steps to facilitate investment. [10]

- FDI in fragile states fell from US$42 billion in 2019 to US$38 billion in 2020 (a 14% decrease). Between 2020 and 2021, FDI to fragile states is estimated to have increased by 5% (recovering to US$40 billion). FDI to fragile states decreased between 2010 and 2019 and the estimated decline into 2021 represents a return to levels as they were about two decades ago. The length of this contraction in investment in all developing countries is harder to predict due to the considerable uncertainty but the loss of already limited resources will clearly have long-term effects. While there is a recovery in 2021 on 2020 levels for all country groupings, levels are still down for developing countries as a whole: 9% in 2021. This impact is not quite as pronounced in fragile states (3%) and LDCs (5%).

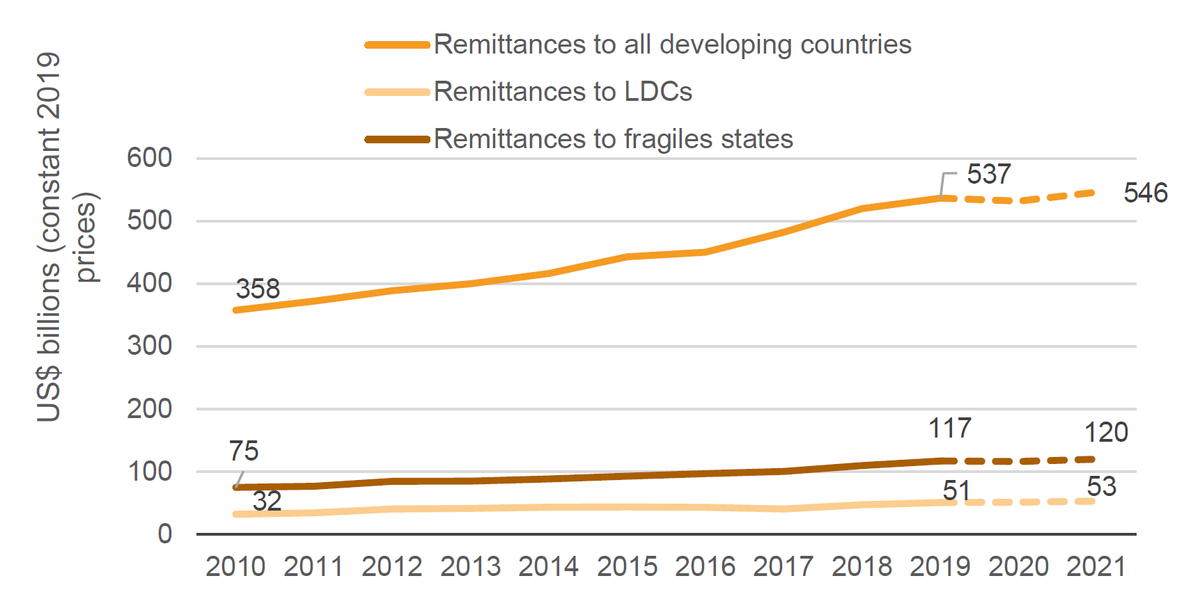

Remittances are estimated to narrowly increase between 2019 and 2021 in developing countries, LDCs and fragile states

Figure 8: Estimates of remittances for all developing countries, LDCs and fragile states

| 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | |

|

Remittances to all developing

countries |

358 | 372 | 389 | 400 | 416 | 443 | 450 | 482 | 520 | 537 | ||

|

Remittances

to all developing countries (estimate) |

537 | 532 | 546 | |||||||||

| Remittances to LDCs | 32 | 34 | 40 | 41 | 43 | 44 | 43 | 40 | 47 | 51 | ||

| Remittances to LDCs (estimate) | 51 | 51 | 53 | |||||||||

|

Remittances to

fragiles states |

74.9 | 76.8 | 84.5 | 84.9 | 88.3 | 92.7 | 97.0 | 100.3 | 109.8 | 117.0 | ||

|

Remittances to fragiles states

(estimate) |

117.0 | 116.2 | 119.9 |

Source: DI based on World Bank

Notes: Estimates based on regional projections for 2020–2021.

- Since 2010 remittances to all developing countries, LDCs and fragile states have been a growing source of international finance. The volume of remittances in developing countries as a whole grew by 50% between 2010 and 2019.

- Remittances are estimated to decline by 1% between 2019 and 2020 before rising by 2.7% in all developing countries into 2021.

- In LDCs, remittances are estimated to have grown by 1% between 2019 and 2020 before rising a further 3.2% into 2021.

- Remittances have been a growing resource in fragile states over the last decade, increasing by 56% from US$75 billion in 2010 to US$117 billion in 2019. Since 2010, remittances had grown year on year in fragile states, before falling by 0.7% from 2019 into 2020. As such, the relative impact on already lower incomes in fragile states is likely to have a more serious effect on people’s ability to cope directly, with broader implications for the economy. However, remittances are expected to recover in 2021 by 3.2% to an all-time high of US$120 billion.

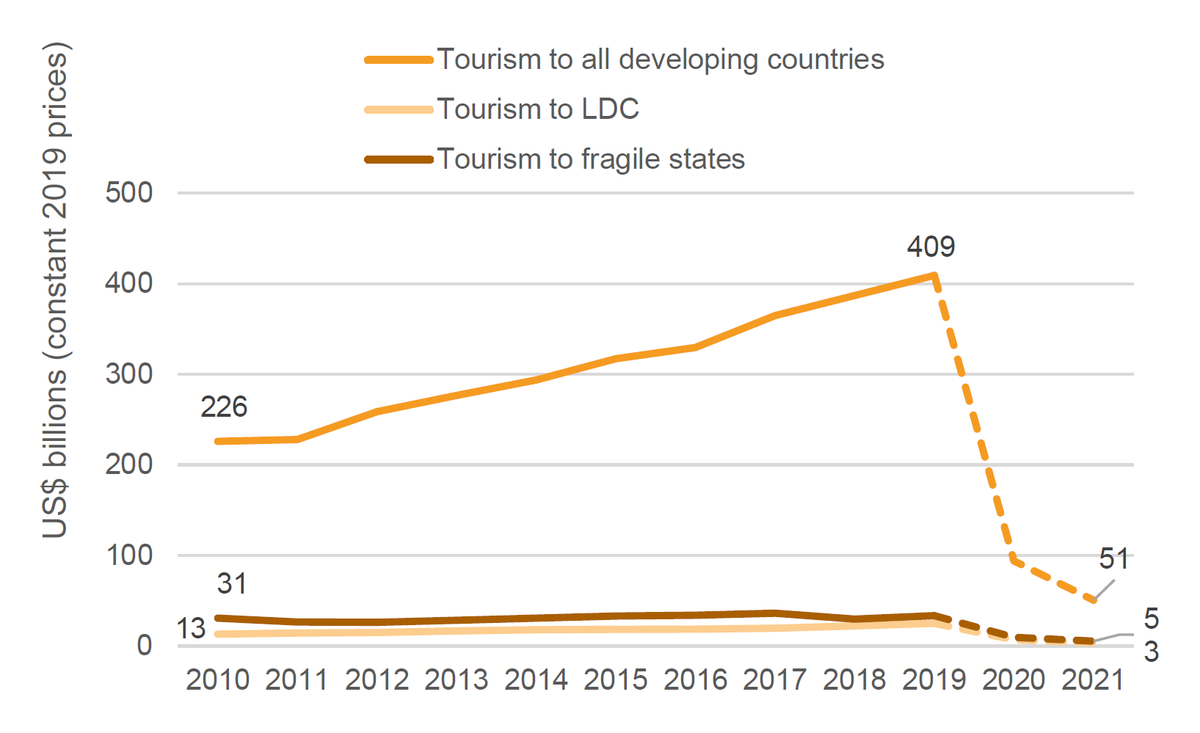

Tourism receipts are estimated to have plummeted by 60–70% for many countries

Figure 9: Estimates of tourism revenue for all developing countries, LDCs and fragile states

| 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | |

| Total developing countries | 226 | 228 | 259 | 276 | 294 | 317 | 330 | 365 | 387 | 409 | ||

|

Total developing countries

(estimate) |

409 | 94 | 51 | |||||||||

| Tourism to LDC | 13 | 14 | 15 | 17 | 18 | 18 | 19 | 20 | 22 | 25 | ||

| Tourism to LDC (estimate) | 25 | 7 | 3 | |||||||||

| Tourism to fragile states | 31 | 26 | 26 | 28 | 31 | 33 | 34 | 36 | 30 | 33 | ||

|

Tourism to fragile states

(estimate) |

33 | 10 | 5 |

Source: DI based on World Bank

Notes: Estimates based on regional projections tourism arrivals for 2020–2021 changes applied to 2019 data.

- Tourism receipts are projected to have plummeted by 60–80% in many countries between 2019 and 2020, and still further into 2021 to over 90% in some cases. In Vanuatu, for example, where tourism represents around two-thirds of gross domestic product (GDP), [11] receipts per capita are estimated to have fallen from just over US$1,000 in 2019 to less than US$50 in 2021. The likelihood of a rapid recovery in 2021 given ongoing travel and other restrictions is small.

- Between 2019 and 2020, tourism to all developing countries is estimated to have fallen by 77% from US$409 billion to US$94 billion. Levels then fell a further 46% into 2021 to US$51 billion.

- In fragile states, tourism revenue is estimated to have decreased by 71% between 2019 and 2020 and a further 44% into 2021.

- Tourism levels in LDCs had been increasing since 2010, close to doubling over this period before the resulting decrease after 2019, when levels fell by 72% and then by a further 49%.

- The estimated rate of decrease between 2019 and 2021 is approximately the same in LDCs (86% decrease), fragile states (84%) and all developing countries (88%).

Conclusion

The pandemic hit developing countries hard. Compared to high-income countries, domestic revenues in developing countries and in countries with the highest poverty levels, such as LDCs and fragile states, have taken a serious hit in 2020 and recovery is likely to take time. While the forecasts presented here suggest a recovery to pre-Covid levels of non-grant government revenue by 2025 for all country groupings (LDC, SIDS, fragile states and protracted crises), the pandemic has adversely impacted significant volumes of government revenue which would likely have resulted in greater growth in a scenario without Covid-19. Furthermore, the projected growth in non-grant government revenue between 2020 and 2025 is at very different levels for different country groupings and this needs special consideration. Fragile states saw the largest decrease in non-grant government revenue between 2019 and 2020 (18%) and their projected growth by 2025 is lower than for all developing countries (19% versus 27% from 2019 levels).

In the context of constrained domestic finance with significant and growing demands and needs, particularly in the poorest countries, external sources of finance are critical. However, major international financial flows to developing countries such as FDI and tourism are estimated to decrease in 2021 following the impact of the pandemic. And while it is positive that ODA is projected to increase from 2020 to 2025 by between 7 and 21%, support to the poorest countries including LDCs and fragile states has grown relatively slowly at 16% and 17% respectively between 2010 and 2019, compared to 24% for all developing countries, while ODA loans are rising rapidly.

The IMF estimates that US$200 billion is needed to step up the spending response to the pandemic while an additional US$250 billion would accelerate convergence to advanced economies. [12] While a mix of development finance sources and a multifaced response needs to be considered to meet the challenge of the pandemic in developing countries, ODA has a critical role to play as the key public international resource in the countries with the most poverty such as LDCs and fragile contexts. Looking at the wider picture, major international flows have fallen in 2021 and are projected to decline even further.

In the countries where poverty is deepest and domestic resources lowest, aid is a critical resource supporting investments in key sectors to develop human capital and alleviate poverty such as health, agriculture, education, social services, digitalisation and water, sanitation and hygiene. These remain central to an equitable pandemic recovery agenda in the short to medium term – one that strengthens the resilience of the poorest people.

Appendix: Projections methodology

Official development assistance

Projections methodology : We consider two scenarios: a high-growth scenario and a low-growth scenario. In a high-growth scenario, projections are based on 2020 official development assistance (ODA)/gross national income (GNI) rates being maintained and applied to projected GNI. The low-growth scenario is based on the 2019 ODA/GNI rate being maintained where the 2019 ratio is higher than the 2020 ratio. This links to 2020 ratios being higher from a number of donors due to a reduction in GNI in 2020 as a result of Covid-19 and one-off larger aid expenditures, both boosting the 2020 ratios in these cases (for example to fight the pandemic and contributions to multilateral organisations). [13] Experts on French, Irish, Swedish and US aid were consulted for the projected GNI to GDP ratios used for these countries. As a result, adjustments based on policy statements on the future ODA/GNI ratios have been used for France, Ireland and Sweden. Adjustments were also made for the UK based on its policy announcements around ODA to GNI. The adjustments refer to the following cases:

- France : Our high-growth projection is based on a steady average annual ODA increase to 2025 to reach 0.7% ODA/GNI. This is based on French lawmakers having passed a bill pledging to allocate 0.7% of the country’s GNI to ODA by 2025. [14] Our low-growth projection for France is based on maintaining 0.5% ODA GNI from 2021 to 2025 and the 0.7% target not being reached. At the time of research, there was no information on how France planned to hit the target, such as a gradual or sudden increase.

- Ireland : Our high-growth projection is based on Ireland hitting the 0.7% ODA/GNI target by 2030 and ODA/GNI growth is based on estimates for single years outlined on the indicative pathway to achieving this described by the Minister of State at the Department of Foreign Affairs, Ireland. [15] The low-growth scenario is based on Ireland maintaining the level of ODA/GNI that was disbursed in 2020 of 0.31%.

- Sweden : Our high-growth projection is based on Sweden hitting around 1% ODA/GNI ratio. We use 1.03% as the high end of a realistic span advised from a key informant interview. Sweden hit 1.14% of ODA/GNI in 2020, however, this was driven up by a large one-off transaction and 1.14% was not seen as a reasonable estimate to use for the projections. Our low-growth scenario for Sweden is based on the country hitting 0.96% of ODA/GNI as the advised lower end of a realistic span.

- USA : Our high-growth projection for the USA was based on it maintaining the 2020 ODA to GNI ratio of 0.17%. Meanwhile the low-growth scenario was based on the country maintaining the 2019 ODA to GNI ratio of 0.15%. These scenarios were based on the volume of ODA increasing in line with GDP growth from a starting point linked to recent aid activity and limited information at the time of research on expected overall shifts in aid and on aims for the ODA/GNI target.

- UK : Our high-growth projection for the UK is based on it maintaining 0.5% ODA GNI from 2021 to 2024 before jumping back to 0.7% in 2025. This was based firstly on the UK’s announcement to cut ODA as a percent of GNI from 0.7% to 0.5% in 2021, and secondly on the government policy to commit to spending 0.7% of GNI on while official forecasts show that, on a sustainable basis the country is not borrowing for day-to-day spending and the ratio of underlying debt to GDP is falling. The return to aid spending at 0.7% of GNI would depend on the official economic forecasts published in autumn 2021. If they are similar to the most recent forecasts (published in March), we could expect aid not to return to 0.7% for at least the rest of the current parliament, which will likely end in 2024. [16] Our low-growth scenario for the UK assumes that the UK’s aid will be maintained at 0.5% ODA/GNI in 2025

Projected GNI is calculated from using forward-looking GDP growth rate figures from the IMF applied to GNI levels. The estimates of GDP are based on the latest IMF World Economic Outlook update (October 2021). One caveat is in cases where a future shock to GDP and/or GNI would cause a divergence to the estimates. This can notably apply in cases where countries face a significant difference between GDP and GNI and one of the measures is affected.

Non-grant government revenue

Projections on non-grant government revenue (2020–2025) are based on (1) figures provided by the IMF in Article IV documents for individual developing countries who receive grants, and (2) figures on government revenue from the IMF World Economic Outlook for countries which do not receive grants on budget.

International resource flows

Foreign direct investment: Country-level projection estimates were made by taking regional estimates from the World Investment Report 2021: Investing in Sustainable Recovery (UNCTAD) and applying them to 2020 data on FDI flows for individual countries. [17]

Remittances: Estimates for 2021 are based on regional growth estimates for 2021 applied to country-level estimates for 2020 data. This data was sourced from the World Bank’s Migration and Remittances data and the World Bank press release ‘Defying Predictions, Remittance Flows Remain Strong During COVID-19 Crisis’ for the regional projections in 2021. [18]

Tourism : Estimates for 2020 and 2021 were based on figures for 2019 showing ‘International tourism, receipts’ available on the World Bank’s World Development Indicators. The estimates on tourism in 2020 and 2021 were drawn from regional projections provided by the UN World Tourism Organization with growth rates on tourism arrivals and applied to the 2019 data for individual countries. [19]

Estimates shown for tourism, remittances and FDI in 2021 are made to capture spending across the entire calendar year for consistency with data shown for other years.

Downloads

Notes

-

1

International Monetary Fund (IMF), 2021. The Great Divergence: A Fork in the Road for the Global Economy. Available at: https://blogs.imf.org/2021/02/24/the-great-divergence-a-fork-in-the-road-for-the-global-economyReturn to source text

-

2

For full details on the methodology used for the high- and low-ODA projection scenarios, see the Projections Methodology section on Official Development Assistance in the Appendix.Return to source text

-

3

Data for 2021 refers to the entire calendar year.Return to source text

-

4

IMF, 2021. Macroeconomic Developments and Prospects In Low-Income Countries–2021. Available at: www.imf.org/en/Publications/Policy-Papers/Issues/2021/03/30/Macroeconomic-Developments-and-Prospects-In-Low-Income-Countries-2021-50312Return to source text

-

5

OECD, 2020. The impact of coronavirus (COVID-19) and the global oil price shock on the fiscal position of oil-exporting developing countries. Available at: www.oecd.org/coronavirus/policy-responses/the-impact-of-coronavirus-covid-19-and-the-global-oil-price-shock-on-the-fiscal-position-of-oil-exporting-developing-countries-8bafbd95Return to source text

Related content

Reversing the trends that leave LDCs behind: How ODA can be targeted to the needs of people living in greatest poverty post-pandemic

This report looks at how trends leaving least developed countries behind can be reversed, and examines how official development assistance can be targeted to meet the needs of the poorest people.

ODA in 2020: What does OECD DAC preliminary data tell us?

Analysis of the OECD DAC’s preliminary 2020 ODA (aid) data. Read about trends in aid, including which donors increased or cut contributions, aid to LDCs, and changes in grants versus loans.

Aid data 2019–2020: Analysis of trends before and during Covid

What key shifts in donors, sectors, targeting and loans during the Covid pandemic are highlighted by new DAC data on 2019 ODA and 2020 aid figures from IATI?